S&P 500 Hot Streak Extended

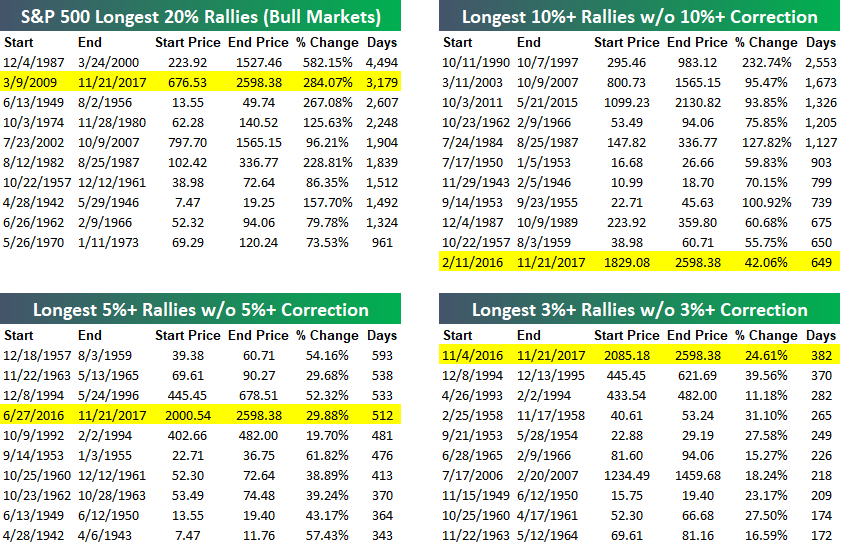

With today’s new highs, the S&P 500’s current bull market has extended to 3,179 calendar days dating back to March 9th, 2009. To surpass the record length for a bull market (20%+ rally without a 20%+ decline), there’s still a long way to go, however, since the longest bull lasted 4,494 days from 12/4/1987 through 3/24/2000.

The current streak of days without a 10%+ pullback has yet to crack the top ten, but it will if we go another 2 days. As shown in the top right table below, the 10th longest streak without a 10%+ pullback was 650 days from 10/22/1957 to 8/3/1959. The current streak without a 10%+ pullback is now at 649 days.

Unfortunately, the S&P 500 isn’t anywhere close to breaking the longest streak of days without a 10%+ pullback. That title belongs to the rally that lasted 2,553 days from 10/11/1990 to 10/7/1997. During that seven year span, the S&P rallied 232.74% without a single 10% decline on a closing basis. For the current streak to match the record, we’d have to make it to February 2023 without a 10%+ decline from a peak.Imagine that.

While the record for longest rally without a 10%+ pullback is nowhere in sight, we’re getting closer to breaking the record for longest streak without a 5%+ pullback. As of today, the S&P hasn’t seen a 5%+ decline since June 27th, 2016 — a period of 512 calendar days. To break the record, the current streak would need to stretch to 594 days, taking us out to February 11th of next year — easily do-able given the market’s current lack of volatility, but by no means a guarantee.

Finally, one record the current rally does hold is the longest rally without a 3%+ pullback. The S&P 500 hasn’t pulled back 3%+ in 382 days dating back to last November. As shown in the bottom right chart below, that’s 12 days longer than the prior record stretch of 370 days without a 3%+ pullback that ran from December 1994 to December 1995.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more