Third Time Lucky For Oil?

(Click on image to enlarge)

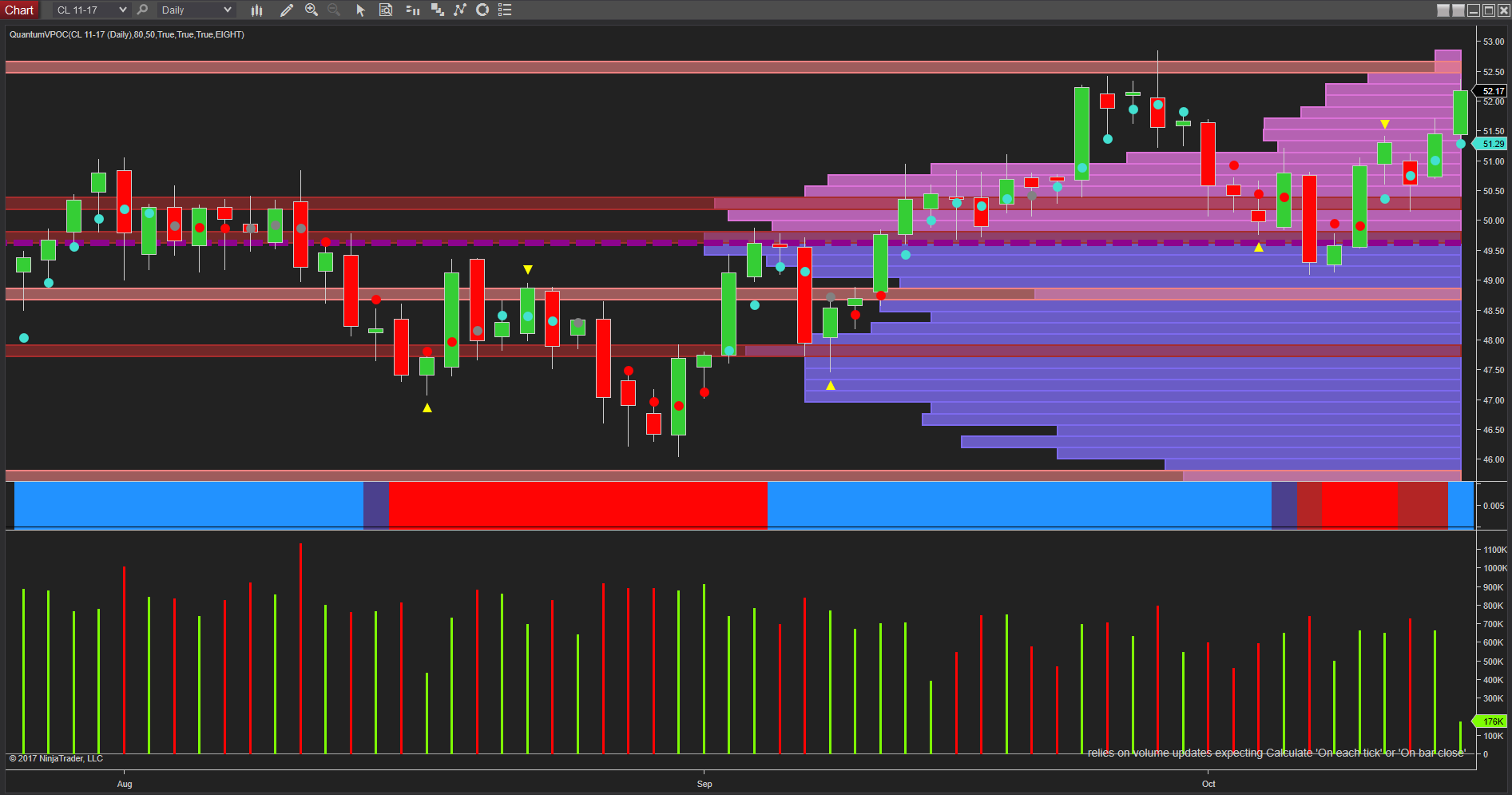

Whilst the fundamental landscape for oil remains much the same, with OPEC continuing to maintain supply control for both member and non-members alike, the technical picture is once again approaching a key price region and one which is likely to set the tone for oil prices moving forward. That price point is $52.50 per barrel and an area that was tested several times, both in late September and in early October, before the price of oil moved back to the volume point of control in the $49.65 per barrel area.

Today’s price action is another attempt to breach this region, with Friday’s candle supported on good solid volume, and indeed was the same price area back in May which saw prices develop a price waterfall and collapse back to $43 per barrel. This is now a key level and one which is being tested for the third time this year. If it is duly breached this will then open the way for a stronger move higher, and up to test the dense congestion region which awaits between the $55 to $58 per barrel region.

Volumes today will be key as will the price candle, and should this close with a wide body and little or no wicks with strong volume, then this will be a strong signal of big operator participation and a continuation of the bullish momentum now building.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more