Still Finding Value In This Red Hot Sector

As we enter the heart of second quarter earnings season, all the major indices sold off two percent or more last week, and volatility has increased within the equity markets over the past month even as stocks are almost exactly at the same level. This week started with a significant test as the Chinese market had its biggest plunge since 2007 as its main stock index sold off more than eight percent overnight before Monday’s open. Safe to say that the market is entering a period of unease at the moment.

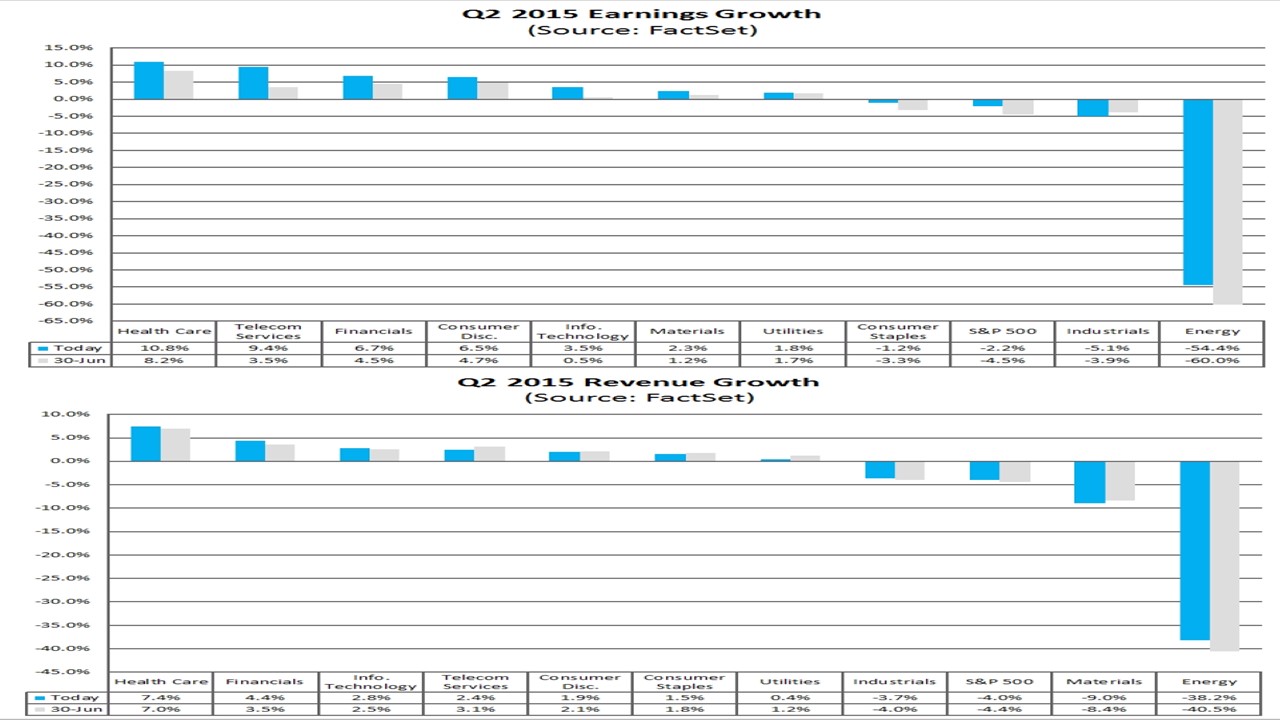

The collapse in profits from the energy and commodity sectors are also a key reason that there has been no year-over-year growth in either earnings or revenues in the first two quarters of the year. Factset is now predicting this disappointing trend will continue into the third quarter of the year. Low interest rates and robust M&A activity have supported the market up to this point, but it is hard to get enthused about the overall market at these levels with the paucity of earnings growth. But, the sector I am recommending stocks in today continues to be a bright spot in the market and is producing the best year-over-year growth in earnings and revenues in the market right now. It is the key reason the sector has been a leader in the market over the past year, and why it has the best growth prospects in the market right now.

