The Stock Market Is Screaming That The Fed Has Crushed Economic Growth

If you need more evidence that the Fed scr**ed up during its latest FOMC meeting, take a look at the below chart.

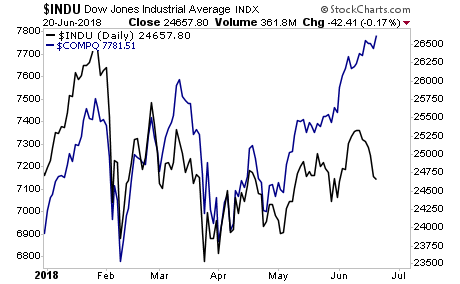

This chart shows the Dow Jones Industrial Average (a stock index comprised of economically sensitive bell-weathers such as Caterpillar) vs. the Nasdaq (a stock index that is heavily skewed towards Tech giants).

As you can see, for most of this year to date, these two indices have moved in a virtual lockstep. The Nasdaq began to outpace the DJIA in April when the Fed increased its QT program from $10 billion to $30 billion per month.

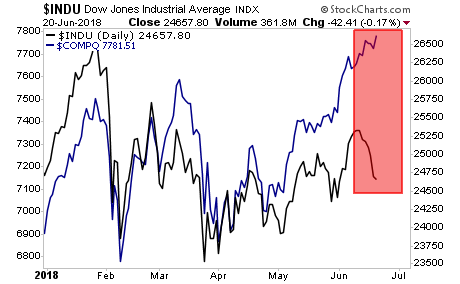

However, it wasn’t until last week’s FOMC that the divergence became extreme. As you can see in this second chart, the DJIA rolled over IMMEDIATELY after the Fed meeting and has taken a nosedive ever since. The Nasdaq, on the other hand, has gone straight up.

Put simply, the market is discounting that Fed policy is going to crush the economic expansion, leaving the only growth in the large Tech space.

If the Fed doesn’t figure this out soon, we could very well see a market bloodbath hit.

Disclosure: We just published a 21-page investment report titled Stock Market Crash Survival Guide. In it, we outline precisely how the crash will unfold as well as which investments will ...

more