S&P 500 And Nasdaq 100 Forecast - August 11, 2016

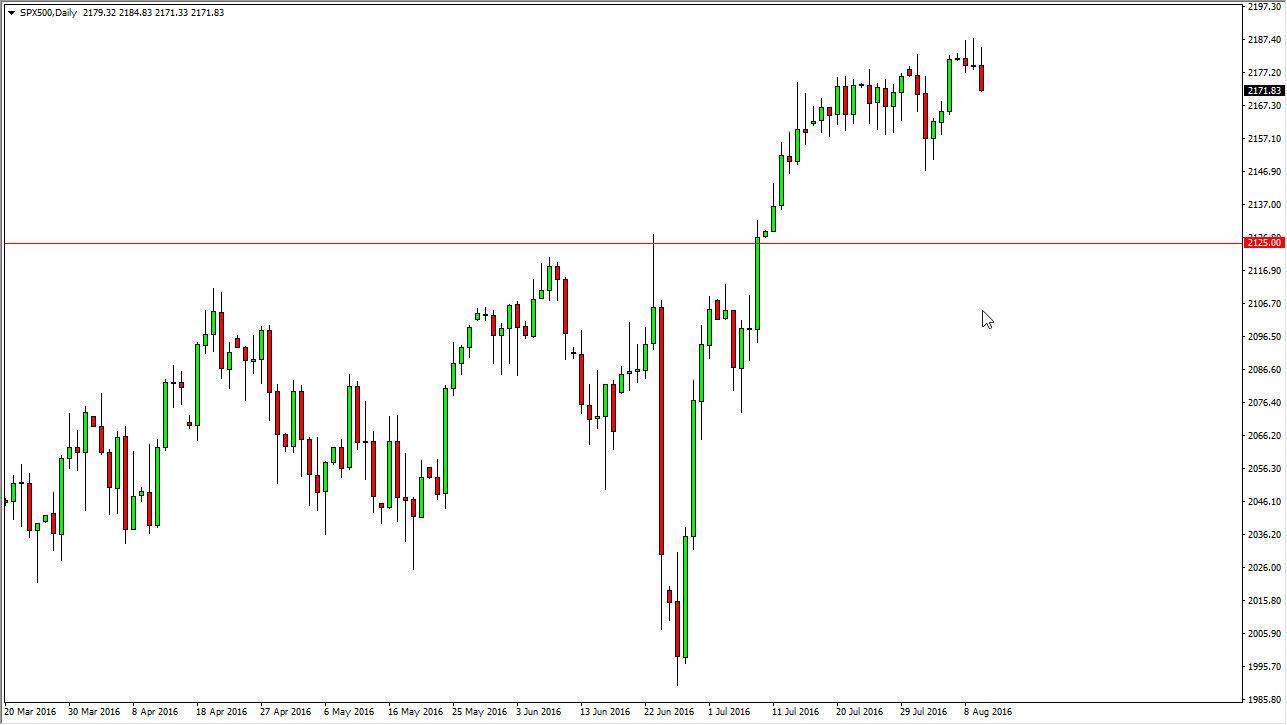

S&P 500

The S&P 500 initially tried to rally during the course of the session on Wednesday, but turned around to form a fairly negative candle. By doing so, the market looks as if it is going to grind lower, perhaps try to reach down to the 2150 level. I believe that the area below is essentially a “floor” in this market going forward. After all, we have broken out to the upside and I believe that interest-rates will continue to be very low in the United States. This of course is a bullish sign for stocks. With this being the case, I think that a supportive candle below is reason enough to start going long, and therefore reaching towards the 2250 handle.

(Click on image to enlarge)

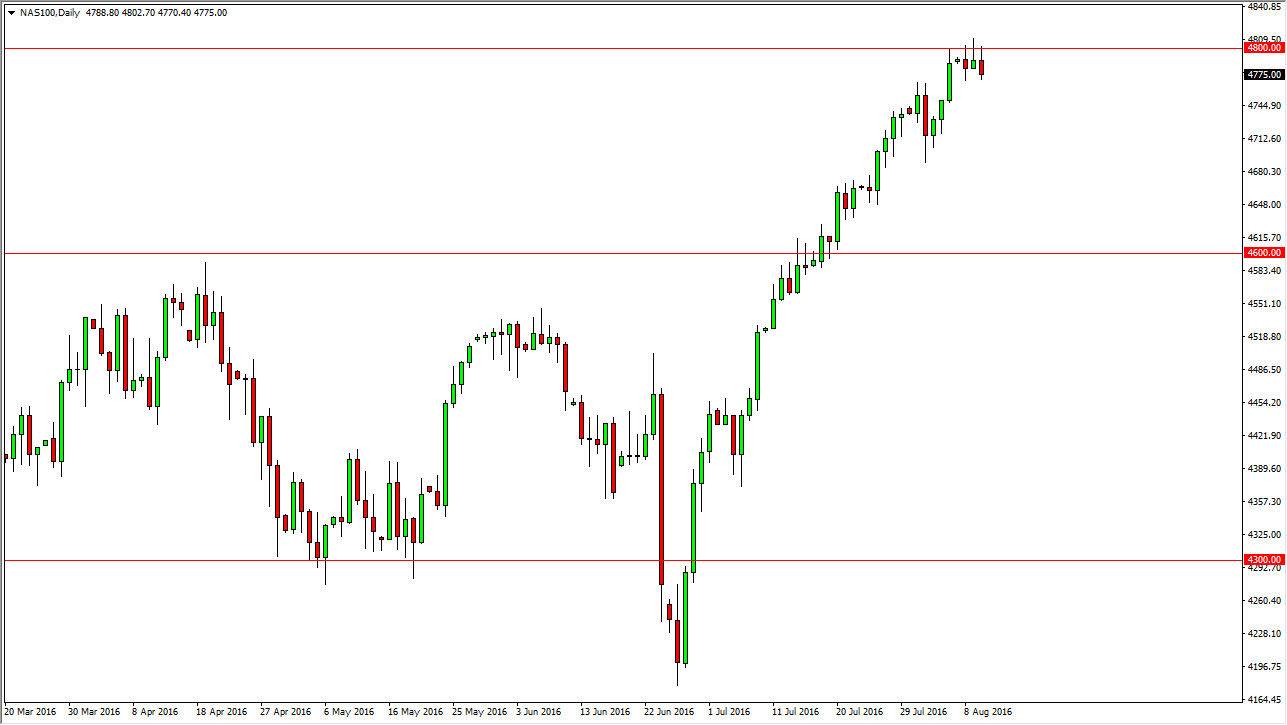

Nasdaq 100

The Nasdaq 100 initially tried to rally during the course of the session on Wednesday, but we failed and turn right back around to form a bit of a shooting star. We also had done this on Tuesday, and quite frankly the Monday candle was in exactly inspiring either. Because of this I believe it’s only a matter of time before we pullback but I also recognize that there should be a lot of support below, and that it’s only a matter of time before the buyers step back into this market. I will look for pullbacks as opportunities to pick up value, but I would also look for supportive candles in order to actually take advantage of them.

Ultimately, I believe that the Nasdaq 100 goes to the 5000 level, but we are bit overextended at this point in time so it makes quite a bit of sense that we may have to reach lower in order to pick up not only support, but perhaps new orders that can help us pick up momentum as well. Momentum of course will be needed to continue going higher.

(Click on image to enlarge)

Disclosure: None.