US Small Grains/Wheat Update

Northern Plains Drought may cut US Wheat Area & Size

Market Analysis

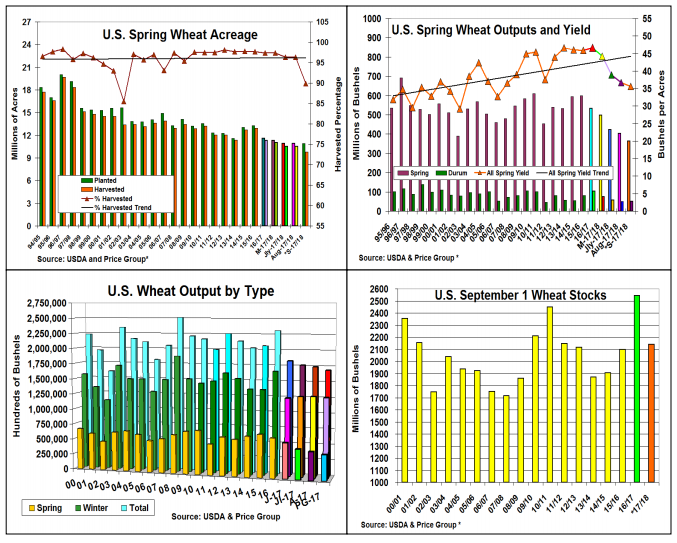

Earlier this summer, ahead of the August USDA crop report, many in the ag markets including us anticipated a significant cut in the US spring wheat crop given the widespread drought that occurred across the N. Plains this year. The USDA dropped its spring wheat yield forecast by 2 bushels 38.3 bu., however, no change in any of the US harvested acres were made that day. Given this year’s growing conditions that appear similar to the past two drought ravaged crops of 2006 and 2002 when the harvested area were 93% and 85.5%, the USDA will likely drop its spring wheat harvested level from 96.3% to 89.9%. or 697,000 on the upcoming Small Grain Report released on September 30.

This year’s heat and dryness also impacted the US durum wheat output in August when the USDA shaved its 6.5 million bu. to 51 million and dropped its yield forecast by 3 bu. to 27.3 bu. Given the pasta demand for this variety, harvested area will likely slip just 3% to 93.8% from the USDA’s previous summer forecast while its output may only drop 1 million bu. to 50 million given some better-than-expected yields floating during harvest. Overall, 2017’s N. Plains output may drop to 413 million bu., off 40 million bu. from the USDA’s August crop levels on this last output report for small grains until January 2018.

Dryness in W.SD and Montana may have also slashed the winter wheat harvested area by 150,000 acres in these states, bringing 2017’s overall reduced combined area to 37.21 million, off 905,000 acres.

This year’s heat & dryness may also slice hard red and white wheat outputs while soft red output may rise in the East. Overall, winter wheat maybe down 12 million bu. bringing wheat’s total crop to 1.688 billion bu. off 51 million from August. This year’s 400 million lower total supplies is the main reason for wheat’s sharp drop to 2.140 billion bu on Sept 1 as a slight export rise counters a slight feed decline.

What’s Ahead:

With 8 months left in the wheat crop year & prices generally below where they began before the summer rally, bakers and wheat users should cover your needs for the balance of the year because of tight high-protein US supplies. Australian dryness & Argentina excessive rainfall are also reasons for a post-harvest recovery to the $4.95-$5.20 range in Dec KC wheat for producers next sales.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more