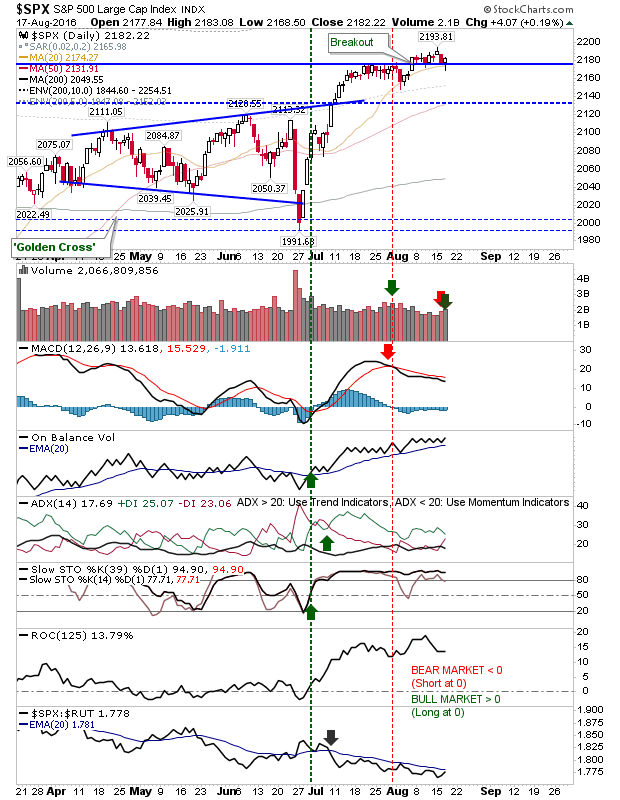

S&P Breakout Support Holds

The weak start didn't deliver a rout in markets. Instead, after the obligatory first half-hour of trading came the (bullish) reversal which lasted the rest of the day. The overall picture hasn't changed, with the S&P stuck inside a narrow range, but a panic sell-off looks less likely now.

Buyers look keen to defend drops below 2,170 in the S&P. Volume climbed to register accumulation, despite general holiday volumes. Bulls will want to see a fresh MACD 'buy' to confirm an end to an effective 7-week consolidation. Aggressive traders can look to the 20-day MA for buying opportunities and/or trailing stops.

In the absence of a trading range, the Nasdaq found support on its approach to its 20-day MA. It didn't quite reach it, but there may be a kick higher in the absence of any real overhead resistance.

The Russell 2000 was perhaps the only disappointment. While it did stage a late day recovery from its 20-day MA, it still finished below yesterday's close. If there is going to be further selling this week, then Small Caps may be the most vulnerable to this.

On sector news front, there have been two weak 'buy' triggers in Utilities. While the first was likely to have led to a stop out, today's was nice for those taking the bite off the open price. The sector finished with a bullish engulfing pattern on big volume.

For tomorrow, bulls can look for continued gains in the S&P and Nasdaq. Bears should continue to track the Russell 2000.

Disclosure: None.