Tech Talk: A Turnaround In Golds

It’s been years since I put any money into a gold stock – that is, until yesterday. Here is my thinking behind picking up some ABX – the venerable Barrick Gold. Let’s begin with the fundamentals.

Although this company's net profit margin is negative, it is above the industry average and implies that Barrick Gold Corp is operating more effectively than other gold companies. Its net income grew year over year last quarter from a loss of (U.S.) $0.23 per share to a gain of (U.S.) $0.15. Furthermore, 26 analysts follow the company, and their consensus is that it’s a buy.

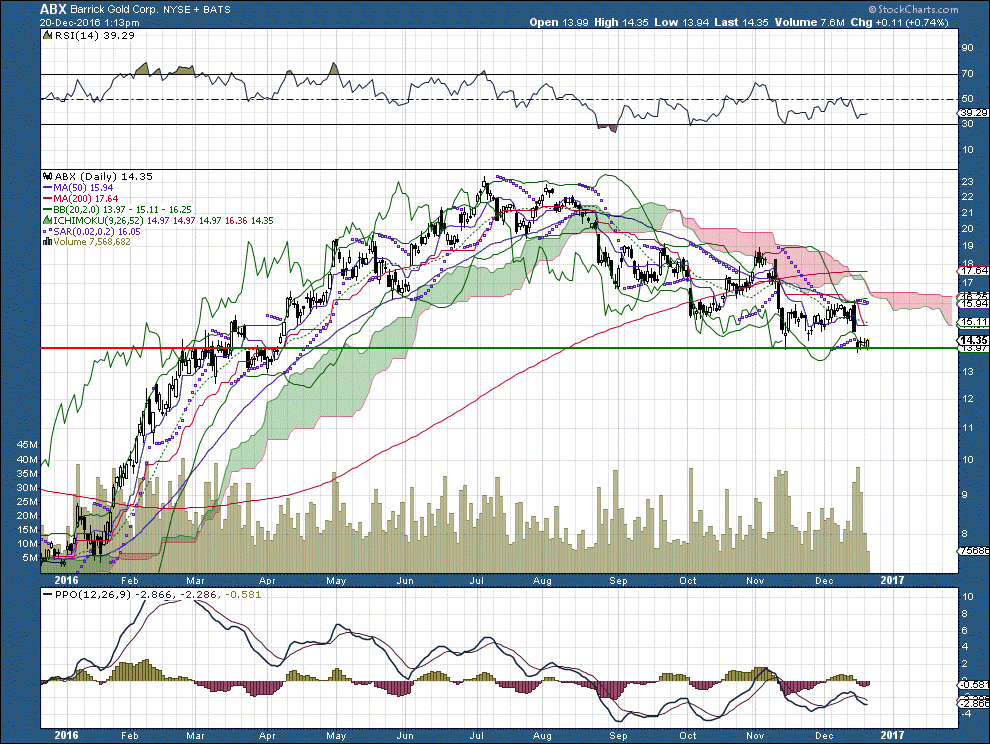

In the chart above, the red/green support resistance live suggests – to me, at least – that it’s now in a pretty good place to buy in. The chart below offers a different perspective.

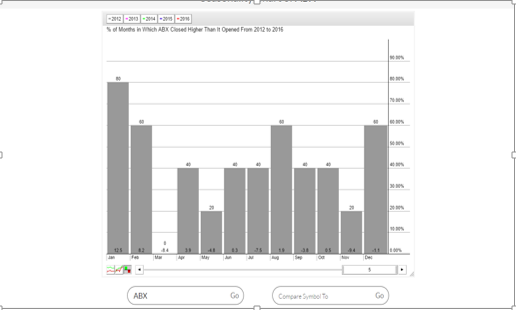

It shows the stock’s seasonality. In the last five years, ABX has gone up in January 80% of the time; in February, 60% of the time. To me, that’s interesting.

