The Last Bull Market Before The Great Depression

It was the year 1921, U.S. President Warren G. Harding signs a joint congressional resolution declaring an end to America’s state of war with Germany, Austria and Hungary. The first radio baseball game is played in Pittsburgh and Adolph Hitler is named Fuhrer of the Nazi party. On the economic front, the 10 year US treasury yield was in the 5% range and the Unemployment rate was 8.7% after the depression of 1920-1921.

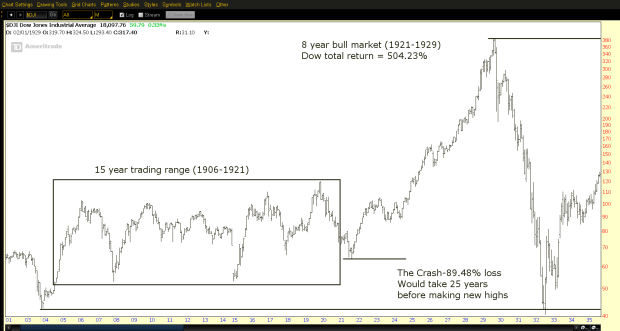

Much is talked about the magnitude of the stock market crash that preceded the Great Depression, resulting in an 89.5% decline, but not much is talked about the bull market that lead up to it. The Dow Jones Industrial Average had endured 15 years of limited progress with increased volatility, inside of a trading range between 50 and 100, which included four separate bear market declines that saw stocks lose at least 40% of their value each time. I can only imagine the consensus sentiment at this point and time. I’m sure there were very few who could have predicted the historic bull market that was about to begin. And who could blame them after the prolonged period of under-performance.

In August of 1921 the Dow Jones Industrial Average bottomed at 63.90. For the next eight years stocks would continue to rise without much interruption. The increased optimism brought out the herd mentality in its fullest form. It was said that at that time one could buy stocks on margin (which means that the buyer would put down some of their own money, but the rest would be borrowed from their broker) by putting down only 10% to 20% of one’s own money towards the purchases. This means that broker’s effectively lent up to 90% to their customers stock buying fiasco. This would effectively increase the risks in the market because at 80% to 90% margin, it did not take much of a price swing against the customer’s holdings to create a margin call.

There were also numerous reports of foul play, as there were very little regulations at that point in time. However as long as there was “easy money” to be made, most seemed to turn a blind eye to the risks involved. Buying stocks was seen as a sure thing and speculators using massive amounts of leverage were rampant.

The Dow Jones Industrial Average continued to rise for eight years at an enormous pace. In September of 1929 the Dow Jones Industrial Average would top out at 386.10. During those eight years investor’s saw stocks gain a total return of 504% or approximately 63% annualized returns a year for 8 years!

In modern terms, that would equate to the Dow Jones Industrial Average trading over 30,000 today, off of it’s 2009 lows in the 6,500 range.

In hindsight it’s easy to judge those involved and say how could they not see that it would eventually end badly. But our generation would suffer the same fate some 60 years later as the 1987-2000 bull market would produce another similar 600% total return gain (Nasdaq would gain much more) resulting in a similar fate both in 2000 and 2008.

After the crash, stocks would eventually find a bottom. And it ended up being 90% below it’s 1929 exuberant highs, a truly horrendous stock market crash. In the year 1955, some 25 years later, the Dow Jones would eventually make new all time highs again. But the countless number of lives effected by this market crash are probably unidentifiable. I imagine at least one generation would likely never trust or be able to stomach investing a penny in stocks ever again, and who could blame them.

In my opinion the terms “crash” or “bubble” have become used and abused. Many in the financial media throw these words around without restraint. I’ve seen many times where analysts use these terms to explain or predict a 20% decline. This is frustrating to me because there is a huge difference between a potential 20% (which happens on average once every 3-5 years) and a 1929 or 2008 style crash which is much less likely to occur.

The purpose of this post was to mesh my interest in history and financial markets. This is NOT to draw any conclusions as to the fate our stock markets. I know there are many that are pointing out the similarities between then and now and predicting a similar demise but I am not going there. My opinions, or anyone’s opinions for that matter, should have nothing to do with your investment goals.

Disclosure: None.