SPX & G6 Prices For The Week Of April 30th

Below is a brief recap of last week’s price projections and the price targets for next week.

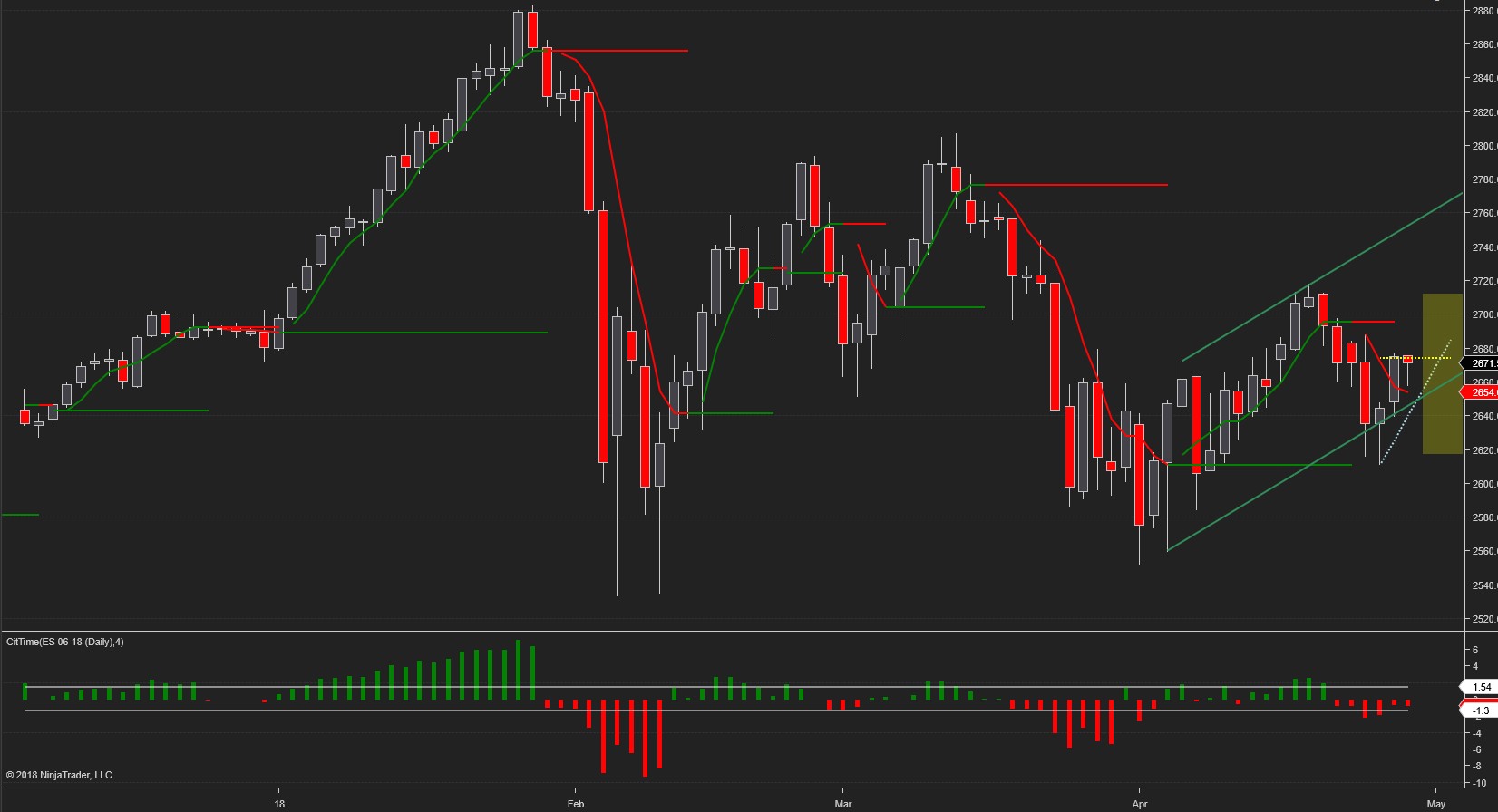

The SPX hit all key numbers but, more importantly, kept the April uptrend alive. It bounced off twice from our downside projection, and all week long managed to close within the April uptrend channel. It also closed above the monthly pivot line, above the 3 x 1 angle and right on the weekly pivot.

Therefore, the analysis remains unchanged from last week. As long as the SPX keeps within the channel and above the monthly pivot at 2635, the intermediate trend remains up. A break above 2676 opens the door for a retest of the mid and upper channel lines.

