Tech Talk: Dr. Copper

(Click on image to enlarge)

It looks as though H.L.Mencken – a cynical, acerbic, dyspeptic but terrific American journalist – nailed it a century ago: “As democracy is perfected, the office of president represents, more and more closely, the inner soul of the people,” he wrote, for the Baltimore Evening Sun. “On some great and glorious day the plain folks of the land will reach their heart's desire at last and the White House will be adorned by a downright moron.”

“The larger the mob, the harder the test,” he continued. “In small areas, before small electorates, a first-rate man occasionally fights his way through, carrying even the mob with him by force of his personality. But when the field is nationwide, and the fight must be waged chiefly at second and third hand, and the force of personality cannot so readily make itself felt, then all the odds are on the man who is, intrinsically, the most devious and mediocre — the man who can most easily adeptly disperse the notion that his mind is a virtual vacuum.”

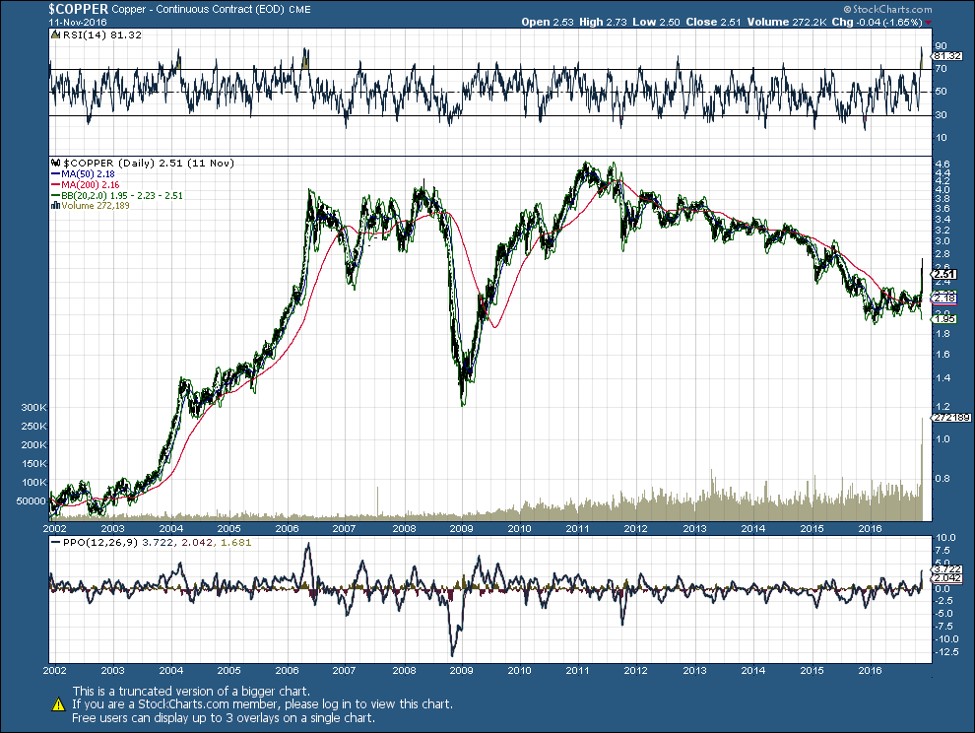

Enough about Trump. On to something with insight into the world: Copper, which technicians have long said has a Ph.D. in economics. The concept is that the commodity has such widespread applications in the economy – homes, factories, electronics, power generation, transmission – that demand for the stuff is a reliable leading indicator of the economy’s health.

I was thinking about this rule a couple of weeks ago, and checked out the ETF for copper producers shown above. It looked on the verge of a breakout, so I bought some. As the chart shows, I got lucky.

Lucky, because for the last ten years copper has been anything but a reliable indicator. Look at the following long-term copper chart.

(Click on image to enlarge)

