Markets: Penny Candy

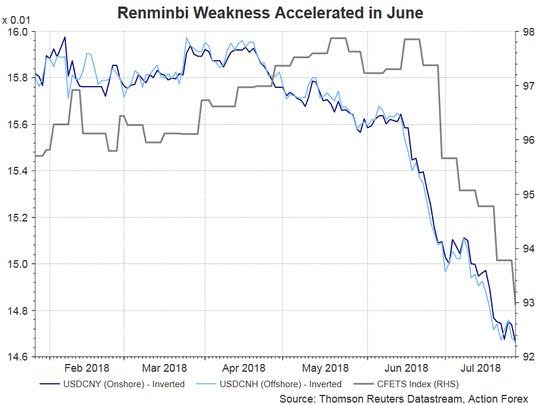

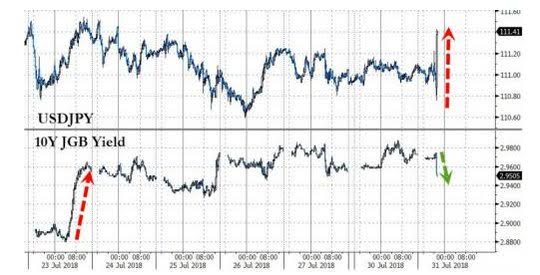

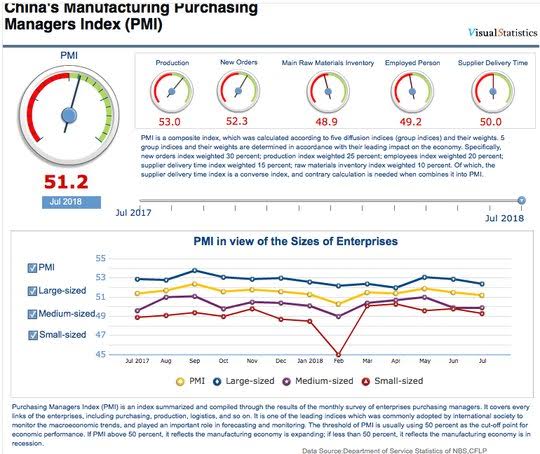

Where I grew up there was a general store in the middle of town that sold penny candy. This was the place to go in summer when you found a quarter under the sofa and had nothing else to do but sweat. Money in hand, biking madly, thinking of gum stoppers and ending up with a bag full of sugar filled with joy. The BOJ decision today is a lot like that for investors, a decision filled with empty calories leaving markets joyful they didn’t act further, but now waiting for a sugar crash. Tweaking, its called, like the day when prices of favorite candies went to 2 cents and the best to a nickel but there still was some penny candy and sometimes free when the store owner needed to get rid of it or throw it away. So BOJ Kuroda sees a wider range for 10-year yields in Japan from 20bps around zero to 40bps around zero. Net result was a rush for risk assets with USD lower in EM, stocks higher and bonds rallying. The ride home from the store always had a stomach-ache, hills were harder to climb – so too today for EU bonds as Eurozone inflation is higher and growth lower. There was so much economic news overnight that the BOJ/Eurozone GDP/CPI headlines are more hills than peaks for risk – as German retail sales missed bounce hopes, jobs were good but not enough, China PMI missed, New Zealand business outlook hits a 10-year low, and Japan jobs and industrial production both miss. Growth lower, inflation higher isn’t a good mix for longer-term risk taking in a world where central banks play with pricing penny candy. Of course, this economic data doesn’t drown out the ongoing geopolitical noise either – call that the eight-track tape of the candy store with Trump thinking about a $100bn unilateral tax cut, with the White House prepared to end Iranian sanctions if Iran behavior changes and with Canada’s bid to be part of US/Mexico NAFTA talks rejected. In the UK, PM May is warning her party of a “humble address” – leaving the risk for early elections open and adding to Labor government fears for markets. Put all that together into the FOMC and BOE meetings along with more earnings and more heavy economic data and you get volatility. The only chart that seems to be on an obvious trend against the USD today is CNY and CNH – and perhaps that is the only candy we need for trading now. CNY weakens 3.1% in July, extending its four-month decline to 8.2%.

