USD/CAD Holding Pattern At Risk As Oil Rally Gathers Pace

|

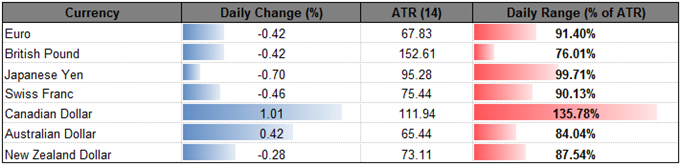

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

USD/CAD |

1.3163 |

1.3292 |

1.314 |

118 |

152 |

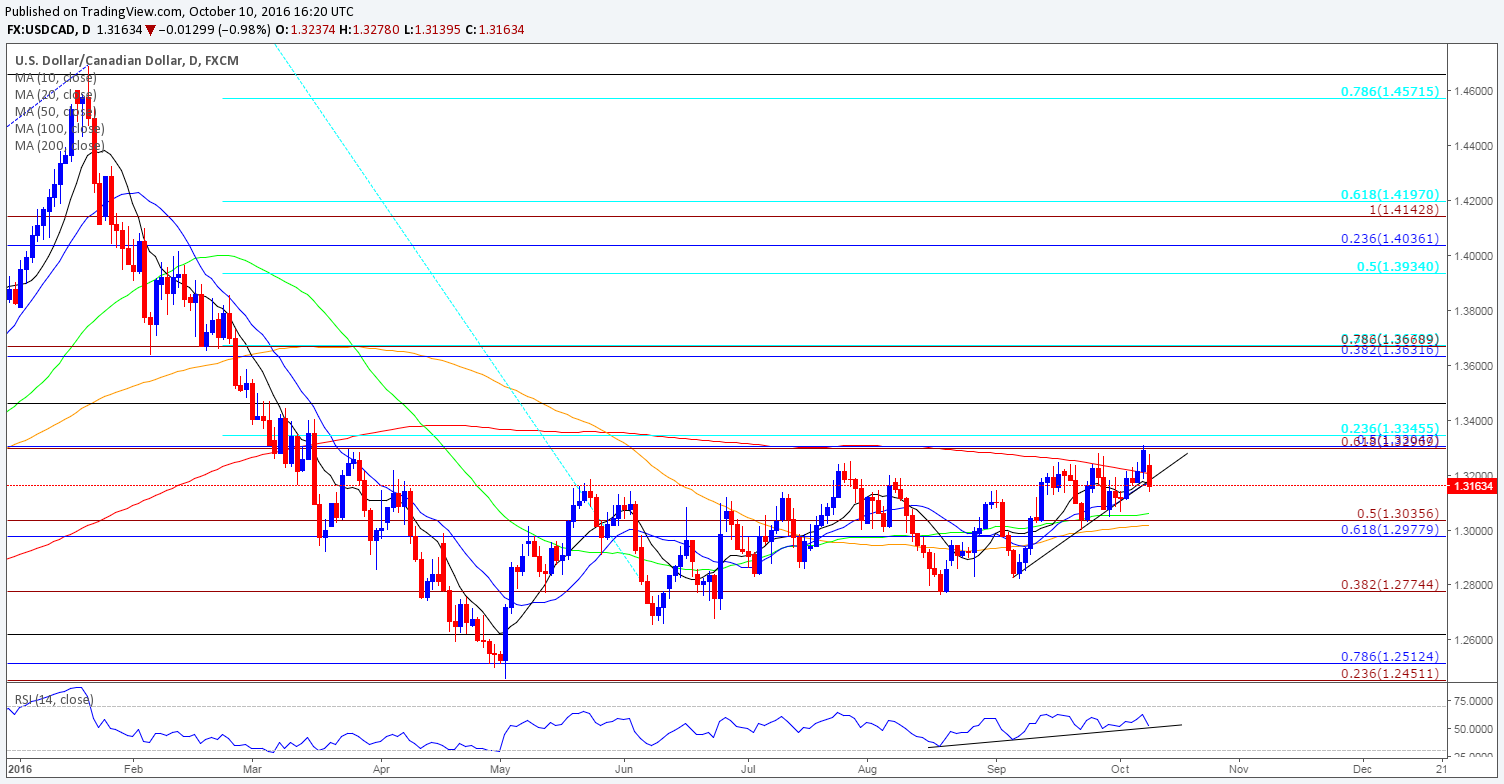

USD/CAD Daily

(Click on image to enlarge)

Chart - Created Using Trading View

- Despite the U.S. holiday, USD/CAD may continue to give back the advance from September as it comes up against trendline support, with the Relative Strength Index (RSI) highlighting a similar dynamic; break of the bullish formations may open up the broader range from the summer months.

