U.S. Treasury Bond Futures Market Review

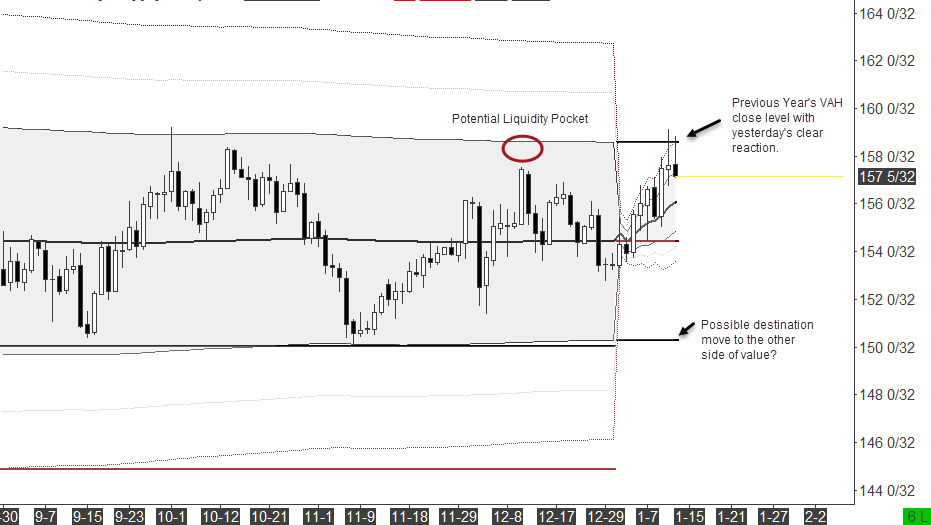

Simplicity is crucial in trading to avoid an information conflict in my opinion. Sure, it's important to understand the higher time frame story to figure out the path of least resistance of whatever market but too much tools or indicators can disturb a clear view and a great trade opportunity could slip away. Take a look at the March contract of the U.S. Treasury Bond Futures for example. Looking at the yearly VWAP with daily bars, we can see that the market hit the previous year's value area high (VAH) close level. As the market opened this year inside of the previous year's value area, we could conclude a potential balanced market behavior for this year with a test of both extremes. With this in mind and yesterday's clear reaction at the VAH level a short trade for the day should be a great idea:

(Click on image to enlarge)

Yes, the market is one time framing higher but with a closer look we can identify a possible liquidity pocket and in combination with the mentioned VAH resistance area a destination move to the other side of value makes the most sense. However, you should always have some several possible scenarios in mind especially in the lovely Bonds.

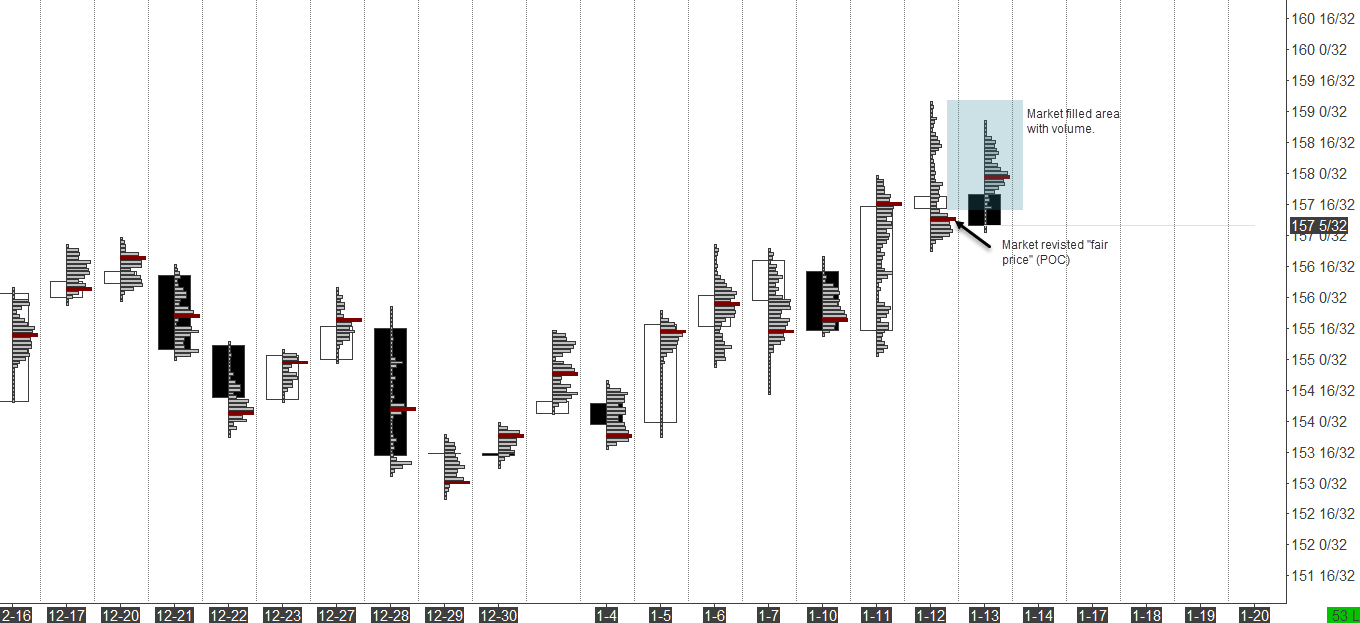

Moving forward to the daily volume profiles, we can identify the previous session’s ‘b’ shaped volume profile. So based on where we opened, we would want to be long biased. However, we quickly moved away from the fair price (POC) and value to fill the low volume areas / single prints. With that the likelihood to revisit the fair price from the previous session was somewhat high. In the end the market corrected its direction to the fair value as said.

(Click on image to enlarge)

Now, we could analyze some smaller time frames to highlight a precise trade entry but I entrust this to you as your homework. By the way, the charts are from Sierra Chart and the chart template is my 'Chess Chartbook'.

Please visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint ...

more