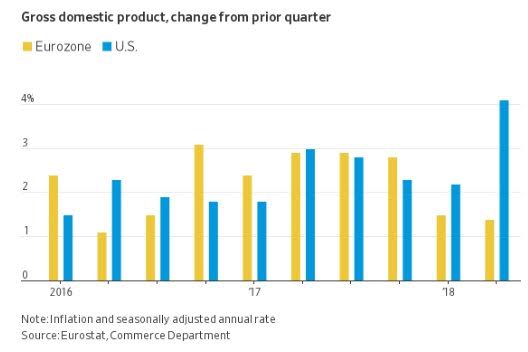

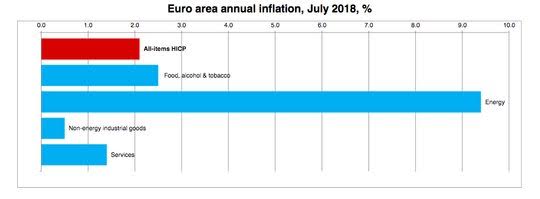

Question for the Day: Does growth or inflation matter to FX? The question seems to be answered today with the EUR over 1.17 despite weaker GDP in 2Q. The inflation flash for the Eurozone was sufficient to keep expectations for ECB action in September alive and to contrast with view that the FOMC is nearer done than just getting started on rates.

The real story today for movement in FX is around the BOJ and its clearly got lower CPI and GDP vs. the US so the rally up in USD/JPY tracking rate spreads maybe the logical consistency macro players want and get today.

What Happened?

- China July CLFP Manufacturing PMI 51.2 from 51.5 – weaker than 51.3 expected. The Services PMI 54 from 55 – also weaker than 55 expected. Expectations fell to 60.2 from 60.8 – the third monthly decline. The manufacturing production index fell to 53 from 53.6 with adverse weather and equipment overhauls cited. New orders fell 0.9 to 52.3 – worst in 5-months. New export orders were flat at 49.8 – linked to US trade conflict. Imports fell to 49.6 from 50 – the first contraction in 5-months.

- Australia June private sector credit up 0.3% m/m after 0.2% - near expectations – still lowest rate since Dec 2012. Investor mortgages fell -0.1% m/m, up 1.6% y/y – record lows. Business credit rose 0.3% after 0%. Personal credit was flat. The M3 growth rose 0.2% m/m but fell to 1.9% y/y – lowest since 1992. Australian June dwelling approvals rose 6.4% m/m after -2.5% revised (-3.2% m/m preliminary) – also near expectations. Apartments rose 7.2% after 4.2% while housese rose 5% after -7.4%.

- New Zealand July ANZ business outlook -44.9 from -39 – 10-year lows. Activity outlook drops to 3.8 from 9.4, exports 11.6 from 12.2, employment plans 1.5 from 1.2, pricing intentions 29.3 from 26.9 with inflation expectations 2.24% from 2.29%. Ease of credit worse -36.5 from 32.1 and investment intentions 0.6 from 3.6.

- BOJ votes 7-2 to make long-term rate targets and asset purchases more “flexible.”The central bank left its JGB buying frequency unchanged for August as well. They also cut their CPI forecast. In the bank's quarterly Outlook Report, the median forecast for the core CPI (excluding fresh food) by the nine-member board was revised down to +1.1% for fiscal 2018 from +1.3% projected in April. The median inflation forecast for fiscal 2019 was also revised down to +1.5% from +1.8% made in April and that for fiscal 2020 was lowered to +1.6% from +1.8%. The forecast excludes the direct impact of a sales tax hike to 10% from 8% planned in October 2019. Firms' cautious wage- and price-setting stances as well as households' cautiousness toward price rises "have not yet clearly changed, and downward pressure on prices stemming from intensifying competition has been strong in some areas," the BOJ said. On the other hand, the median economic growth forecast for the current fiscal year was revised down slightly to +1.5% from +1.6% made in April. The GDP projections for fiscal 2019 and 2020 were left at 0.8%. The BOJ continues to see Japan's potential growth rate in a range of 0.5% to 1.0%.

- BOJ Kuroda: Sees wider trading band for 10-year bonds. "Trading in the JGB market has shrunk and its function has been reduced. By allowing a wider trading range, I think the market will regain some vitality," Kuroda said in his news conference post the BOJ decision. "But this does not mean that we are making an adjustment to the policy stance or seeking to raise interest rates." He added that there is no need to further expand the 10-year yield trading band in the near future. The BOJ adopted "forward guidance" for the policy rates to show that it is "strengthening its commitment" to guiding low inflation to its stable 2% target. This should help the bank "persistently continue" aggressive monetary easing as the stubborn deflationary mindset lingers among businesses and households. "Today's decision doesn't mean that we are moving toward an exit (from easing)," Kuroda said. The tweaked policy stance "clearly denies the notion that it amounts to a rate hike."

