S&P 500 Intrinsic Value Update

“Davidson” submits:

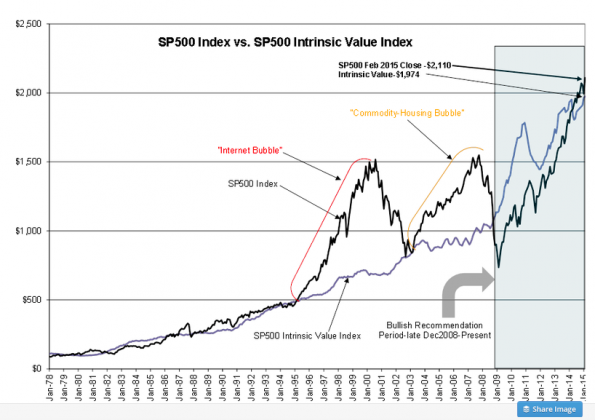

The Dallas Fed reported their preferred inflation measure in January 2015 at 1.5% for the 12mo Trimmed Mean PCE. (See the table) This is used in the market capitalization rate which in turn is used in the denominator to calculate the SP500 ($SPY) Intrinsic Value Index. Falling inflation results in justifiably higher equity prices all things being equal. The SP500 Intrinsic Value Index has risen to $1,964 compared to the SP500 closing February level of $2,110. (See the chart) The degree to which the SP500 differs from the SP500 Intrinsic Value Index I interpret as the current impact of Momentum Investors over Value Investors. At the moment, Value and Momentum have a roughly equivalent impact on overall market prices.

This is just one more report in a series since late 2008 which have identified a favorable investment environment for equities and the SP500 in particular. Investors should continue to expect higher equity prices in spite of temporary drops in investor confidence. The equity markets have a long history of rising till economic trends have peaked regardless of most geopolitics or events which tend to acerbate investor fear.

IF the trends in place continue as they have historically, we can expect a much higher SP500 5yrs-7yrs from today. I continue to recommend that investors add capital to equities and avoid fixed Income. Rate rises which drive wider credit spreads have always resulted in broadening bank lending which cause economic activity to accelerate. Yes, indeed, higher rates if they lead to wider credit spreads result in economic expansion. This is contrary to consensus. The key here is the term ‘wider credit spreads’.

How high the markets go and when they will get there is impossible to predict. Can you predict tomorrow’s market psychology? No one has ever done this? But, one can make estimates that the markets should be significantly higher in 5yrs or so if we see a continued period of economic expansion, employment growth, auto sales, new home sales and etc. As of today there is no indication of any slowing in economic activity. In fact, trends show some signs of acceleration the past 12mos.

Disclosure: The information in this post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more