The Market Rallied Nicely Today

The market rallied nicely today, but under the covers it is still struggling just a bit. Nasdaq listed stocks are marching higher, but the NYSE listed stocks are having their troubles... as shown by the bullish percents in the chart below.

(Click on image to enlarge)

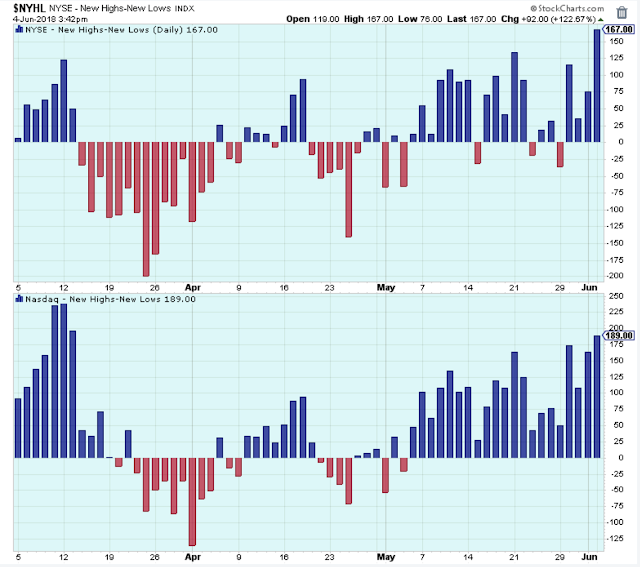

Supporting the bulls.. the new highs/ new lows looked really good today on both exchanges. This is not the look of market with many struggles.

(Click on image to enlarge)

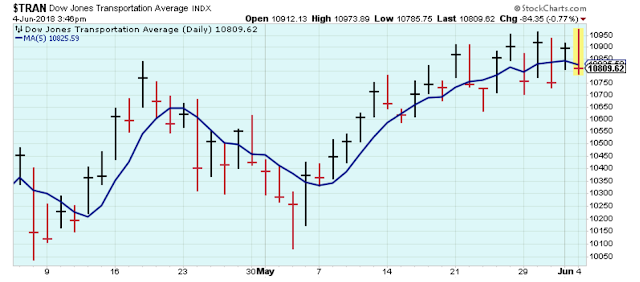

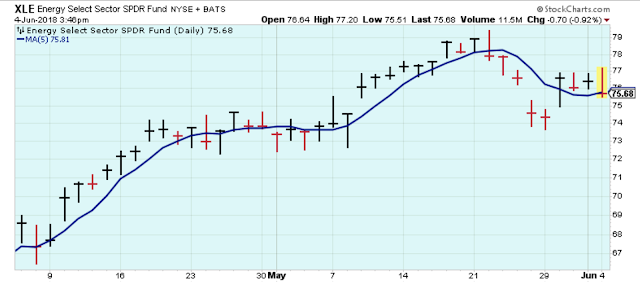

Supporting the bears... while Technology investors were celebrating new highs, the inflation-sensitive trade was pushing in the wrong direction.

I think we all prefer a market where everyone joins in, but let's not complain too much or too soon, and for now we just keep an eye out to see if these ETFs can hold support.

(Click on image to enlarge)

(Click on image to enlarge)

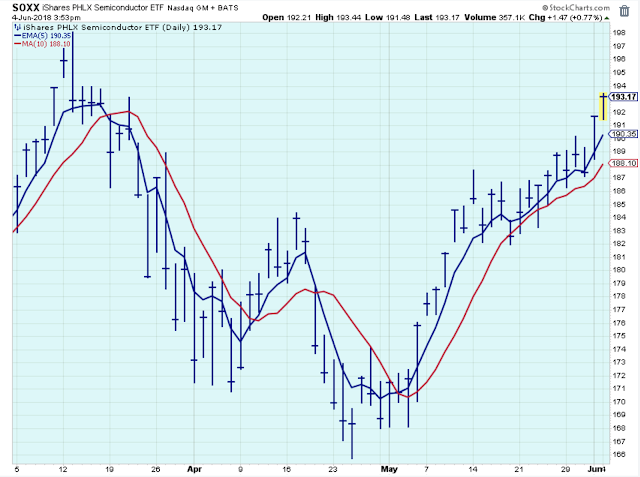

Speaking of keeping an eye out, this is an ETF that I am watching with the most interest because without it the market is unlikely to move higher. This is looking quite favorable at the moment... this is bullish for Technology and the general market.

(Click on image to enlarge)

Bottom Line: The performance of today's leaders and laggards could be pointing back towards weaker growth and low rates. For now, this trend works in favor of Technology and against Energy.

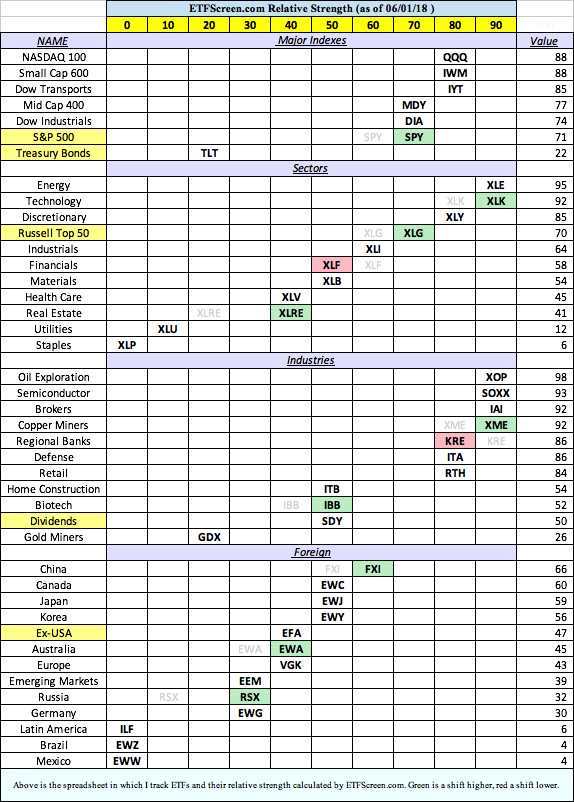

Sector Strength

What is this spreadsheet telling us?

The major stock ETFs are all strong which is a good sign for the general market.

There are two ETFs that contain bank stocks, XLF and KRE, and both are red meaning that the outlook for interest rates is a bit lower compared to last week.

It really doesn't seem right that XLF is relatively weak in a rising rate environment. In addition, we just had a very strong jobs report which would usually mean higher rates, yet the two rate-senstive ETFs ticked lower? It doesn't add up. (Problems in Europe? A slowdown in US growth?)

Weak dollar-denominated foreign ETFs indicates a stronger US Dollar and warns against buying foreign ETFs as long as you think the US Dollar is going to be gaining strength.

(Click on image to enlarge)

Bottom Line: I am sticking with market leaders.

Side Note: I also continue to believe in an early summer market peak, and a market that struggles into the November elections.

Outlook Summary:

The long-term outlook is cautious.

The medium-term trend is up as of May-10.

The short-term trend is up as of May-7. It was a mistake to think that a short-term downtrend had started May-29.

The medium-term trend for bond prices is up as May-29.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more