"Trade Wars Are Good, And Easy To Win": Soybean Edition

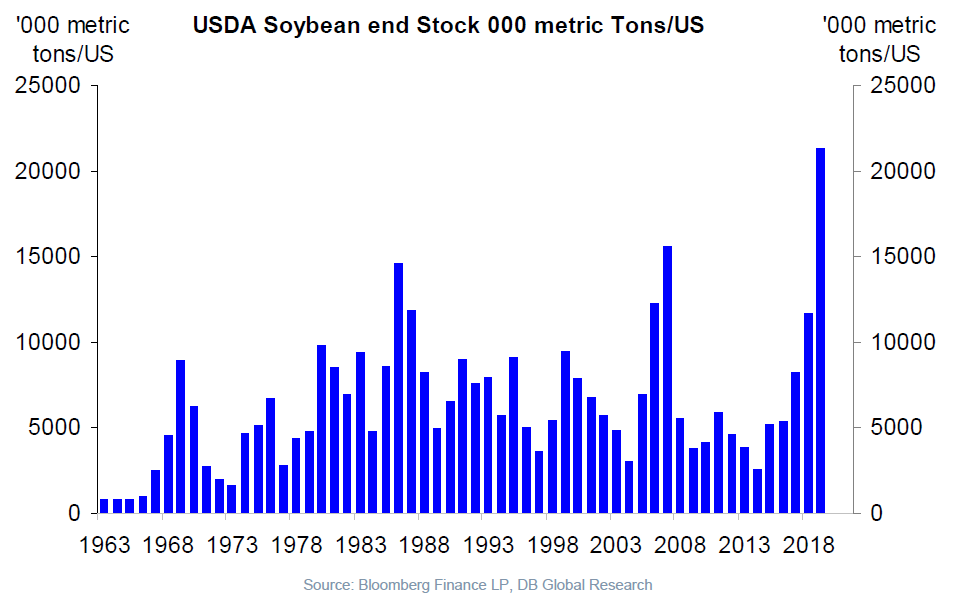

I am dubious. End-market year soybean stocks at record highs.

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

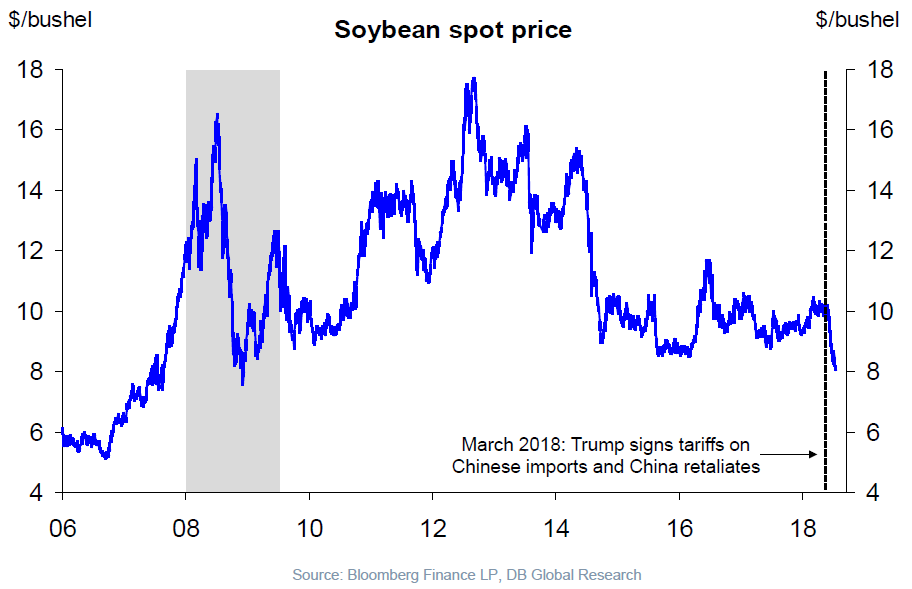

And those stockpiles are now valued at lowest prices in a decade, down 20% from when Mr. Trump started imposing sanctions.

