Traders Unload Tech, Industrials… Buy Health Care, Utes, And REITs

This earnings season has been very strong by almost every measure when it comes to the numbers coming out of corporate America. But as investors know, the ultimate gauge is how stock prices react to earnings reports.

In general, what we’ve seen this earnings season is an initial positive stock price reaction to the news followed by a large batch of selling throughout the trading day.

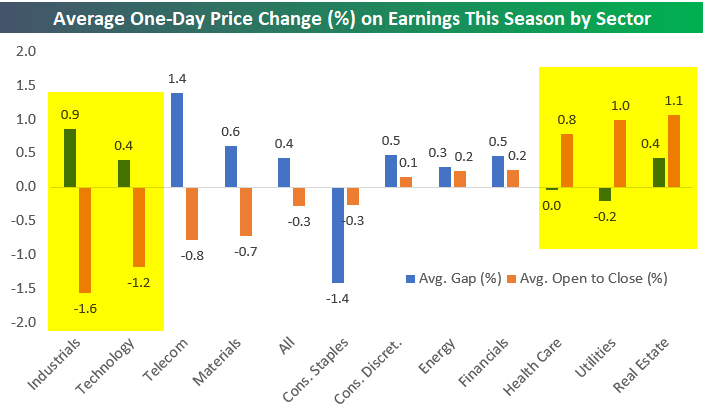

We measure the one-day stock price change in reaction to earnings for every company that reports quarterly numbers. We also break that one-day price change into two parts — the initial gap that share prices experience when they open for trading following their earnings report, and the change from that gap at the open of trading through the close of trading that day (open to close % change).

Below we show how much the average stock that has reported earnings this season has gapped up or down at the open by sector. We also show how much the average stock that has reported has moved from the open to the close of trading.

For all stocks that have reported earnings this season, the average move has been a gap up of 0.40% at the open followed by decline of 0.30% from the open to the close. This means investors are initially bidding shares up on earnings before sellers come in during the trading day.

A few sectors stand out. First off, both Industrials and Technology have seen shares bid up at the open on earnings optimism, but they’ve sold off hard throughout the trading day. The average Industrial stock has gapped up 0.90% at the open following earnings only to sell off 1.60% from the open to the close. For Tech stocks that have reported, they have averaged a gap up of 0.40% and then an open to close decline of 1.20%. For these two sectors, positive earnings news appears to have already been priced in.

Other sectors have seen their stock prices do well this earnings season. Consumer Discretionary, Energy, and Financials have all seen initial gaps higher and continued buying throughout the trading day. Health Care, Utilities, and Real Estate (REITs) have seen a wave of buyers come in during regular trading hours. Utilities and Real Estate stocks that have reported have averaged gains of more than 1% from the open to the close. We don’t view shifts out of Tech and Industrials and into Utilities and Real Estate as a very bullish signal.