Tuesday's Stock Crash-Then-Rebound

Stocks Crash - Heightened Volatility On Tuesday

Tuesday was extremely volatile as it had the feeling of a bear market rally. The stock market was oversold coming into the day. But the S&P 500 still fell 2.34% at its worst point in the day.

It rallied in the afternoon to only close down 0.55%. This makes investors feel great because the market is off the lows. However, stocks ended the day even more severely oversold than they started it.

Nasdaq fell 0.42% and the Russell 2000 fell 0.84%. VIX increased 5.45%. This caused the CNN fear and greed index to fall from 16 to 12 as it still indicates extreme fear.

The lower it falls, the higher the chance stocks will rally in the next month. At one point in the day, the index fell to 8. It’s interesting to see that exactly one year ago, the index was at 85. That's extreme greed.

Stocks Crash - Previous Corrections

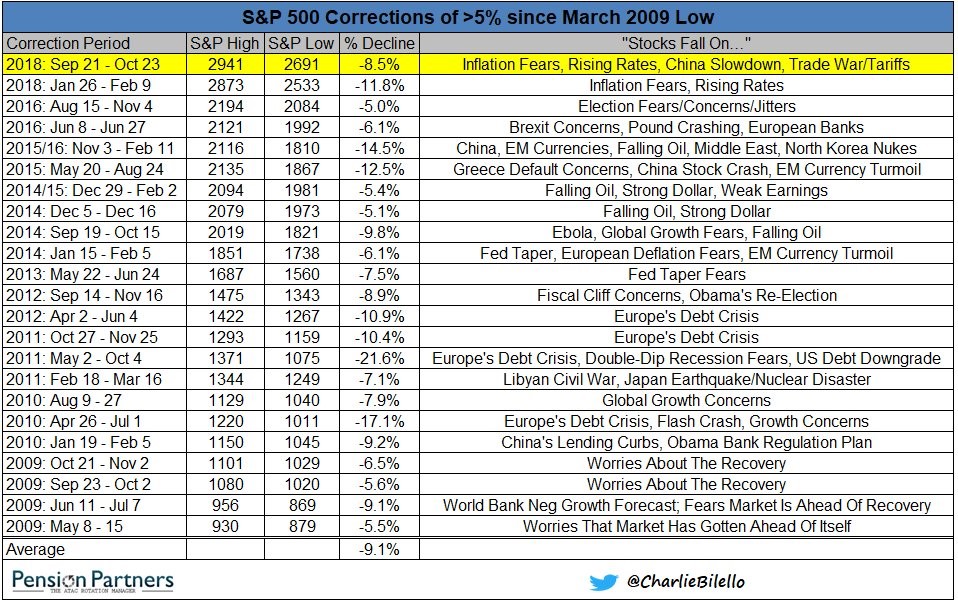

The table below is an amazing depiction of all the corrections since the start of the bull market in March 2009.

To be fair, I don’t agree with each description. The point is to show how there are always worries the market needs to overcome. I disagree that the current correction is caused by inflation. The most recent CPI report showed inflation is falling.

Rising rates are now a problem because the housing market is weak. The principal reason the market is weakening is affordability. But rising rates don’t help.

The Chinese economy is slowing, but it might improve in 2019 because of the tax cut.

Finally, the trade wars are a big factor. It doesn’t look like there is any progress being made on getting a deal done with China before the tax rate increases to 25%.

(Click on image to enlarge)

Stocks Crash - Details Of Tuesday’s Action

One interesting part about the day’s trading action is the home builder ETF rallied 1.62%. It turned positive at 11:10 AM while the S&P 500 was down huge.

This was a good sign the market was about to turn because the selling in the worst group was abating. The KBW small bank ETF also outperformed. But it still closed down 0.047%. The auto industry has been underperforming this year as well. Auto ETF CARZ was up 0.33%.

201 stocks in the S&P 500 are down more than 20% from their 52-week high. Only 3 of the 32 stocks with above a $150 billion market cap are 20% below their high.

This shows how the decline has been driven by small caps. As of the trough in the morning, 16.8% of S&P 500 firms traded at their 52-week low. That's the highest total since February 2016.

As of mid-morning, the S&P 500 was down 6.4% in October. The only two worse mid-term October performances were in 1978. That's when stocks fell 9.2% and 1930 when stocks fell 8.9%. To be clear, the current decline has little to do with the elections.

Worst sectors were energy and industrials which fell 2.67% and 1.6%. Three positive sectors were consumer staples, real estate, and communication services. They increased 0.41%, 0.69%, and 0.4%, respectively. It’s interesting that the risky communication services sector was positive. Real estate being positive supports the theme on the day that the worst performers stopped selling off.

The 10-year bond yield fell 5 basis points to 3.15% and the 2-year yield fell 5 basis points to 2.86%. Finally, the treasury market showed sympathy with the decline in stocks. Junk bond index JNK fell 0.057%.

Stocks Crash - The Fed Doesn’t Come To The Rescue

Since the financial crisis, the Fed has turned dovish after the stock market has fallen 12.5% on average.

With the S&P 500 down 6.5%, the Fed is maintaining its current policy. Atlanta Fed president Bostic made hawkish statements in a speech on Tuesday.

He said, “And while I wrestle with that choice, one thing seems clear: there is little reason to keep our foot on the gas pedal”. That means the Fed sees little reason to pursue a stimulative policy based on the current economic growth trajectory. That’s in spite of the weakness in housing.

Bostic also said, “After digging through the data, consulting our economic models, and gathering a Main Street perspective from our extensive network of business contacts, I come away with the sense that economic growth is on a strong trajectory. It’s on solid footing and hasn’t been materially pushed higher or lower”.

This disagrees with the ECRI leading index and the housing data which suggest there is a slowdown coming. The current CNBC rapid update which averages the Q3 GDP guesses shows growth is expected to be 3.3%. This is a bit slower than Q2 which had 4.2% growth.

Bostic ended his speech by saying, “That does not mean that the trajectory for the economy is immovable. There are ample reasons for a central banker like me to be concerned. But, from my perspective, the economy is performing well enough to stand on its own without support from accommodative monetary policy”.

It’s certainly fair to avoid panicking about the weakness in housing because other areas of the economy are strong. Furthermore, the ECRI housing price index is a prediction, not a fact.

Finally, homebuilder stocks are being hit by increasing metals cost and wage inflation. So it’s not as if the housing market is the only issue the industry is facing.

Stocks Crash - Conclusion

Stocks were a huge buy on Tuesday morning if you have a short-term time horizon because they are oversold.

However, the intermediate term seems to look worse almost every day. The Fed is raising rates steadily while global growth is slowing. Tariffs are about to hurt GDP growth by 1%.

Latest odds show there is a 77.2% chance of at least one hike by the end of the year. That’s down slightly because of the ‘risk off’ action. However, there needs to be more weakness to take that hike off the table.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more