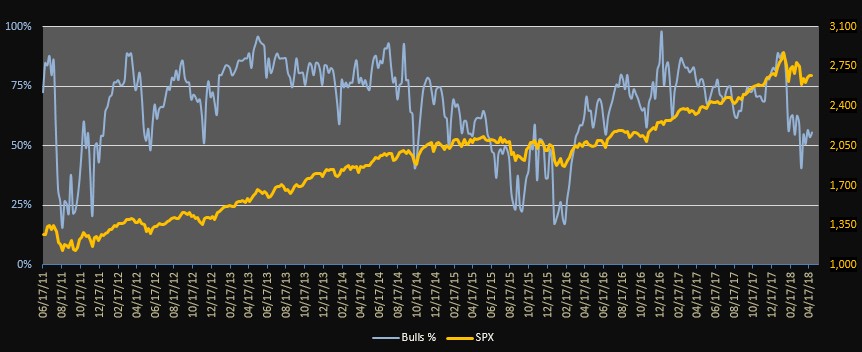

Weekly bullish sentiment remains neutral:

The projected price range for next week for the E-Mini is 2600 – 2712:

The USD started the week with a bang against the G6 currencies on the back of rising US Treasury yields. The Dollar rally was so strong that most inside channel projections were reached by Tuesday, while the wider/outside channel projections were hit by Thursday.

The Euro broke down from the three month trading range, and registered a swing decline three times bigger than the average. For a change in trend (CIT) wait for price to cross above the angle.

The projected price range for next week for EURUSD is 1.20 - 1.2214:

The Pound continued to weaken and broke below the monthly pivot line at 1.40, turning the trend negative. There's support at 1.37 which should halt the decline at least temporarily.

The CIT Channels projected trading range for next week for GBPUSD is 1.37 - 1.40:

The upward bias of USDJPY continued, and after hitting resistance at 190.5 the USD finished the week at the outside channel projection and at the 2 x 1 angle.

The projected trading range for next week for USDJPY is 108.2 – 110:

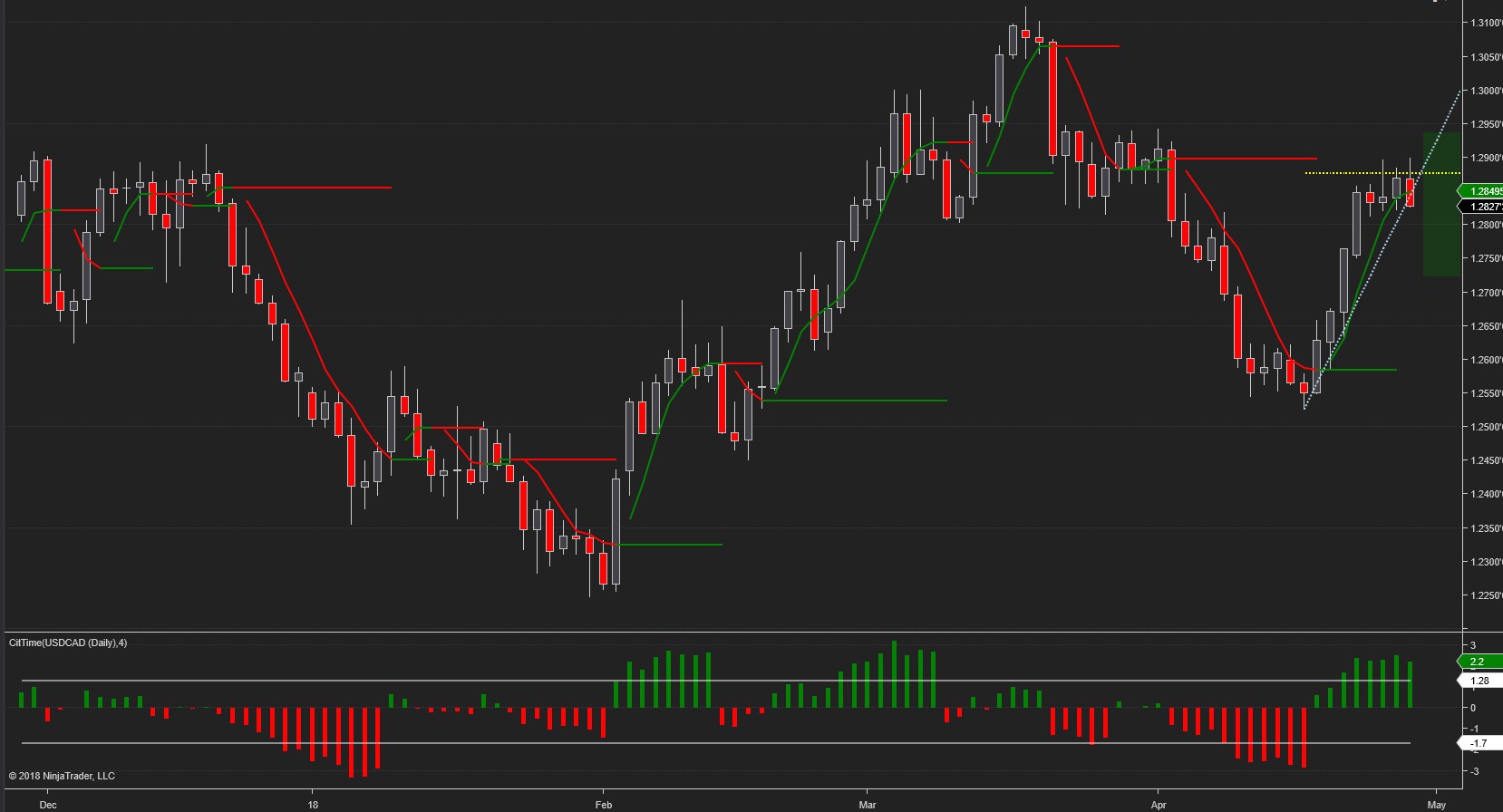

The USDCAD found resistance at our upside weekly target, and just like the USDJPY pair, finished the week on the 2 x 1 angle. A break below that angle and support at 1.2825 will signal the beginning of a retracement.

