Things You’ll Never Believe

So today I’m going to leap all over the place and show you some some interesting things that’ve come across my desk in the last week. Why no full fledged blog?

Well, if you didn’t notice, this week’s WOW on the “Trumpification” of US foreign policy (and its winners and losers), was, I dare say, a bit of a beast. And so for all my avid readers who managed to get through it all, it was worth it for me. Also, I’ve been spending some time on my latest Insider alert and time is running short.

First out of the gate, a funny conversation I had with my dear wife:

- Wife: So, let me get this straight: you’ve got thousands upon thousands of people on your list but only 42% of them read your work?

- Me: Well, I guess only 42% open their emails, yes. I couldn’t understand it for a while.

- Wife: You’d better step up your game, that’s awful.

- Me: Well, I’m told it’s actually quite good as open rates for this blogging stuff are typically around 20%, so in theory I’m killing it, honey.

- Wife: Well, that makes no sense. Why would someone sign up and then not read your emails? It must be that you’re just not that good. I think you should just focus on your fund and leave all this stuff alone.

- Me: Well, this helps me to concentrate on thinking stuff through so that the fund will do well. And look, it’s working.

- Wife: Seems all backward to me.

- Me: Yeah, but you don’t use the net like most and you never use social media at all so you wouldn’t know.

I was hoping she wouldn’t ask if all of the 42% who open the emails (according to my mail system) are members of Insider (they’re not). Then I’d have some explaining to do. She didn’t. Whew!

It made me realise how much I’ve learned since starting my blog and how many people, just like my wife, don’t understand revenue models for businesses which brings me to…

Hahaha! Going in at an eye watering valuation of $25 billion.

Now, if you’re one of those guys (you know who you are) who are running an IPO book, then you’ve been waiting for something like this. The equity markets have seen a dearth of these so it’s about time, heh? After all, all the fun’s been in fixed income (aka bubble) markets.

Your problem is that the media is pretty hyped about this little baby and so the bookmakers don’t need to give you that stock allowing you to dump it in the first few weeks. Nope, you’ll have to take the lockups they offer you and then you and I both know the risks you’re running now, don’t we? I look forward to see how you play it.

You’re playing on the gullibility of the retail guy. And for the retail guys amongst you, remember this and etch it into your brain: IPOs are NOT an entry. They are an exit. Realize that you are the last in line after founders, venture capitalists, lawyers, and investment bankers. They are all looking for liquidity – exiting.

If that’s not enough then consider the following:

- Negative gross margins and a $2 billion commitment to Google.

- What the hell is the business actually? I mean is this a social media/advertising business or is it a data center reseller?

- Amusingly the company actually calls itself a “camera” company in its company filings. No, it’s bloody not. If you make your money selling cameras, you’re a camera company, OK? If you make it selling advertising, then you’re an advertising company. And if you make your money selling your clients data, then you’re a data reselling company, OK? These guys are most certainly not a “camera” company. Sheesh!

If you buy into the IPO, you’re speculating. This isn’t investing. At some point – and we’ll return there again – investors are going to give a shit about profits again and companies that fight for eyeballs and concoct valuations based on eyeballs (and not hard cash in the till) will find a significantly different environment.

If you want my take on valuing businesses based on “eyeballs” go read “Watch Out For Your Eyeballs”, which was fun to write but not half as fun as the responses I received from venture capitalists explaining to me how wrong I was and that “this time it’s different”.

Back to Snipsnap chitchat. Even if the market really likes it. Explain to me where’s the asymmetry in this? High risk, low reward. Why bother?

What You See Is What You Get

I think this is going to become my mantra for Trump.

Friends who hated the thought of the basilisk winning automatically became Trump supporters. I think it’s a terrible idea to think that notvoting for one party should equal cheerleading their foe. Trump is a perfect example of this.

The man shows disturbing signs of adolescence. He’s childish, petulant, and self obsessed. Again, what you see is what you get. Trump the president is the same as Trump the “before president”. People mistakenly believed he’d “grow up” and become more “presidential”. Nope!

Case in point: Mexico.

He’s lost a lot of money in Mexico and clearly holds a grudge. Fine for an individual but as a foreign policy?

