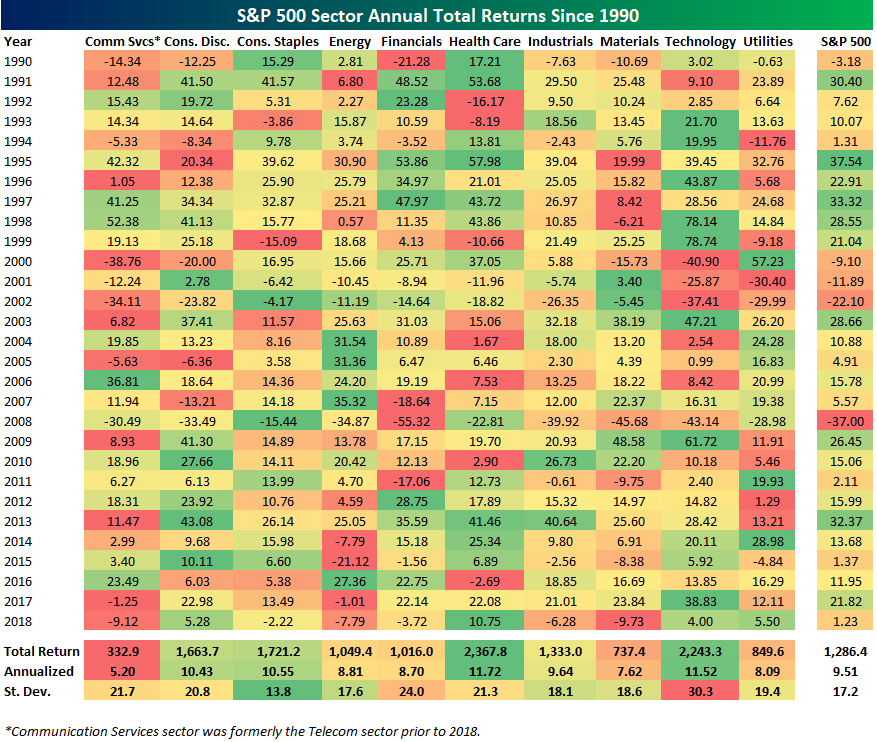

S&P 500 Sector Annual Total Returns Since 1990

Below is a look at annual total returns for S&P 500 sectors going back to 1990. At the bottom of the table, we also show each sector’s cumulative total return since the start of 1990 and its annualized return over this time period. We also show the standard deviation of annual total returns.

In the table, the red and green shading shows how well each sector performed in that specific year. Sectors highlighted in dark green performed best that year, while sectors highlighted in red performed the worst.

Health Care has performed the best since 1990 with an annualized total return of 11.72%. Technology ranks second at +11.52%, while Consumer Staples ranks third at +10.55%. Notably, Consumer Staples has outperformed Consumer Discretionary since 1990, and with much lower volatility. Staples has by far the smallest standard deviation of annual total returns of any sector. Staples has also beaten the S&P 500’s annualized total return by more than one percentage point over this time period.

Note that the Utilities sector has posted annualized total returns of 8.09% since 1990, which is better than Materials and only slightly below Financials and Energy.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more