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

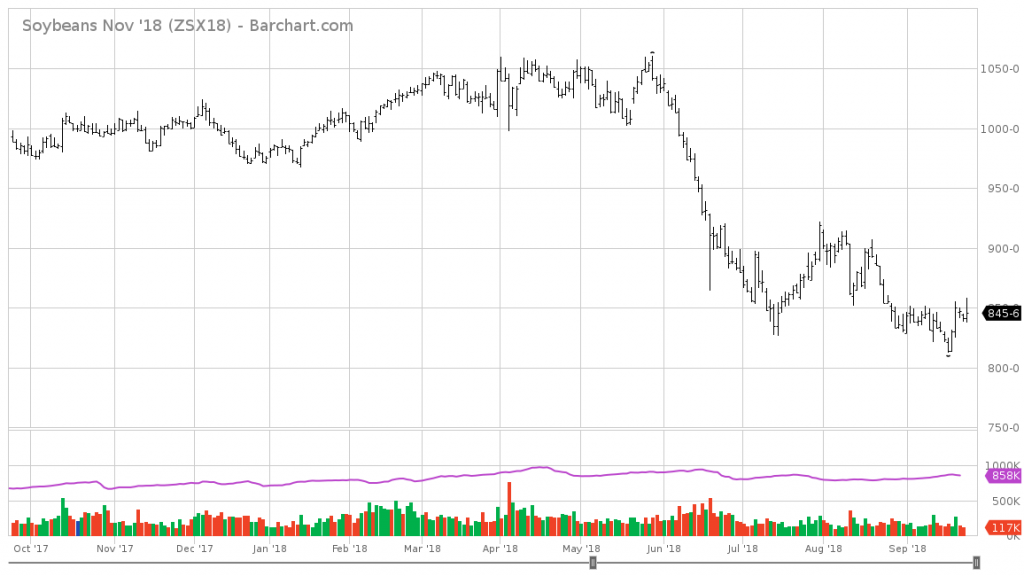

There have been numerous voices commenting on this weblog arguing that US soybean prices will recover during the harvest period in the US when Brazilian soybean sources are exhausted. Thus far, futures prices (for November, etc.) have not exhibited such behavior. Since several studies (Chinn-Coibion, 2014; Reichsfeld-Roache, 2011) have documented that futures are unbiased predictors of future soybean prices, I do not think the market’s sentiment is in synch with such predictions.

Source: barchart.com.

Interesting article from FoxNews today, entitled Farmers fear China will never return to the US soybean market:

“The short-term worry is a significant number of farmers are unable to meet their cash flow needs, Heck tells FOX Business. He says he’s been able to use hedging strategies to limit his losses, but knows some others farmers aren’t as fortunate. He fears they may soon lose their farms, or at least have to refinance their mortgages. Adding to that, Heck says he has heard China may cut back on direct purchases of U.S. soybeans by as much as 75 percent. The question he and other farmers now have to face: Will the Chinese buyers ever return?

…“As of the beginning of March, the Chinese are working to not ever have to buy U.S. soybeans until trade disputes are resolved,” says Burke in a telephone interview with FOX Business from Beijing. “They made every effort to purchase every last soybean they can find from Brazil. That allows them to get through November, and maybe December.”

Burke and other observers are just looking at the calendar, and using history as a guide. China turned so heavily to Brazil because poor weather in Argentina damaged the crop in that country. Next year, that will presumably be corrected, giving China more options. The more options it has, the fewer U.S. soybeans it’s likely to buy.

The impact is already being felt in price. “If there was no tariff, China would be buying U.S. soybeans at a premium to make up for the short crop in Argentina,” says Burke. “U.S. soybeans are usually the most expensive in the world. Now they’re the cheapest.” …

Disclosure: None.