Stocks And Bonds Both Testing Key Areas

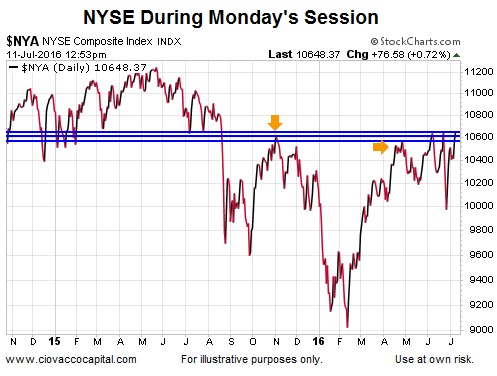

Broad Stock Market Back To Familiar Area

While the S&P 500 (SPY) was able to push to a new high during Monday’s trading session, the broad NYSE Composite Stock Index (VTI) was still looking for a close above an area that acted as resistance in the past.

Are Stocks Set To Rocket Higher?

This week’s video looks at the narrative for stocks breaking out and pushing higher, as well as the impact of slowing credit growth on asset class behavior.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

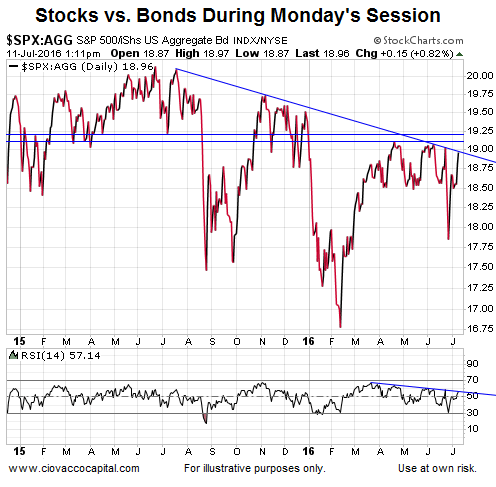

Stocks vs. Bonds Near Key Trendline

Like the NYSE Composite, the ratio of the S&P 500 (SPY) to a diversified basket of bonds (AGG) was testing a key area Monday. If the ratio can push above the downward-sloping blue trendline, it would be a positive development for stocks relative to bonds. Conversely, if the ratio fails to push/hold above the blue line, it increases the odds that Monday’s stock breakout may be followed by relatively tepid price action.

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more