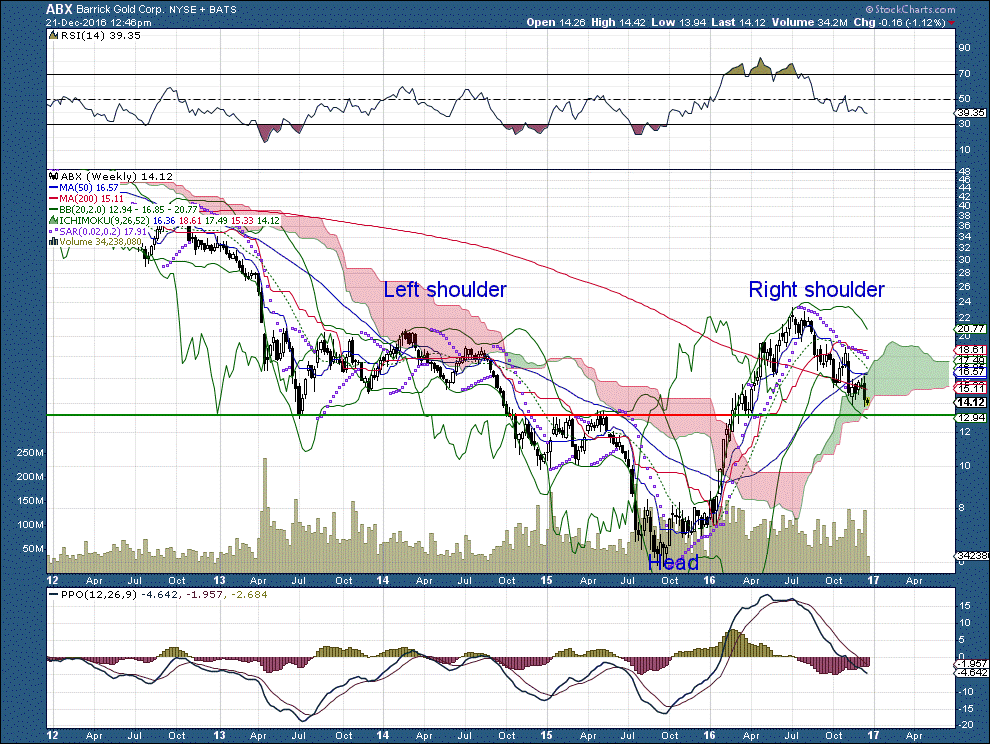

So is the inverted head and shoulder formation in the chart below. To me this suggests that sellers got exhausted last summer, and they have been painfully buying back in. They have moved slowly, I suspect, because so many other areas in the market have been so hot – not because gold bullion has been on the move.

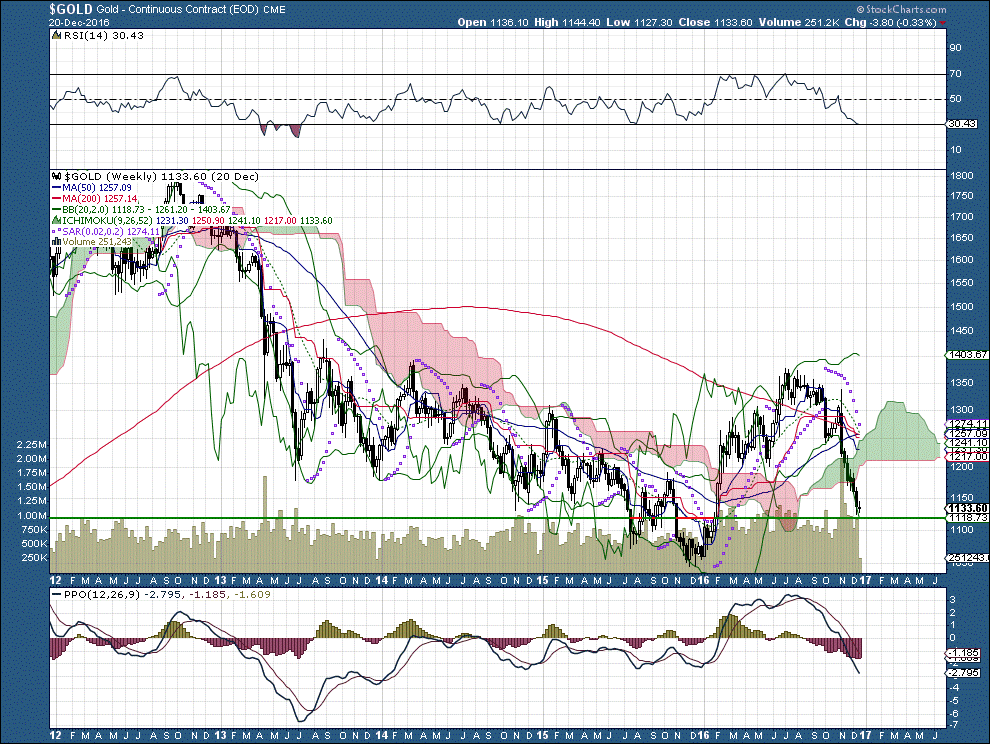

As this chart shows, gold bullion itself has not been doing well. That said, you can almost see a pale reflection of the inverse head and shoulders pattern in this five-year chart. If you look carefully, you will also notice that gold prices rise to celebrate the new year.

Full disclosure: None.

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks ...

more