The Morning Track – Acronyms

Some sets of letters strike fear in traders – BBB used to be one of them back in the crisis days of 2008. Credit mattered then and the BBB ratings were illiquid and effectively become junk – forget that pesky letter C. This meant AAA was supposed to save you but it didn’t and thus the fear factor. Today, markets are worried about a different set of BBB – BoJ, Brexit, and By-elections (read as US mid-terms but extending to politics in general) and returns to watching C as it stands for China and the ongoing weakness of the CNY and talk of an RRR cut again to spur growth. Defining what is fear and what is junk may be the order of business for August and not the month-end flows today and tomorrow as markets wait for the wisdom of central bankers.

- BOJ: Focus on rates remains global as many news sources suggest that the BOJ could adjust monetary policy tomorrow, through an ETF purchase tweak, the removal of pre-announcements on the Rinban, and perhaps even a change to the Yield Curve Control (YCC) levels.

- Brexit: The UK Times reports that Britain has privately conceded that EU judges will be legal arbiter of disputes over payments to Brussels and the residency rights of more than three million European citizens. PM May is facing a backlash from grassroot conservatives, while the Cabinet has drawn up a "fallback" option to the Chequers plan according to the Telegraph. For the first time since the vote in 2016, more people in the UK support a second referendum than not – 42% to 40%.

- By-Elections in Australia: Little market reaction to the latest round of by-elections in Australia over the weekend with the ruling coalition losing badly to Labor – it’s a humbling result for PM Turnbull according to the press.

All of this puts today as a warm-up for the central bank and larger economic data points due ahead. This is the overload week for macro news and its unlikely to be easy with volatility and liquidity at odds with each other as Summer Vacation looks more dangerous. The currency that everyone is watching is JPY and yet the one that maybe most noisy overall is the GBP with its C/A, politics, BOE decision and technical picture all flashing yellow.

Question for the Day: Does the Pakistan IMF bailout matter? The FT reported that Pakistan is set to seek $12bn in an IMF bailout with financial officials ready to give the plan to the new leader Imran Khan after his party won 115 seats – but needs 22 more allies to build a coalition. Khan pledged in the election to spend money on healthcare, better schools and a larger social safety net – all of which will clash with any IMF deal. The IMF will want government actions, such as raising electricity tariffs, cutting subsidies for the agriculture sector and selling loss-making public companies. This year the IMF projects that Pakistan’s fiscal deficit could hit 7%, against a target of 4.1%, meaning the fund is likely to demand deep cuts in planned public spending.

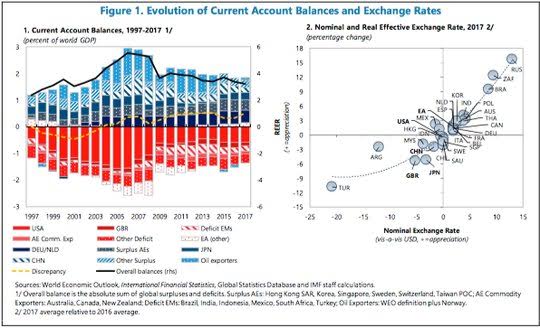

The reason why Pakistan matters is threefold – 1) Its shift to China was notable in the last 2 years and the loans from China are going to matter in any IMF deal – putting some further pressure on the Belt-Road deals elsewhere and likely to lead to a larger push for China to be part of the Paris Accord. This debt transparency will be important for understanding the EM/Frontier leverage risks. 2) The Pakistan bailout follows Argentina and its just another place where big C/A deficits matter to traders – as Turkey sees today. The ability for the present C/A deficits to fund with FOMC rate hikes and US growth is in doubt. 3) FX is clearly part of the story as the devaluation of the EM currencies hasn’t spurred recovery in the economies as it has in the past – with inflation and global trade clearly the focus.

What Happened?

- Japan June retail sales +1.5% m/m, +1.8% y/y after -1.7% m/m, 0.6% y/y – better than +0.1% m/m, 1.6% y /y expected. The increase was supported by recent gains in the prices for food and beverages as well as fuels, compared to year-earlier levels. Sales of fuels accelerated to +16.7% y/y in June from +13.7% in May while those of food and beverages rose 1.5% y/y in June after +0.7% in May. On the other hand, sales of apparel fell 2.1% on year, the third year-on-year drop, while those of vehicles posted the sixth straight y/y decline, down 5.1% vs. -2.6% in May. METI maintained its view that retail sales are "flat." In February, it downgraded its view for the first time since January 2016.

- Spain July flash HICP -1.2% m/m, 2.3% y/y after 2.3% y/y – less than 2.4% y/y expected. The preliminary national CPI -0.7% m/m, 2.2% y/y from 2.3% y/y.

