Thin Rally? Thin Argument

It continues to amaze us at how often we hear arguments that the market’s rally this year has been thin. A rally that is thin is one where just a handful of stocks are participating in the market’s gains, while the rest of the market languishes. An extreme example of this was in the late 1990s and early 2000 when tech stocks surged, while most other areas of the market declined. Today’s market is nothing even close to resembling that. Take, for example, the S&P 500’s cumulative A/D line. Since the S&P 500 last made a closing high in late January, the cumulative A/D line has seen close to 20 new all-time highs. That’s the opposite of a thin rally!

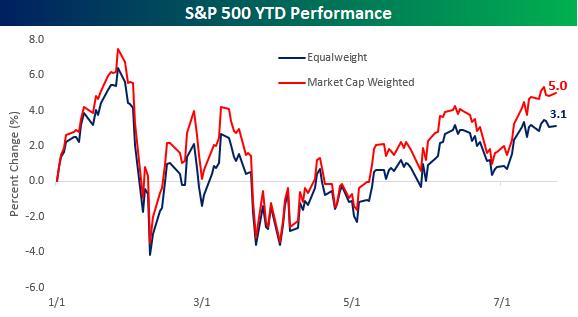

Another way to look at this is to compare the performance of the S&P 500 on both a market cap and equal-weighted basis. Looking at performance on an equal-weighted basis tells you how the ‘average’ stock is doing, while the normal market cap weighted approach puts a larger emphasis on the bigger names. So far this year, the market cap weighted S&P 500 is up 5% YTD, while the equal-weighted index is up 3.1%. These performance numbers definitely imply that larger mega-cap stocks in the index are doing the best so far YTD, but all 500 stocks in the index are also up an average of 3.1%, so they’re not exactly slumping.

(Click on image to enlarge)

Performing the same analysis on a sector by sector basis, proponents of the thin rally argument may be surprised to learn that in six of the S&P 500’s eleven sectors, the YTD performance of the weighted index is actually underperforming the performance of the equal-weighted index. Looking at the chart, the only sector where the market cap weighted sector performance is materially greater than the equal-weighted performance is in the Consumer Discretionary sector where Amazon’s 56% return and Netflix’s 87% gain have really skewed things. Outside of Consumer Discretionary, though, there is not a single sector where the market cap weighted sector performance exceeds the equal-weighted performance by more than two percentage points.

(Click on image to enlarge)

Given the fact that there is plenty of strength in the market outside of the large mega-caps, a good place to look for new ideas is in our more