The projected trading range for next week for USDCAD is 1.2718 – 1.2935:

The uptrend of the USD against the CHF continued until it reached the middle of the heavy resistance area identified last week. Our expectation is that the USD will consolidate within the .98 – 1.00 range.

Projected range for next week for USDCHF is 0.977 – 0.995:

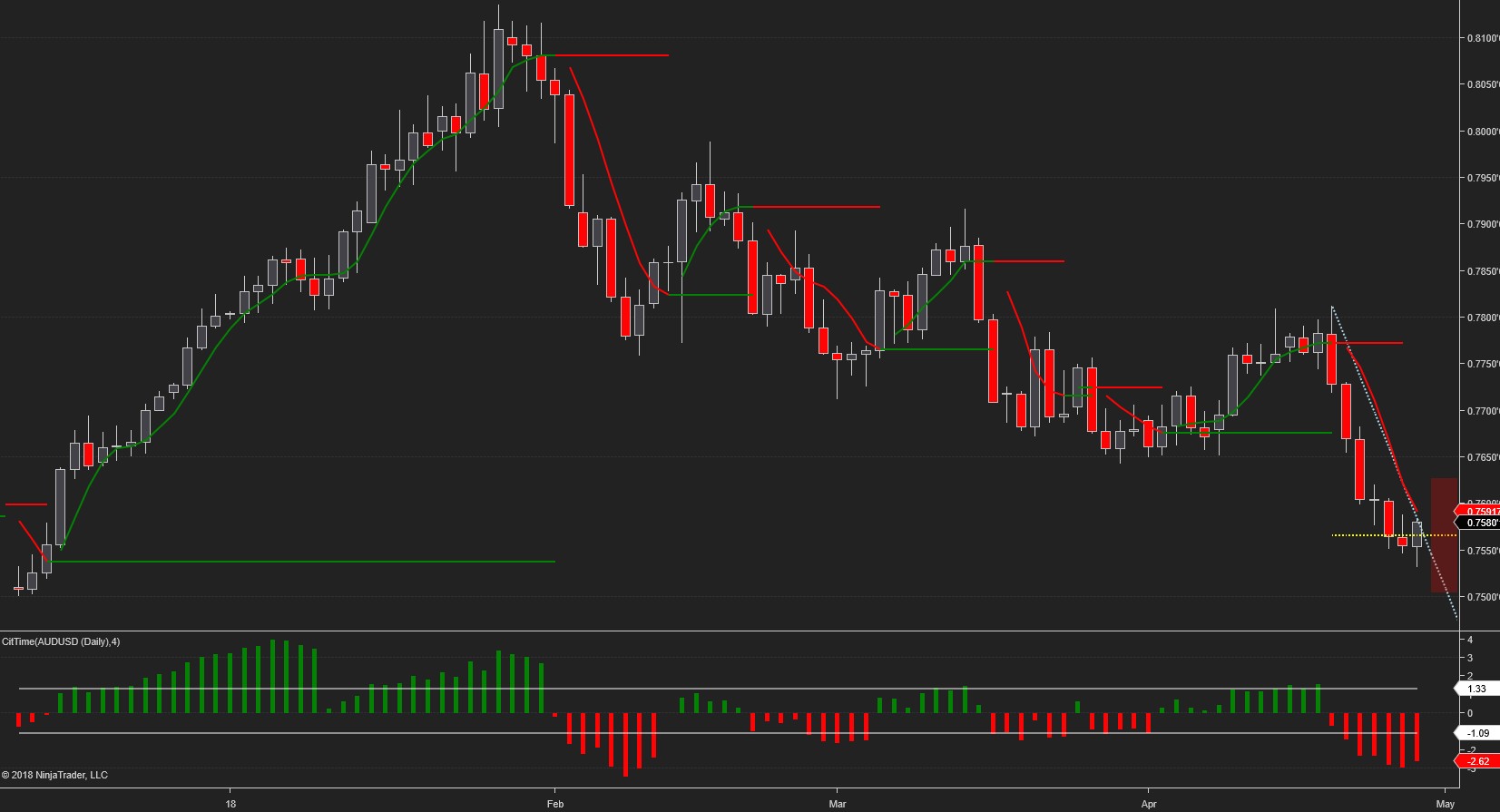

The AUDUSD bearish swing continued uninterrupted all week long, and the Friday close was 8 pips below the outside channel projection, and right on the 2 x 1 angle. A break above the angle will signal the beginning of a rebound.

Support at 0.765 becomes now resistance, and the December ‘17 low at 0.75 is our projected downside target:

Charts and data courtesy of NinjaTrader 8, Kinetick and CIT Collection

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more

Do you forsee any sudden changes in the near future?

Changes in what?