- Swiss July KOF Economic Barometer drops to 101.1 from 101.3 – near expectations – points to slightly above-average growth. The June KOF revised lower from 101.7. Negative indicators for manufacturing, the export industry and the accommodation and food service activities sector were mainly responsible for the slight decrease. Positive signals come from the banking and the construction sectors. In the goods-producing sectors (manufacturing and construction), the indicators of employment, business situation, production, barriers and capacities point to a positive development. They are counterbalanced by the negative outlook for orders, the competitive situation, intermediate goods, earnings, and exports. Overall, the positive and negative indicators more or less balance each other out.

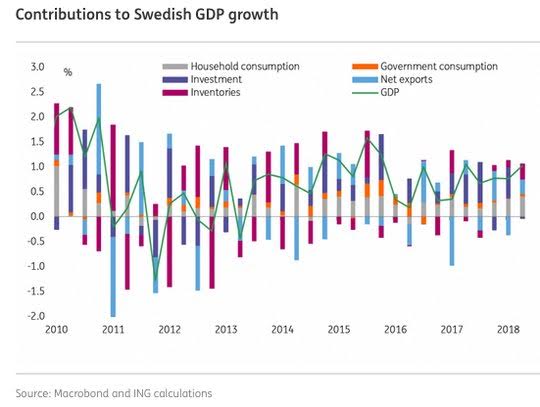

- Sweden 2Q preliminary GDP jumps 1% q/q, 3.3% y/y after 0.8% q/q, 3.3% y/y – better than 0.5% q/q, 2.6% y/y expected. Inventories and exports both helped in the gain with inventories adding 0.3% pp and exports up 0.5% while imports fell 0.1%. Household consumption rose 0.9%, government spending up 0.2% q/q, capital formation fell 0.2%. Production rose 1.2% as manufacturing rose 0.7% while services rose 1.5%.

- UK June Mortgage Approvals rise to 65.619 from 64,684 – near expectations – second monthly gain and above the 6M average of 63,858. The BOE M4 ex OFCS -0.1% m/m, +3.6% 3M y/y. UK June Consumer Credit GBP1.567bn from GBP1.575bn – more than GBP1.3bn expected – and above the 6M GBP1.4bn average. The BOE's data showed consumer overdrafts at their highest since October 2017. The rate of 19.68 was also not far away from the series high of 19.72.

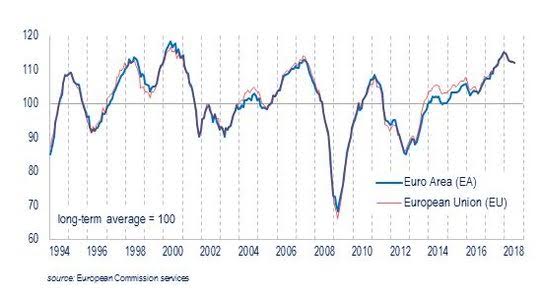

- Eurozone July Economic Sentiment slips to 112.1 from 112.3 – near 112.0 expected.All in all, developments between Eurozone and broader EU were similarly flat over the last four months, with both showing a decrease from March. The Business climate slips to 1.29 from revised 1.38 – weaker than 1.40 expected and revised from 1.39. The Consumer Confidence -0.6 from -0.6 revised from -0.5; Industry slips to 5.8 from 6.9, Services rise to 15.3 from 14.4, Retail -0.1 from +0.7, Construction 5.4 from 5.6.

- German July flash HICP expected at 0.4% m/m, 2.1% y/y from 0.1% m/m, 2.1% y/y – after State Reports.

- NRW CPI 0.3% m/m, 2.0% y/y from 2.1% y/y

- BW CPI up 0.2% m/m, 2.2% y/y from 2.4% y/y

- Hesse up 0.4% m/m, 1.8% y/y from 1.8% y/y

- Brandenburg up 0.4% m/m, 2.2% y/y from 2.2% y/y

- Bavaria up 0.2% m/m, 2.2% y/y from 2.4% y/y

- Saxony up 0.4% m/m, 2.2% y/y from 2.1% y/y

Market Recap:

Equities: S&P500 futures are up 0.14% after losing 0.66% Friday. The Stoxx Europe 600 is off 0.35% holding losses from the open with focus on tech shares. The MSCI Asia Pacific is off 0.3% with focus on BOJ tomorrow.

