Stocks, Bonds, And Gold Down

This past Friday (3/6/2015) was a difficult day for most portfolios that are long any major asset excluding the dollar index and volatility. Stocks, bonds and gold declined.

SPY was down 1.4%, TLT fell 2.2%, GLD also down 2.7%.

We got some reactions from some of our subscribers asking if the models are failing. So let’s put things in perspective.

Is this common?

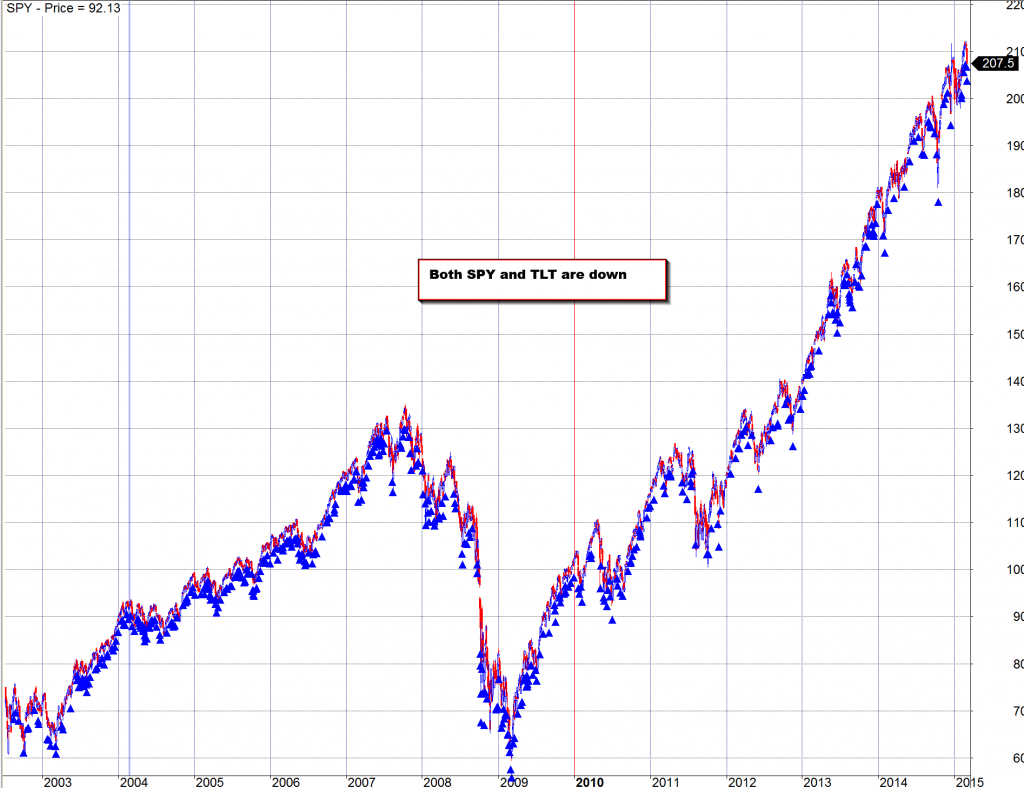

As you can see this is an outlier. It has only happened a few times in over 12 years.

Well, let’s ask another question. Is it often that both SPY and TLT fall the same day?

On the other hand, the SPY and TLT declining on the same day is not uncommon.

Let’s say we panic, we think everything is going down and short on the next open. We cover the next day close. Over time, we lose money…not a good idea.

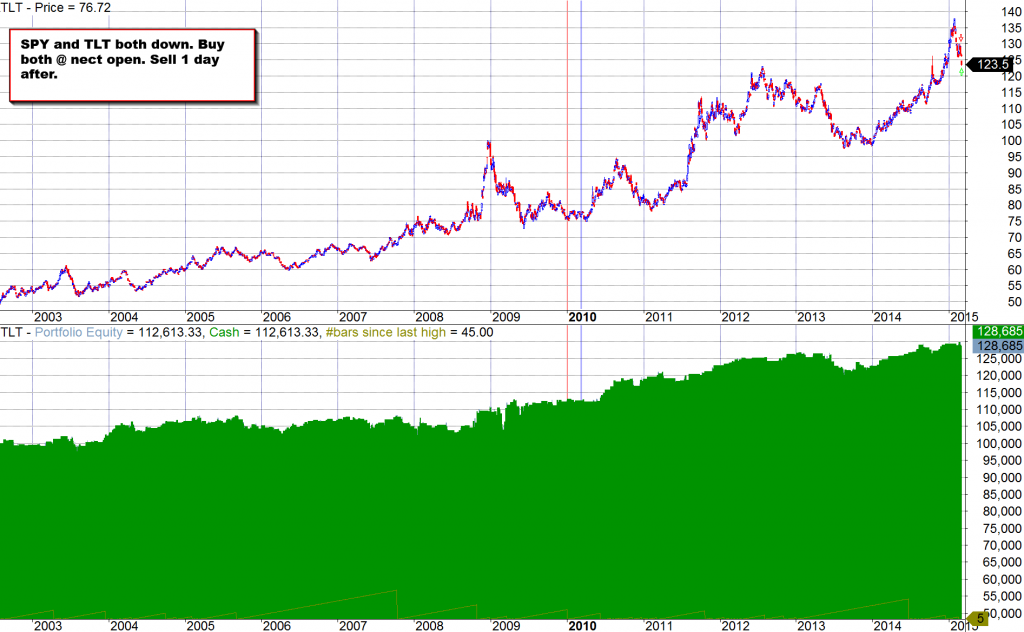

Top pane: Price of 20 year Treasury ETF: TLT. Lower pane: Bakctest results starting with 100k.

Now let’s do the opposite. We go against our instinct and actually buy both SPY and TLT at the next day open. We sell the next day at the close. We see that over time this is a better strategy.

Top pane: Price of 20 year Treasury ETF: TLT. Lower pane: Bakctest results starting with 100k.

So what does this mean?

Co-movement between equities and bonds are not uncommon. It does not mean that the basic correlation between the two assets has fundamentally changed. History shows that thinking something is wrong and selling is counter-productive.

The idea is to have a long term plan and to follow it while paying less attention to short term movements, news, hype and emotions. It is possible that a model stops working. In this case, that would mean the fundamentals of the stock & bond market have radically changed. Coming to that conclusion needs to be evaluated on a different basis over a longer period of time, and there is no indication of that yet.

Disclosure: None