U.S. Junk Bonds Led Markets Higher Last Week

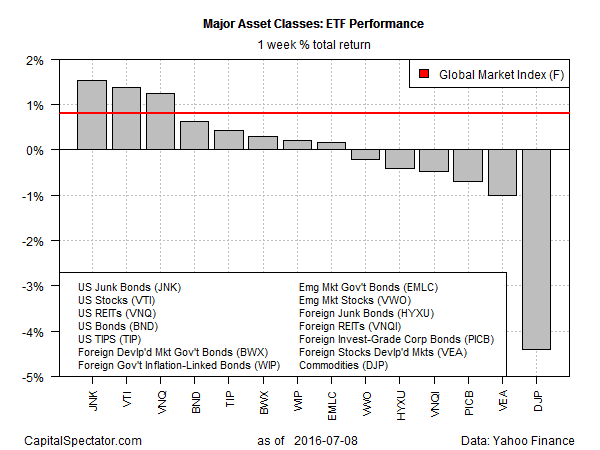

The SPDR Barclays High Yield Bond (JNK) posted a solid 1.5% total return for the shortened four-day trading week through July 8—the best performance among the major asset classes, based on a set of proxy ETFs. The advance marks the second straight week of strong increases for the fund. Part of the renewed allure: relatively juicy payouts at a time when the 10-year Treasury yield has been plumbing new all-time lows amid increased confidence that the US economy will continue to avoid a recession for the near term.

Last week’s big loser: broadly defined commodities. Although gold’s rebound of late has grabbed the headlines, commodities overall have faded in recent weeks. The iPath Bloomberg Commodity (DJP) tumbled 4.4% in the first week of July, the third weekly decline in the past month.

Markets overall reflected an upside bias. The Global Markets Index (GMI.F) — an investable, unmanaged benchmark that holds all the major asset classes in market-value weights—posted a healthy 0.8% total return for the week just passed.

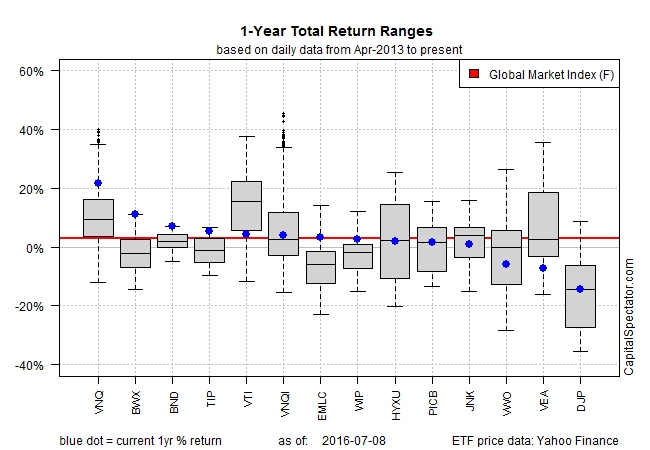

For the trailing one-year period, US REITs continued to hold the lead among the major asset classes. The Vanguard REIT (VNQ) climbed a bit more than 21% for for the 12 months through July 8—outpacing the number-two performer (foreign developed-market government bonds) by roughly two to one over the past year. The comparatively high yields in REITs is probably a key factor as bond rates continue to slide.

Meantime, broadly defined commodities slipped back into the bottom rung for trailing one-year returns. Last week’s loss left the iPath Bloomberg Commodity (DJP) down by 13.4% vs. the same period from a year earlier.

For perspective, GMI.F is up 2.9% for the year through July 8.

Disclosure: None.