- Japan Nikkei off 0.74% to 22,544.84

- Korea Kospi off 0.06% to 2,293.51

- Hong Kong Hang Seng off 0.25% to 28,733.13

- China Shanghai Composite off 0.12% to 2,870.06

- Australia ASX off 0.36% to 6,368.80

- India NSE50 up 0.37% to 11,391.55

- UK FTSE so far off 0.15% to 7,690

- German DAX so far off 0.20% to 12,838

- French CAC40 so far off 0.30% to 5,496

- Italian FTSE so far

Fixed Income: Global bonds are lower waiting for BOJ, FOMC, BOE combination. Supply from Italy and German CPI main stories apart from BOJ intervention at 0.1% again. Core EU bonds lower – UK 10Y Gilt yields up 4.5bps to 1.322%, German Bunds up 3.6bps to 0.437%, French OATs up 3.5bps to 0.73% while periphery also suffers – Italy up 1.7bps to 2.75%, Spain up 3.2bps to 1.395%, Portugal up 3.7bps to 1.742% and Greece up 4.2bps to 3.835%.

- Italy sold E2bn of 5Y 0.95% Mar 2023 BTP at 1.8% with 1.47 cover – previously 1.82% with 1.3 cover. Italy also sold E4bn of 10Y 2.8% Dec 2028 BTP at 2.87% with 1.42 cover and E1.5bn of 7-year Sep 2028 CCTeu at 1.75% with 1.6 cover – previously 1.67% with 1.3 cover.

- US Bonds are bear steepening with focus on BOJ/FOMC – 2Y up 0.8bps to 2.677%, 5Y up 1.9bps to 2.858%, 10Y up 2.4ps to 2.978% and 30Y up 2.2bps to 3.105%.

- Japan JGB close flat after another BOJ fixed buying at 0.1% - 10Y close 0.095% after touching 0.111% early. The BOJ bought Y1.6trn of 10Y at 0.10% today.

- Australian bonds lower, track US with eye on China/BOJ – 3Y up 1bps to 2.075%, 10Y up 1bps to 2.65%.

- China PBOC skips open market operations, net drains CNY130bn on the day. There are CNY210bn of reverse repos maturing this week. Money market rates were mixed with 7-day up 0.5bps to 2.627% and O/N off 6.5bps to 2.174%. The 10Y bond yields were flat at 3.52%.

Foreign Exchange: The US dollar index fell 0.15% to 94.53. In Asia EM FX, USD mostly bid – KRW off 0.2% to 1120.40 reversing early gains, TWD off 0.1% to 30.609, but INR up 0.1% to 68.62 – waiting for RBI next; In EMEA, USD mixed – with RUB up 0.25% to 62.616, ZAR flat at 13.164 and TRY off 1% to 4.8985.

- EUR: 1.1685 up 0.25%. Range 11648-1.1693 with 1.1720-40 the resistance holding and focus on 1.1650 support for stopfest.

- JPY: 111.05 flat. Range 110.89-111.17 with EUR/JPY 129.80 up 0.25%.Waiting for BOJ, market prepared for lower with 108-110 protection.

- GBP: 1.3115 up 0.15%. Range 1.3084-1.3138 with EUR/GBP .8910 up 0.1%.BOE focus but Brexit bubbling up in news. No summer break.

- AUD: .7400 flat. Range .7386-.7406 with NZD .6805 up 0.3%. By-elections, lower copper and China worries leave .73-.75 range play.

- CAD: 1.3050 flat. Range 1.3038-1.3079 with focus on US and NAFTA hopes with 1.30-1.32 consolidation still. Oil up helps.

- CHF:.9920 off 0.2%. Range .9918-.9962 with EUR/CHF 1.1590 flat.Nothing to see here with KoF basically flat, holiday Wed.

- CNY: 6.8131 fixed 0.27% weaker from 6.7942, trades stronger to 6.8141 from 6.8246 Friday close, now 6.8215.The CNH is flat on the day after running to 6.8497 with 6.85 the big line in sand for more pain.The CFETS RMB weekly index fell 0.89% to 92.95 – back to Aug 2017 lows.

Commodities: Oil up, Gold down, Copper off 1.5% to $2.7990.

- Oil: $69.59 up 1.3%. Range $68.80-$69.61. WTI watching $70 and then $71.50. Brent up 0.45% to $74.62 with focus on $75 and $75.80 next.

- Gold: $1222.15 off 0.15%. Range $1218-$1223.50. Focus is on USD and central banks. Silver flat at $15.501. Platinum off 0.65% to $825.50 and Palladium up 0.3% to $926.70.

Economic Calendar:

- 1000 am US June pending home sales (m/m) -0.5%p +0.1%e (y/y) -2.2%p -6%e

- 0200 pm Fed Senior Loan Officers Survey (possible during this week).

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Really, the world would be better off if there was a HUGE tax on all acronyms, such that nobody would use them. And perhaps the worst abusers could be drowned in the huge pot of acronym soup, and then fed to the hungry bears in the market.

Well said, my friend!