Stock Market Omens For The New Year: January Indicators Are Mixed

With each new year, superstitious investors look to omens in the hope of getting advance knowledge concerning how the stock market will perform. Many investors believe in the so-called, “Santa Claus rally”, which is based on trading activity during the last five sessions of December and the first two trading days in January. If the stock market should head higher during that period, it is seen as a bullish omen about the year ahead. If there is no rally, investors are to expect bearish stock market performance throughout the New Year.

Nevertheless, Jeffrey Hirsch at the Stock Trader’s Almanac has pointed out that there have been a number of Santa Claus rallies which were followed by bearish years for the stock market. The most recent example was 2011, which managed to gain some strength during the final weeks to end the year basically flat.

The Christmas season of 2014 brought no “Santa Claus Rally” which would point to a bearish year for stocks.

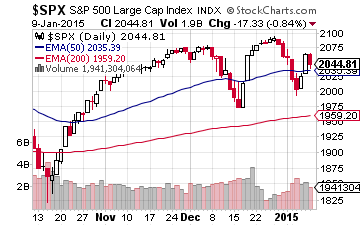

Immediately prior to the commencement of the last five trading days of December, the S&P 500 closed the December 23 session at 2,082. The Dow Jones Industrial Average was at 18,024. By the market close on the second trading day of the New Year, January 5, the S&P 500 closed at 2,020 and the Dow was at 17,501. Beyond the absence of a Santa Claus Rally, the stock market actually declined. According to this omen, we should expect 2015 to be a bearish trading year.

Superstitious investors then looked to another omen for a signal of hope. The “First Five Days” early warning signal is based on the notion that if the stock market is bullish for the first five days of January, then the stock market should have a positive year. This time, the believers were in luck.

After closing at 2,058 on New Year’s Eve, the S&P 500 climbed to 2,062 by closing bell on January 8. The Dow ended 2014 at 17,823. By the market close on January 8, the Dow had risen to 17,907. Unfortunately, the “First Five Days” early warning signal has a terrible track record. According to the Stock Trader’s Almanac, the previous 24 “First Five Days” early warning signals resulted in 11 full-year declines for a 45.8 percent accuracy rate. As a result, the “First Five Days” signal is less reliable than a coin toss.

Those who rely on omens are now looking at the entire month of January for clues as to how the year will go. The January effect is based on the premise that stock prices increase more in January than in any other month. The January effect has been traditionally associated with the performance of small-cap stocks, rather than “blue chip”, or large-cap stocks. Studies have been conducted, which have shown that during the month of January – especially during the first half of the month, small-cap stocks generally outperform large-cap stocks.

For those who believe that there is currently a “tie” between the negative Santa Claus Rally and the positive “First Five Days” indicator, the January Barometer will become even moreimportant. This doctrine is based on the maxim: “As goes January, so goes the rest of the year.” In other words, if the S&P 500 can advance during the month of January, the rest of 2015 should be bullish. According to the Stock Trader’s Almanac, where the January Barometer was created, January has correctly predicted the year’s stock market performance with an accuracy ratio of 89.1 percent, since 1950.

Although the stock market sank on January 5 – 6, it has since recovered from that slump. Believers in the January Barometer will be watching closely, through the remaining three trading weeks, for a signal about what to expect from the stock market during 2015.

If you’re looking to hedge your bets in 2015 and make sure you’re covered regardless of which direction the market moves, take a look at Marshall Hargrave’s recent article, “2015 Could Be A Reset Year, Here’s How To Invest”.

Disclosure: None.