US REITs Led Most Major Asset Classes Higher Last Week

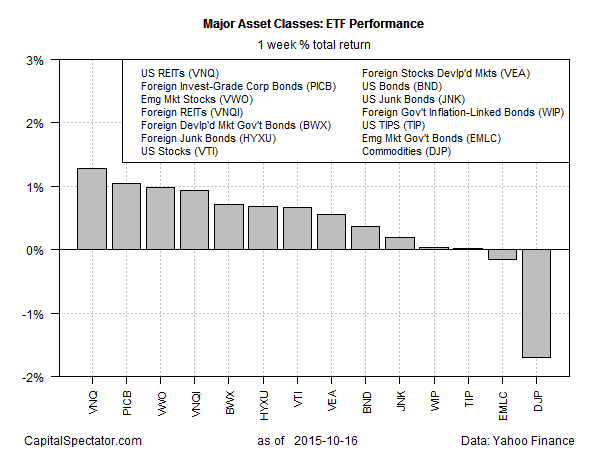

Last week delivered another positive run for most of the world’s risky assets. Although the gains were relatively modest vs. the weekly surge through Oct. 9, the generally bullish bias for the five trading days through Oct. 16 marks a second week of higher prices for the major asset classes, based on a set of representative ETFs.

Leading the pack higher: US real estate investment trusts for the week just passed. The 1.3% total return for the Vanguard REIT (VNQ) is the best performance, edging out the 1.0% increase for foreign corporate bonds via PowerShares International Corporate Bond ETF (PICB). In third place: emerging-market stocks, which added another weekly gain after the previous week’s hefty rise.

The big loser last week: commodities, broadly defined. The iPath Bloomberg Commodity ETN (DJP) shed 1.7%.

The recent rebound in asset prices is starting to bring back positive comparisons in the year-over-year scorecard. Five of the major asset classes via ETF proxies are now showing modest gains for the year through Oct. 16. US REITs (VNQ) are at the front of the line here as well, posting a nearly 12% total return for the trailing one-year period (252 trading days) through last week’s close.

What’s behind the popularity of REITs these days? Two possible explanations are on the short list. One is the ongoing allure of relatively high yields at a time of unusually low interest rates. Morningstar reports that VNQ’s trailing 12-month yield is 4.14%–double the payout rate for the benchmark 10-year Treasury as of Friday (Oct. 16).

A second source of support for REITs: an attractive landscape for mergers and acquisitions. Institutional Investor notes that the recent discount in the price of REIT shares relative to the value of the underlying properties has triggered a “buying spree,” including three acquisitions by the Blackstone Group. The II article advises:

REITs traded at an average discount of 13% as of Oct. 1, according to real estate research firm Green Street Advisors, which estimates the value of the properties in a REIT’s portfolio and compares that total with the company’s market capitalization. The discount was even bigger a few weeks earlier: It neared 20% during the market swoon of August and September, but REIT prices have bounced back a bit since then.

What might temper or even derail the current love affair with REITs? An interest rate hike by the Federal Reserve wouldn’t help. For the moment, however, tighter monetary policy is considered a low-probability event for the near-term future. New York Federal Reserve Bank President William Dudley, quoted in an Italian newspaper late last week, says it’s too early to consider a rate hike. “The situation changed over the last few months,” Dudley explained to CorrierEconomia via Reuters. “It’s true we thought we could raise interest rates by the end of 2015, but turbulence on financial markets, modest global growth, energy prices and macro-prudential imbalances are slowing this process down.”

Fed funds futures at the moment tend to agree with Dudley’s analysis. The probability of a rate hike this month is less than 5%, according to CME Group’sFedWatch data. For December, the probability rises to roughly 30%.

When and if the crowd changes its outlook and sees a rate hike as imminent, REITs could suffer. But in the current climate, the crowd’s inclined to raise allocations to publicly traded real estate securities.

Disclosure: None.