Stocks In Trouble If Rates Peak Here, Says Joe Friday

(Click on image to enlarge)

(Click on image to enlarge)

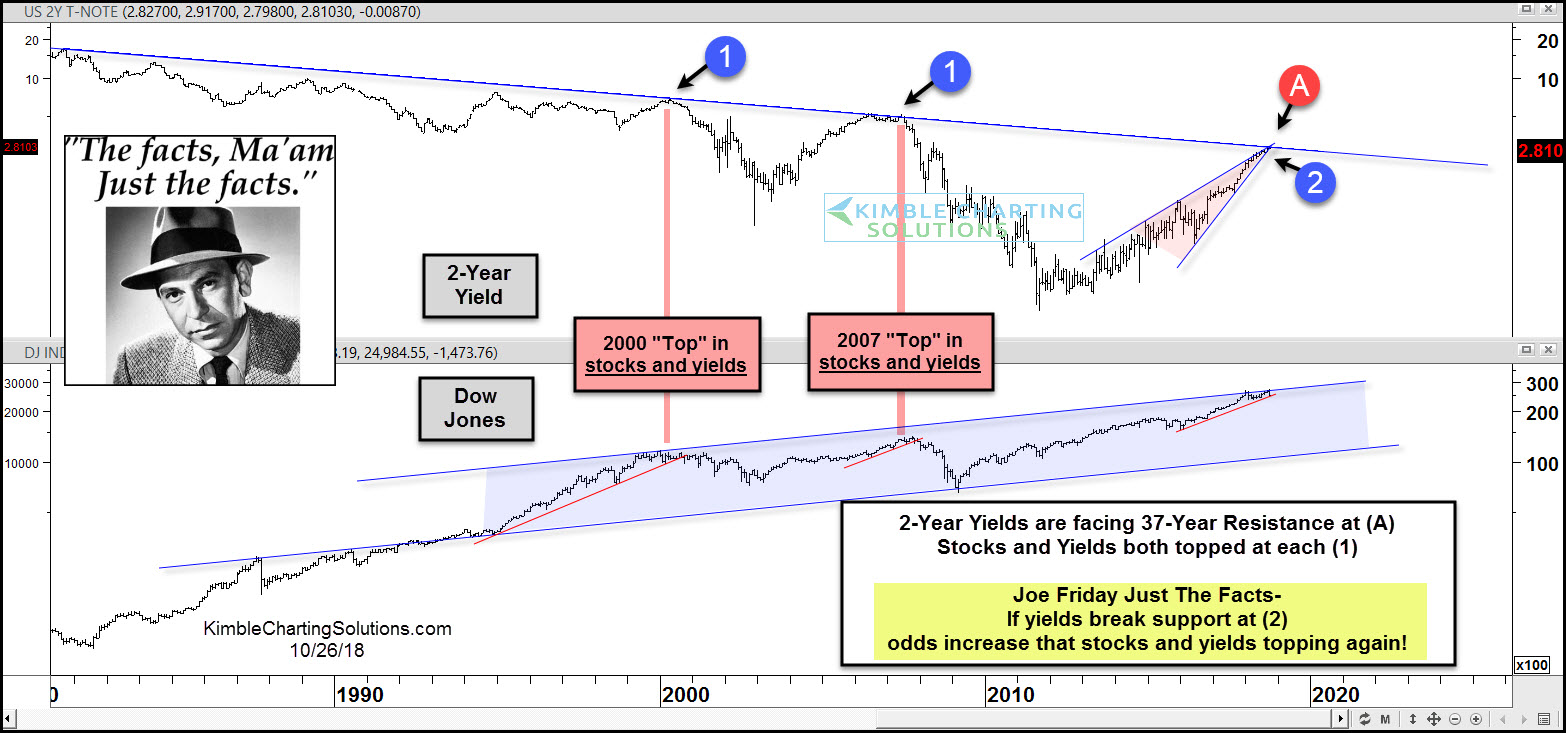

Could the yield on the 2-year note send important messages about the future direction of stocks? They have in the past and they could again!

The top chart looks at the yield on the 2-year note over the past 37-years. When the 2-year yield hit resistance and turned lower in 2000 & 2007 at each (1), interest rates and stocks both fell a large percentage.

At this time yields are testing 37-year resistance as the Dow is testing the top of a 20-year rising channel.

Joe Friday Just The Facts Ma’am- If 2-year yields turn lower and break support at (2), odds increase that stocks turn weak. Keep your eye on what bond yields do in the next few weeks as they could be sending a key message to the stock market!

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.