Trading: That’s That

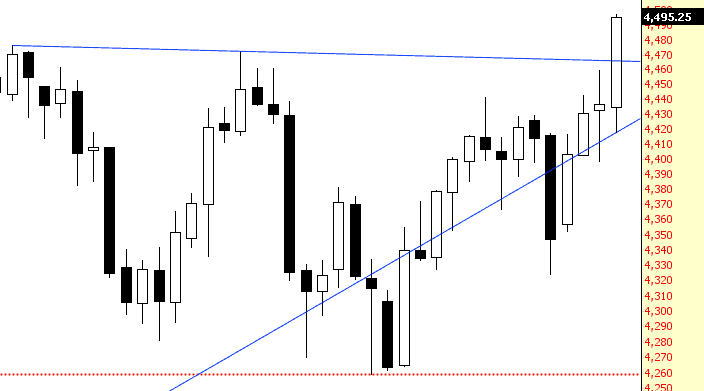

I wrote last night about Bears in the Balance, musing that if we pushed a little higher, it was pretty much curtains for the bears. Well, that’s what happened: the S&P 500 and NASDAQ both closed at the highest levels ever recorded. The NQ has burst above its pattern, yielding a very bullish breakout:

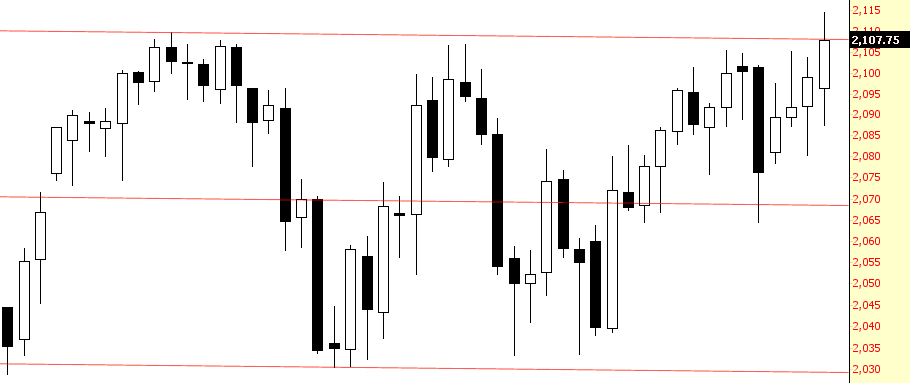

And the ES likewise got above its own pattern Thursday, although it closed immediately within the pattern, not as bullishly-situated as the NASDAQ.

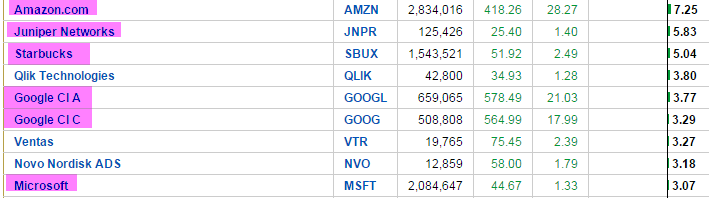

Before Thursday’s close, I would have said the only thin hope the bears might have is for earnings disappointments, but judging from the charts, there was nothing bearish about them. Sure enough, all the big boys are enjoying big gains after hours:

So is it all over for the bears? Are the bulls in a position to simply run away with this market?

Well, yeah. Kinda so. For myself, I have no ETF positions at all, and I’ve backed off my aggressiveness so I’m not using any margin. I am in sixty-four roughly equally-sized individual equity shorts, with a high concentration in resources and energy, and I’m simply going to manage those on a case-by-case basis.

But I gotta tell ya, it’s looking like the S&P might be poised for another 80 points higher in the near future. The relentless bull market is so long-lived at this point, I’ve noticed a severe change in tone over at ZH. The comment section has morphed from a cabal of tin-foil hat wearing lunatics into basically a bunch of people pissed off at ZH for being solidly bearish since its founding in early 2009. I have seriously never seen behavior like that over at ZH, so I guess the last wispy threads of bearish spirit have finally been snuffed out for good.

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more