Stocks Close At Record-est Highs, Ensuring 'Confident' Black Friday, Despite Macro Massacre

The S&P 500 closed at new record-er-est highs (a record 29th day above the 5DMA) providing just the right amount of confidence-inspiring 'wealth creation' to ensure you spend, spend, spend this weekend all those gas price savings (despite 9 of 9 macro data misses today). Dow and Trannies underperformed today as Nasdaq surged on AAPL strength. The USDollar fell for the 3rd day (first time in a month) and Treasury yields tumbled (down 5-8bps on the week) near 18 month closing lows. VIX traded briefly with an 11 handle and lost its inversion (1st day in 6). Gold prices flatlined for the 3rd day (as EURCHF fell) ahead of the Swiss gold referendum this weekend. Oil tumbled to fresh 4-year lowsas OPEC hinted at no cuts and copper slipped to fresh 4 year closing lows. Late-day shenanigans sent stocks ripping higher... in a totally rational manner. Turkey prices are at $1.67/lb and have been remarkably stable over the past few years.

This happened...

- Mortgage Applications -4.3%

- Durable Goods Ex-Transports MISS -0.9% vs +0.5% Exp

- Initial Jobless Claims MISS 313k vs 288k Exp

- Personal Income MISS +0.2% vs +0.4% Exp

- Personal Spending MISS +0.2% vs +0.3% Exp

- Chicago PMI MISS 60.8 vs 63.0 Exp

- UMich Confidence MISS 88.8 vs 90.0 Exp

- Pending Home Sale MISS -1.1% vs +0.5% Exp

- New Home Sales MISS +0.7% vs +0.8% Exp

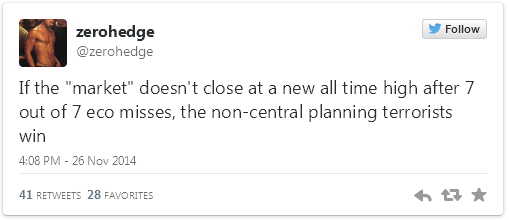

Which explains this..Another Death Cross... right?

What's funny is how fucking predictable it has all become...

Rather oddly, S&P 500 e-mini liquidty was at its highest point since the Treasury yield flash crash with an hour to go... (h/t @NanexLLC)

Recorder-est 29th day in a row closing above its 5-day moving-average

On the day, Nasdaq won thanks to AAPL...

Thanks to a 3Sigma above VWAP ramp

Thanks to the ubiquitous VIX slam at 330ET

As AAPL passed $700 billion market cap and saw some chunky block orders in the late-day meltup...

But that was not enough - S&P futures melted up after the bell (after dumping into at the cash close) to intraday record highs...

Thanks to VIX being slammed...

On the week, the Dow (and less so the S&P) have flatlined as high beta muppetry surged...

Since the Bullard Lows, Trannies are up almost 20%...

The USD fell for the 3rd day in a row (for the first time in a month)

Treasury yields continue to tumble (down 5-8bps on the week) with 30Y closing below 2.95% - just shy of the lowest close since May 2013 (cough S&P at record highs cough)

Which means as a reminder...

as the week follows the same path...

Commodities... gold flat ahead of Swiss gold vote, copper and oil slipped to new 4-year closing lows...

Charts: Bloomberg

Bonus Chart: Turkey prices have been oddly stable pre-Thanksgiving for the last few years (though down this year from 2013)

Bonus Bonus Chart: SDRL was monkey-hammered as the HY Shale Oil play canary in the coalmine just died...

Disclosure: Copyright ©2009-2014 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more