Urban Outfitters Impresses With Fourth Quarter Earnings, But Is Now The Time To Buy?

Shares of retailer Urban Outfitters (NASDAQ: URBN) shot up roughly 11% in trading on the morning of Tuesday, March 10th after the company posted better than expected earnings for the fourth quarter the prior evening.

Highlights from the report include earnings of $0.60 per diluted share, beating the analyst consensus of $0.57 and marking a 1.7% increase from the same quarter a year prior. Urban Outfitters posted $1.01 billion in revenue, marking a 12% increase on a year-over-year basis and staying in line with analyst estimates. The company’s revenue growth was driven by a 6% overall sales increase in its retail segment as a direct result of strong holiday sales.

Investors were happy to see the Urban Outfitters brand had a 4% growth in comparable sales, as the company saw a sales dip for the past 3 quarters. The company saw an increase in sales at its sister brands as well; 6% at Anthropologie and 18% at Free People.

Richard A. Hayne, Chief Executive Officer stated, "We are pleased to report our first billion dollar quarter, fueled by positive retail segment 'comps' at all of our brands… It is encouraging to see this sales trend continue into Q1.”

The reason for the Urban Outfitters brand past struggle was due to its core customers ranging from 14-17. The company has been diligently working to have the age range of its core customers between 18-28, which is starting to pay off with its improved sales.

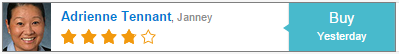

On March 10th, Janney analyst Adrienne Tennant upgraded her rating on Urban Outfitters from Neutral to Buy with a $48 price target, believing that the retailer is getting back on track. She noted, “we choose to upgrade based on the fundamental inflection & look for opportunistic entry points to accumulate.”

Overall, Adrienne Tennant has a 50% success rate recommending stocks and a +6.2% average return per recommendation.

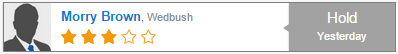

Separately on March 19th, Wedbush analyst Morry Brown reiterated a Neutral rating on Urban Outfitters and raised his price target from $40 to $44. The analyst was “somewhat cautious around 1Q margin visibility” ahead of the company’s earnings report “given IMU and mix shift challenges at UO, along with lapping record merchandise margins at Anthropologie.” He added, “Management noted these headwinds in its commentary on 1Q; however, executives' full year comments struck a confident tone, as the company outlined expectations for margins to increase 100 bps YOY in 2015.” As a result, the analyst believes “this removes much of the risk for margins to disappoint near term, and shares are likely to be supported by improved comp sales trends – which have continued in the mid-single-digit range QTD.” However, Brown said “the positive commentary does raise the bar significantly on execution during 2H15.”

Morry Brown has an overall success rate of 56% recommending stocks and a +9.4% average return per recommendation.

On average, the top analyst consensus for Urban Outfitters on TipRanks is Moderate Buy.

Disclosure: None