Taking A Big Step Back

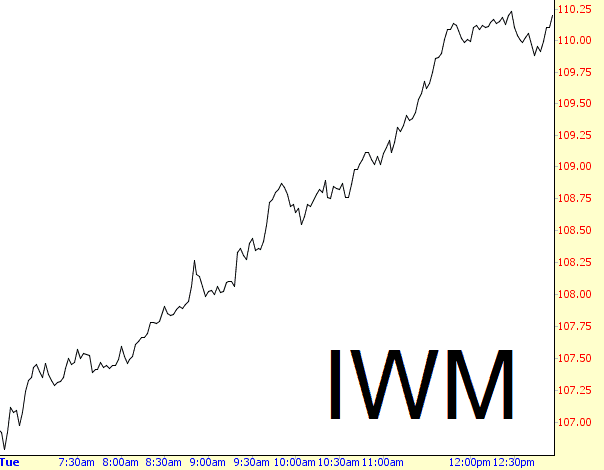

Today stunk for me. This chart of the IWM captures the pain nicely:

(As an aside, I’m actually not in any ETFs at all, but I thought the above chart showed the persistence of Tuesday’s lift-off; it’s like the small caps “knew” of Janet’s dovishness before she said a single word).

I wanted to take a big step back here and think out loud about these so-called markets of ours.

Now, more than ever, people are saying you’re a fool if you don’t simply buy the market and stay with it, since the Fed (and other central banks around the world) quite clearly have your back. I would be hard-pressed to argue against this point, since, for some seven years now, those who get long and stay long, irrespective of any reasons to do otherwise, have been proved winners time and again. Today is a microcosm of those past seven years.

Let’s walk through this logic:

(1) Humans are self-interested creatures;

(2) Central Bankers (“CBs”) are humans (more or less), and they likewise are interested in their careers, their power, their reputations, and their wealth;

(3) As such, CBs are going to do anything and everything within their power to keep asset prices high, since that is the clearest, easiest-to-measure outcome to illustrate their success. Forget about all this “dual mandate’ crap. The public judges Yellen based on where the Dow is at.

(4) I used to ask myself, “if this is all so easy, why did they even allow 2008 to take place?” I think the answer is: “Because conditions didn’t permit them to have the kind of power and “tools” at their disposal that they do today, but the financial crisis gave them unprecedented power and unprecedented access to “experiment.”

(5) Given that 2008 did, in fact, take place, my belief is that the CBs have vowed, post-holocaust style, “Never Again.”

(6) They will, therefore, use every legal means at their disposal to forward their agenda which, to date, has met with pretty much 100% success.

(7) If and when the time comes that legal, sanctioned means lose their efficacy, they will resort to more desperate “emergency” measures, perhaps even illegal ones, to continue to forward their agenda. No one in power will have a reason to stop them.

Given all the above, it has already been seven years of central banker omnipotence, and I don’t see any reason – – any reason at all – – for the CBs to decide in the next seven, or the next seventy, years that this madness really all has to stop, and they would choose to sacrifice themselves in order to do what’s moral and proper. They will not end this of their own free will. Not ever.

Now, everyone from Jim Cramer on up has made sure to utter (repeatedly!) “This will end badly someday”, but no one knows how far off “someday” is. To someone like me, “someday” has often seemed Right Around The Corner, and periods like December 29-February 11 excite me into thinking, “Yes! It’s really here! Finally!” And, then, whammo, we all get a bamboo stick shoved up our backside.

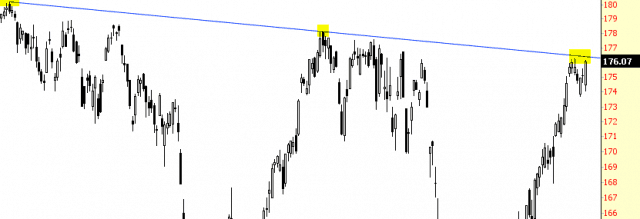

What’s wrenching to a chartist like myself is that, even with the monstrous, roaring ascent of equity prices from February 11 until today, I can show you over 100 equity charts that are screaming, howling, and jumping up-and-down to be shorted. And, of course plenty of broad-based index charts likewise delicious-looking short candidates. And yet the market keeps marching higher!

Now, of course, there are plenty of bullish-looking charts – – I track them carefully – – but they are not basing patterns that are ready for a big ascent. They are, instead, charts which have been trending higher month after month, year after year, and I would say that the opportunity to buy them (cheaply, obviously) is long past. At this point, one buys only to hoping that the trend persists.

All I can say at this point is that Janet Yellen has, yet again, won. Added to which, we are perilously close to ruining some of the core patterns that constitute what I believe (and still hope) are the shapes that define the nascent bear market. If this strength persists, however, I’m going to be bereft of ideas as to how much longer equities are going to keep pushing higher. The answer may well be “forever, until further notice.”

Disclosure:Short Workday This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make ...

more