Unfortunately, it is just not commodity and energy companies delivering disappointing growth. Outside of financials and healthcare, the other eight industry sectors of the market are currently delivering negative or slightly positive earnings and revenue growth. The opposite is true for health care where the main biotech index is up over 50% in the past twelve months even factoring in last Friday’s four percent plunge within the biotech sector.

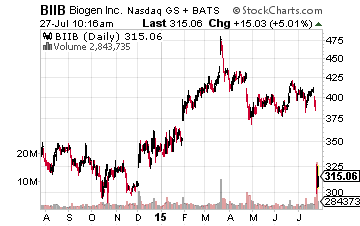

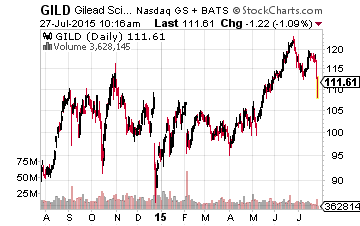

Obviously, valuations in health care are not as compelling as they were a year ago. In addition, some of the highflyers within this sector are very susceptible to any bad news. This was demonstrated Friday when one of the largest biotech plays, Biogen Idec (NASDAQ: BIIB), plunged more than 20% on the day after issuing disappointed forward guidance. The stock was selling for just under 25 times this year’s earnings before the plunge and was vulnerable to any sort of bad news.

Healthcare should continue to provide superior growth to the overall market, but I believe investors should be selective with new allocations to the sector given its large run up over the past year. That being said, I did pick up some additional shares in Gilead Sciences (NASDAQ: GILD) late on Friday as the overall market sold off. The shares of this biotech juggernaut have sold off some eight percent from recent highs, partly in reaction to Biogen’s dismal forward guidance. However, the shares are cheap at under 11 time this year’s consensus earnings and I expect it to deliver robust results when it reports quarterly results on Tuesday.

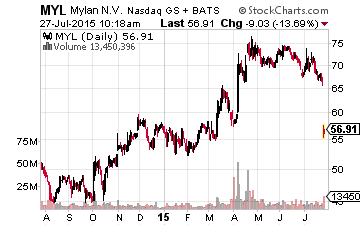

Generic drug maker Mylan (NYSE: MYL) looks interesting here. The stock dropped sharply on Monday as Teva Pharmaceuticals (NASDAQ: TEVA) purchased the generic drug business from Allegan (NYSE: AGN) for over $40 billion. Both Allegan and Teva had made runs at taking over Mylan and the buyout premium on Mylan evaporated after this deal was announced.

However, this transaction leaves Mylan free to pursue its own strategy of getting larger in the space by pursuing Perrigo Company (NASDAQ: PRGO). Earnings at Mylan are advancing approximately 15% annually right now. After Monday’s fall, the shares are very reasonably priced at around 13 times next year’s profit projections.

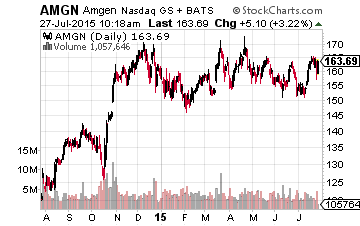

Finally, we have Amgen (NASDAQ: AMGN). This biotech pioneer is one of the few large biotech stocks that still sports reasonable valuations as it no longer gets the love given to the so called “four horsemen” of biotech. True, Amgen is not showing the growth of some of its large cap brethren. However, the company is still turning in respectable revenue growth in mid-single digits annually. Earnings are moving ahead 10% to 15% on a yearly basis. The company has a nice pipeline, pays a two percent dividend yield and goes for just 15 times next year’s earnings projections. The company is also being mentioned as a possible takeout target for Allergan now that they have sold off their generics business.

I expect healthcare to continue to provide some of best growth rates within the market. Although the stocks from this space have run up substantially over the past year, there are still some relative bargains to be had by prudent investors.

Positions: Long AMGN & GILD