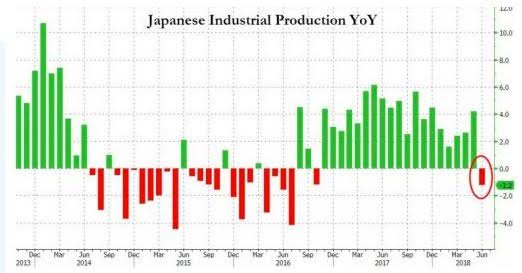

- Japan June industrial production -2.1% m/m after -0.2% m/m – weaker than -0.4% m/m expected. The METI July survey forecast revised higher from 0.8% m/m to +2.7% m/m and in August 3.8% m/m. Adjusting for upward bias from the survey, the METI sees 0.2% m/m in July. The government kept its view that output is picking up modestly. The 2Q output was up 1.2% q/q after -1.3% in 1Q.

- Japan June unemployment rate jumps to 2.4% after 2.2% - worse than 2.3% expected. The employment rose 1.04mn y/y after 1.51mn in May.

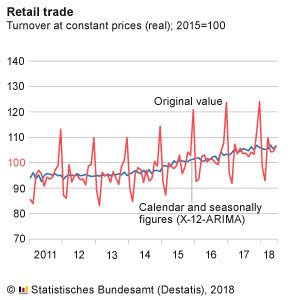

- German June retail sales +1.2% m/m, 3% y/y after revised -1.5% m/m – better than +1% m/m expected. 2Q sales rose 0.9% q/q after -0.5% in 1Q. The 3M average rose to 0.4% in June after 0.1% in May.

- German July unemployment change -6,000 after -14,000 – less than -10,000 expected – but the unemployment rate steady at 5.2%. The total unemployment fell to 2.338mn form 2.344mn with job vacancies up 6,000 after 5,000 rise in June. Payroll jobs rose 28,000 after 32,000. The June ILO employment rose 28,000 to 44.698mn with unemployed 1.49mn and a rate dropping to 3.4% from 3.5%.

- Eurozone 2Q preliminary GDP 0.3% q/q), 2.1% y/y after 1Q 0.4% q/q/, 2.5% y/y – weaker than 0.4% q/q, 2.2% y/y expected – much of the slowdown is linked to base effects.

- Spanish 2Q preliminary GDP up 0.6% q/q, 2.7% y/y after 0.7% q/q and 3% y/y – slightly better than 2.8% y/y expected.

- Italy 2Q preliminary GDP up 0.2% q/q, 1.1% y/y after -.3% q/q, 1.4% y/y – slightly less than 1.2% y/y expected. Agriculture fell while services and industrial output rose. 2Q results show 0.9% acquired GDP for 2018.

- Eurozone June unemployment held steady at 8.3% after May revised to 8.3% - as expected. Youth unemployment held steady at 16.9% as well.

- Eurozone July flash HICP up 2.1% y/y after 2% y/y – more than 2% y/y expected. Core HICP rose 1.1% after 0.9% y/y – also more than 1% y/y expected. The energy component rose 8.4% y/y and food/alcohol rose 2.5% y/y.

- Italian July flash HICP -1.4% m/m, +1.9% y/y after 1.4% y/y – more than 1.4% y/y expected – highest since April 2017. Core HICP 1.2% from 0.8% y/y. The NIC CPI was 0.3% m/m, 1.5% y/y with core 0.7% after 0.8% y/y.

- French July flash HICP -0.1% m/m, +2.6% y/y after 2.3% y/y – more than 2.4% y/y expected. The flash CPI -0.1% m/m, +2.3% y/y after 2.0% y/y.

Market Recap:

Equities: The S&P500 futures are up 0.5% after losing 0.58% yesterday. The Stoxx Europe 600 is up 0.3% after opening flat – tracking earnings – The MSCI Asia was flat with gains in China offset by losses in Hong Kong.

- Japan Nikkei up 0.04% to 22,553.72

- Korea Kospi up 0.08% to 2,295.26

- Hong Kong Hang Seng off 0.52% to 28,583.01

- China Shanghai Composite up 0.26% to 2,876.40

- Australia ASX off 0.04% to 6,366.20

- India NSE50 up 0.33% to 11,356.50

- UK FTSE so far up 0.40% to 7,732

- German DAX so far up 0.10% to 12,806

- French CAC40 so far up 0.10% to 5,495

- Italian FTSE so far 1.1% to 22,200

Fixed Income: Bull flattening caused by the BOJ tempered slightly by Eurozone flash CPI but supported by GDP. 10-year UK Gilt yields off 0.5bps to 1.335%, German Bunds flat at 0.443%, French OATs off 0.7bps to 0.735%, while periphery gains with Italy off 1.5bps to 2.765%, Spain off 1.5bps to 1.407% and Portugal off 1.5bps to 1.74% - but Greece is the exception up 7.5bps to 3.92%.