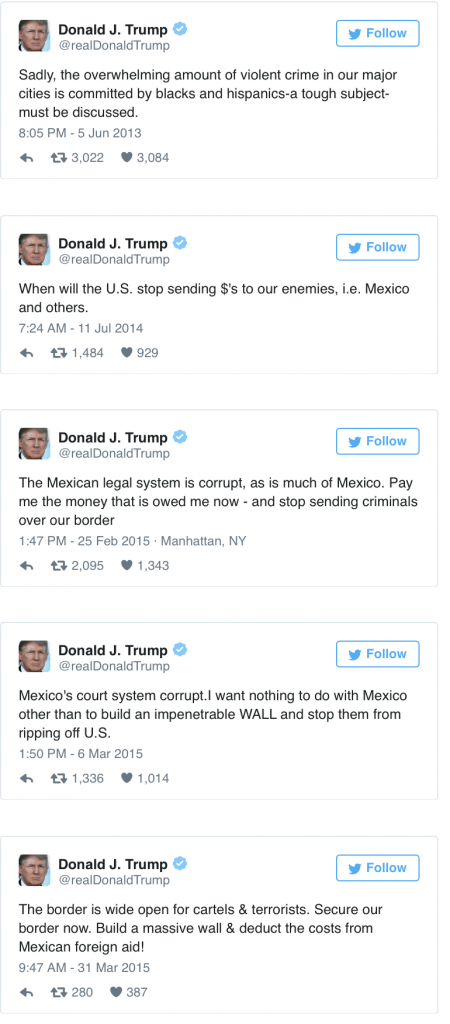

Time published an entire list of Trumps tweets on Mexico:

This is a guy who is combative, a bully, and unfortunately doesn’t seem to understand that threatening nuclear superpowers is, ahem… dangerous.

As I mentioned in my Wednesday’s WOW, talking to China like it’s a naughty adolescent is plain stupid.

When Trump was on the campaign trail telling the paid for media and the elites to get knotted this was a lot of fun but treating Iran and China like misbehaving schoolchildren while at the same time pissing off allies (Germany, Britain, Australia, Canada) simply means that you’re backing yourself into that corner that every bully ultimately gets backed into – the one where he finds himself with a blood nose and the other school kids laughing at him.

A Question

Lastly, I’ll answer a question and, as always, my sincere apologies to all those who wrote to me with questions which I haven’t replied to. I do read them all but if I had to answer them all I’d be divorced, and there’d be no blog.

Chris,

Your understanding of the world is truly unique. Yours is easily the most insightful financial publication on the internet… and I’ve been a consumer for financial publications for over 30 years now. I have gone back and read many of your posts from years ago and though I’ve not tabulated any results you’ve definitely got an impressive track record.

I realise that I’m just a little guy unlike some of your readers who are clearly sophisticated investors and professional money managers. I’m a retail investor with a small portfolio (about $200k) and if you’d be so kind I’d love to know how you would allocate a portfolio of this size.

Thanks very much for all your work.

Firstly, allocations are dependent on so many factors such as your current income, cost of living, obligations, tolerance to risk, and experience in managing your money.

I do think the most valuable thing I’ve ever managed to do, and it’s an ongoing process, is to “know yourself”.

I’m largely risk tolerant. This is due to my personality but also because of my background. I didn’t come from wealth and it is risk taking that has brought me so much. I know that if you dropped me into some unknown country in my underpants I’ll come out OK. This feeling or attitude allows me to take risks few would dare take.

But risk for the sake of risk is dumb. You want risk that is skewed in your favour. Vegas is dumb risk. Investing in cyclical sectors that are bottoming is skewed risk.

That said, I believe that you should try focus on income generating assets for the core part of your wealth. That’s tough in today’s environment where dividend yields are low, bond yields are non-existent, and equity valuations are far from cheap (I’m referring to the US here).

My personal attitude is to protect the majority of your capital and not expect anything from it, and then to take a portion of your portfolio (and only you can decide what that is) and focus on the greatest asymmetry around.

Coincidentally, I believe we have more on offer in that space than at any time in history. Literally every asset price has been distorted by the actions of central bankers, creating huge misallocations of capital as asset mangers have chased one sector after another in search of returns. I believe we’re in the early stages of this unwinding. As a reader, you’ll know it’s a topic I’ve covered extensively.

We’re not in any “normal” investing environment today. What worked for the last 10 years almost certainly isn’t going to continue to last for the next 10. This is a time to be really vigilant. And that’s what I’m doing.

Disclosure: Long FINN13 and FIHO12

Disclaimer: This site is not intended to render investment advice.None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed ...

more