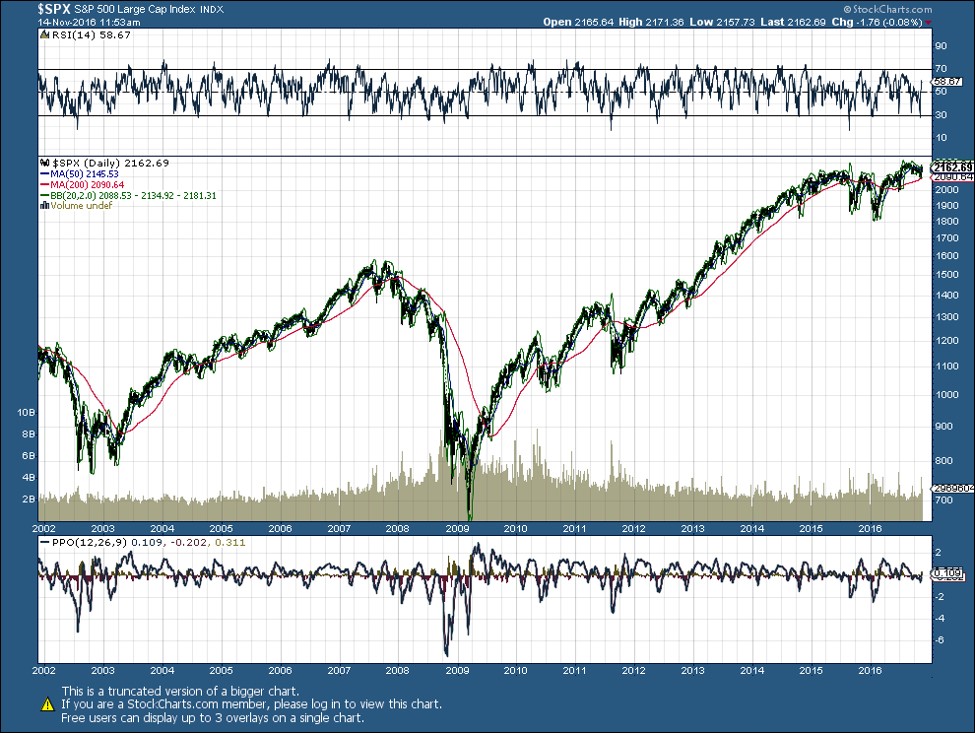

And now, compare it to a parallel chart of the S&P 500, below.

(Click on image to enlarge)

Copper was a reliable indicator until 2011, after which the two charts began to diverge. As Andy Home explains in the Globe and Mail, for the last few years there has been oversupply in the global copper market. Those chickens are now coming home to roost.

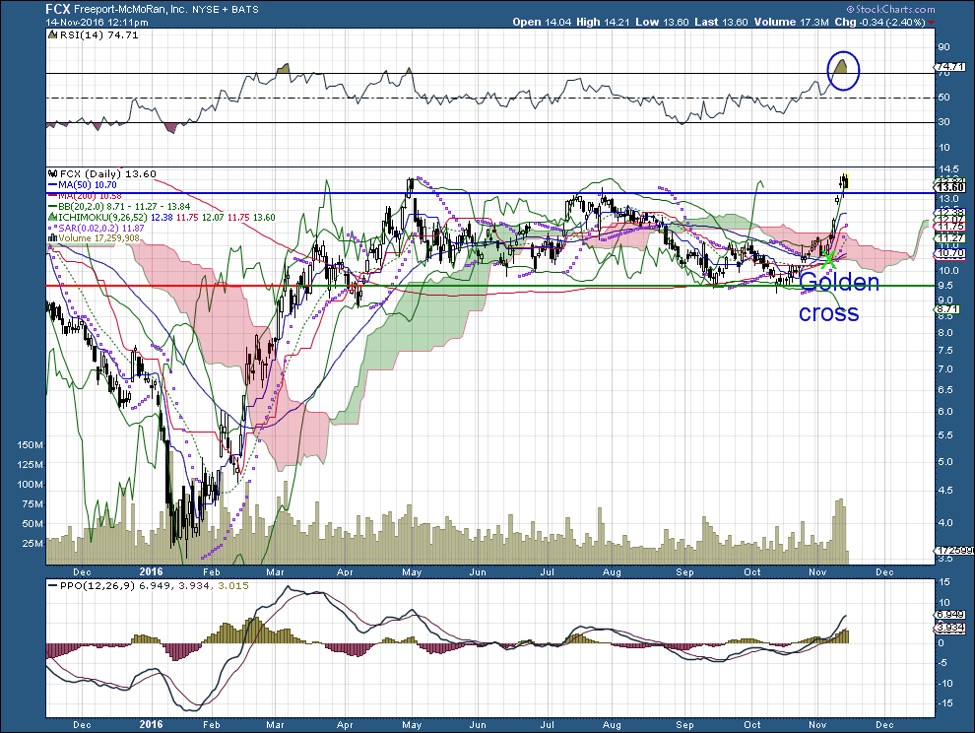

To continue the farming metaphors, my father used to tell me to go big or, as he would put it, “You might as well be hanged for a sheep as a lamb.” That being the case, I also picked up some Freeport-McMoRan, a big copper producer. In the chart below you will see on the RSI line that it’s a bit overbought, but you will also see a green X marking a golden cross, which is often bullish.

(Click on image to enlarge)

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks for informational purposes only. ...

more

Thanks for sharing

Thanks for sharing