- Belgium sold E1.335bn of 3M bills Nov 8 TC at -0.55% with 2.26 cover – previously -0.57% with 2.11 cover.

- US Bonds are bid with bull flattening post BOJ flexibility – 2Y flat at 2.661%, 5Y off 1.3bps to 2.836%, 10Y off 2.2bps to 2.951%, 30Y off 3.2bps to 3.073%.

- Japan JGBs see massive bull flattening post BOJ – 10Y off 6bps to 0.55%, 40Y off 12bps to 0.875%.

- Australian bonds lower on building approvals, caught with risk-on mood – 3Y up 2bps to 2.095%, 10Y up 1bps to 2.66%

- China PBOC skips open market operations, net drains CNY30bn on the day. The O/N rate fell 12bsp to 2.04% and the 7-day was steady at 2.62%. 10Y bond yields fell 4bps to 3.49%.

Foreign Exchange: The US dollar index is off 0.3% to 94.25 with 93.95 and 93.71 back in play. In Asia EM FX, USD is offered – INR up 0.2% at 68.547, KRW up 0.2% to 1117.00 and TWD flat at 30.61 off 0.4% on the month; In EMEA EM FX, USD mixed – RUB off 0.3% to 62.429, ZAR up 0.35% to 13.097, TRY off 0.3% to 4.8965.

- EUR: 1.1725 up 0.3%. Range 1.1700-1.1744 with 1.1780 and 1.1820 next.

- JPY: 111.55 up 0.5%. Range 110.75-111.59 with EUR/JPY 130.85 up 0.70% - focus is on 111.80 and 112 barrier again.

- GBP: 1.3155 up 0.2%. Range 1.3113-1.3173 with EUR/GBP .8915 flat. UK May and Brexit still key but BOE and data next drivers.

- AUD: .7415 up 0.1%. Range .7404-.7434 with NZD .6815 off 0.15%. Focus is on metals/growth/crosses with NZD hit on biz confidence drop

- CAD: 1.3050 up 0.2%. Range 1.3023-1.3096 with NAFTA deal hopes weaker and oil lower – 1.30 base for 1.32 again.

- CHF: .9880 flat. Range .9869-.9890 with EUR/CHF 1.1590 up 0.2%. Stuck.

- CNY: 6.8165 fixed 0.05% weaker from 6.8131, trades weaker off 0.2% to 6.8325 at close. CNH off 0.2% on the day to 6.8405 off 3% on the month.

Commodities: Oil lower, Gold lower, Copper off 0.4% to $2.8060.

- Oil: $69.73 off 0.6%. Range $69.55-$70.22 with Brent $75.09 up 0.15%. Focus is on API tonight, Saudi supply risks, Iran/US talks with Brent holding $74.50-$76 consolidation.

- Gold: $1220 off 0.1%. Range $1215-$1222. Focus is on $1216 and $1204 support with USD key. Silver flat at $15.487, Platinum up 0.45% to $832.40 and Palladium up 0.2% to $931.55.

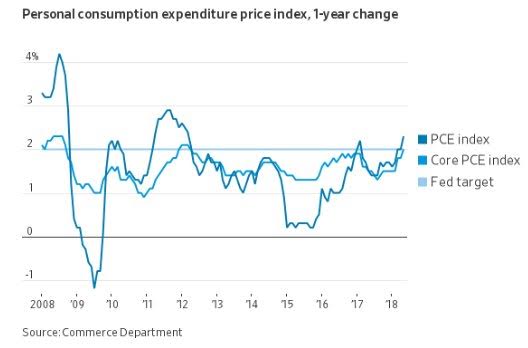

Conclusions: Is the PCE index the key for FOMC and trading today? The markets are going to get a lot more news today PCE prices maybe lost but they seem important to the Fed credibility and the recent reaction of bonds to BOJ tweaks. The PCE core over 2% looks important, perhaps more than Apple earnings. Though the risks for equities remain in further rotation plays as the FANG index slips into correction territory.

Economic Calendar:

- 830 am US June personal income (m/m) 0.4%p 0.4%e / spending 0.2%p 0.4%e / PCE prices 2.3%p 2.2%e / core PCE 2%p 1.9%e

- 0830 am US 2Q employment cost Index 0.8%p 0.7%e

- 0830 am Canada June industrial PPI (m/m) 1%p 0.3%e / raw materials 3.8%p 2.5%e

- 0830 am Canada May GDP (m/m) 0.1%p 0.3%e

- 0900 am US May Case-Shiller home prices (y/y) 6.6%p 6.4%e

- 0945 am US July Chicago PMI 64.1p 63.0e

- 1000 am US July conference board consumer confident 126.4p 126e

- 0430 am US weekly API crude oil stocks -3.16mb p -1.4mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.