- Canadian dollar appears to be responding to rising oil prices amid headlines the Organization of the Petroleum Exporting Countries (OPEC) as well as Non-OPEC producers are planning to boost their efforts in rebalancing the energy market; may see the key dynamic continue to drive USD/CAD price action ahead of the next Bank of Canada (BoC) interest rate decision on October 19 as GovernorStephen Poloz argues ‘total CPI inflation is below the 2 per cent target, mainly because of the temporary effects of lower consumer energy prices.’

- Break of trendline support may spur a move back towards the monthly low (1.3068), with a break/close below the Fibonacci overlap around 1.2980 (61.8% retracement) to 1.3040 (50% expansion) opening up the next downside target around 1.2770 (38.2% expansion).

|

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

USD/JPY |

103.66 |

103.76 |

102.81 |

58 |

95 |

USD/JPY Daily

(Click on image to enlarge)

Chart - Created Using Trading View

- USD/JPY may face range-bound prices ahead of the slew of Fed rhetoric schedule for the days ahead as it remains largely capped by 104.20 (61.8% retracement), but the bullish formation carried over from the end of the previous month may continue to take shape as the Federal Open Market Committee (FOMC) makes a more collective approach to prepare U.S. households and businesses for a December rate-hike, while the Bank of Japan (BoJ) endorses a dovish outlook for monetary policy.

- For now, the BoJ’s ‘yield curve control’ dynamic appears to be having the intended impact as USD/JPY moves away from the 2016 low (98.79), and the Japanese Yen may face additional headwinds over the remainder of the year as Governor Haruhiko Kuroda warns that ‘it may take slightly more months to reach the 2 percent inflation rate.’

- Need a break/close above 104.20 (61.8% retracement) to open up the next topside target around 105.40 (50% retracement), but failure to hold above near-term support around 102.70 (38.2% expansion) may expose the range-bound price action from September.

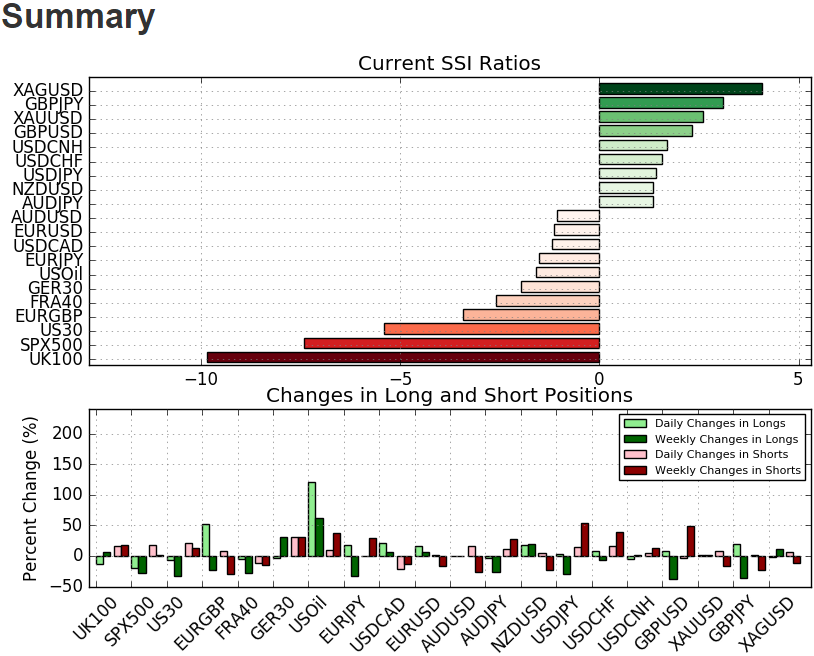

(Click on image to enlarge)

- The DailyFX Speculative Sentiment Index (SSI) shows the FX crowd remains net-long USD/JPY since July 21, with the ratio hitting a fresh 2016 extreme during the last week of September as it climbed to +6.03, while traders have been net-short USD/CAD since September 12.

- USD/JPY SSI currently sits at +1.51 as 60% of traders are long, with short positions 56.2% higher from the previous week, while open interest stands 12.3% below the monthly average.

- USD/CAD SSI currently sits at -1.56 as 39% of traders are long, with short positions 15.7% higher from the previous week, while open interest stands 12.2% below the monthly average.

- Will look for signs of exhaustion in USD/JPY as the sharp pullback in the SSI is accompanied by waning open interest.

Subscribe to Jamie Saettele's distribution list in order to receive a free ...

moreComments

Please wait...

Comment posted successfully.

No Thumbs up yet!