USD/CAD Testing Monthly Open Support Ahead Of Canada CPI

USD/CAD Daily

(Click on image to enlarge)

Technical Outlook: USDCAD has continued to trade within the confines of this modified pitchfork extending off the yearly lows with price extending into fresh nine-month highs. The pair responded to a key resistance range early in the week around 1.3575 - this region is defined by the 50% retracement of the 2016 range and converges on multiple parallels over the next few days. Note that the last two days have seen strong defense of support at the 3/16 high / monthly open at 1.3405/07. Look for a break of this range with our focus weighted to the topside while above the median-line.

USD/CAD 240min

(Click on image to enlarge)

Notes: A closer look at price highlights support at the sliding parallel which also converges on the monthly open. Note that RSI held 40-support on this last pullback and suggests that the immediate downside momentum is waning. That said, look for interim resistance targets at the weekly open / 1.3501 & 1.3575 – a breach above this region is needed to keep the long bias in play with such a scenario targeting 1.3650, the upper median-line parallel (~1.3695) & critical resistance at 1.3815/31.

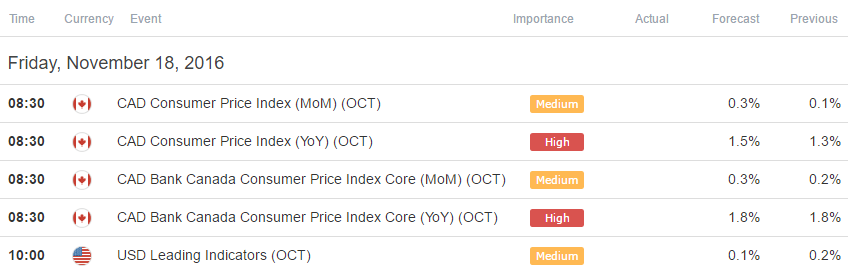

Heading into the release of Canada’s Consumer Price Index (CPI) tomorrow, the trade remains constructive while above today’s lows with a break below 1.3388 risking a more meaningful correction towards the lower parallels. From a trading standpoint, I would be looking to fade weakness targeting a breach above highlighted resistance into the weekly high.

(Click on image to enlarge)

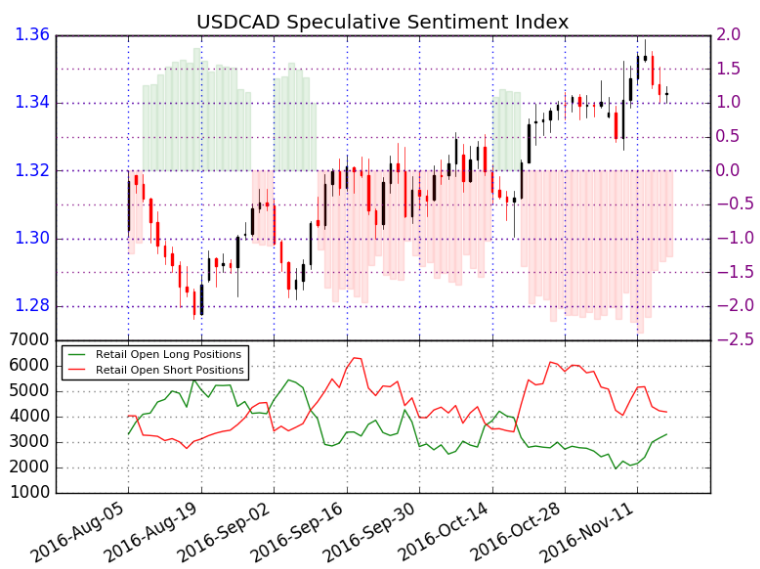

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net short USD/CAD- the ration stands at -1.27 (44% of traders are long)- weak bullish reading

- Long positions are 43.9% above levels seen last week while short positions are 9.5% lower over the same time period.

- Open interest is 5.7% below its monthly average.

- The current surge in long-positioning suggests that retail crowds are attempting fade this decline, leaving the risk for further losses near-term. That said, it’s important to keep in mind that price is coming off support and we’ll be looking for a further build in short exposure to support the long-bias.

Relevant Data Releases

(Click on image to enlarge)

Continue tracking these setups and more throughout the week- Subscribe to more