Some Caution Appears Warranted

Good Monday morning and welcome back. To be sure, the healthcare bill was a fiasco for the Republicans and will perhaps sow seeds of doubt about the prospects for getting tax reform or a stimulus package done. So, with an abundance of prognostications about what the future looks like here, let’s move away from the subjective world and start the week with a review my key market models and indicators.

To review, the primary goal of this exercise (something I actually do on a daily basis) is to remove any preconceived, subjective notions about the markets and ensure that I stay in line what “is” really happening in the market.

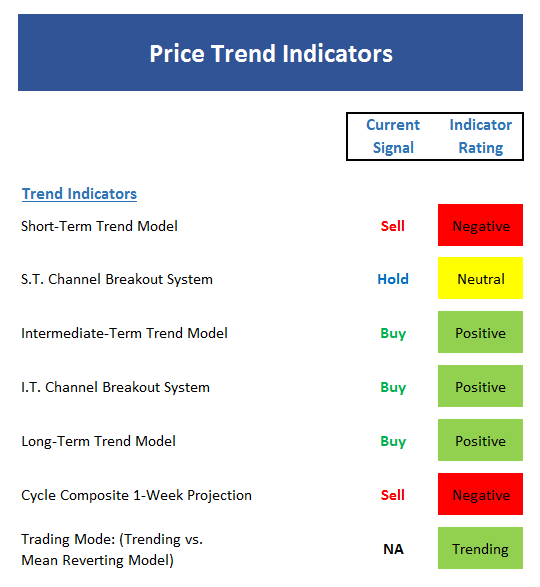

The State of the Trend

We start each week with a look at the “state of the trend.” These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- Summary of the Short-Term Trend Model – The Index is currently below its short term moving average and ma itself is moving lower

- S.T. Channel Breakout system currently “on the line” between buy and sell

- S&P 500 weekly chart also sitting on the 4-week trend smoothing

- I.T. Channel Breakout system still on a buy but a break below 2335 would turn the indicator red

- The Long-Term Trend remains bullish

- The Cycle Composite remains negative for the next two weeks

- Not surprisingly, one of our “trading mode” models flipped to “mean reverting last week and the other is moving in that direction. I.E. unless the bulls get something going quickly, the trading mode will change

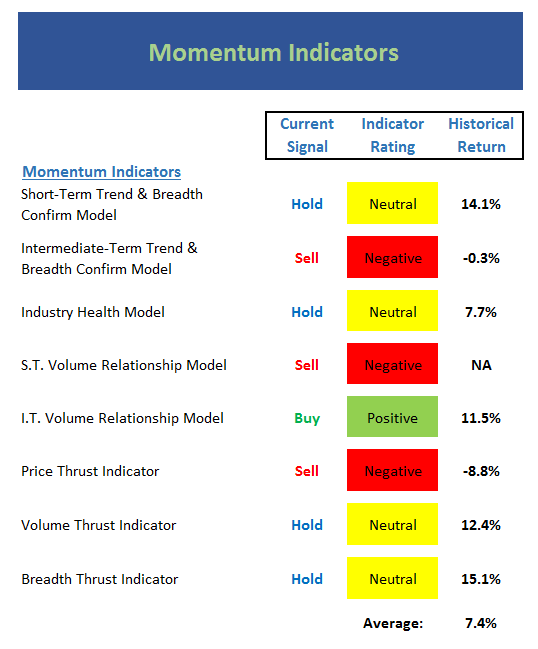

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any “oomph” behind the current trend…

Executive Summary:

- Short-term Trend & Breadth Confirm model neutral but, can go either way in a hurry

- Intermediate-Term Trend & Breadth flipped to negative, but not by much. However, this is an indication of the current environment – i.e. not great

- No change to Industry Health model reading. However, the percentage of industries that are “technically healthy” is trending lower at present time

- The Short-term Volume Relationship has slipped to negative – suggests bears have slight edge here

- While the Intermediate-term Volume Relationship model remains positive, demand volume is trending lower and supply volume is trending higher. Recall that this indicator is best used for confirmation of environment

- The Price Thrust indicator is solidly negative

- The Volume Thrust indicator is at the lowest reaches of neutral

- The Breadth Thrust indicator is also neutral – but note that the historical return remains strong when the indicator is yellow

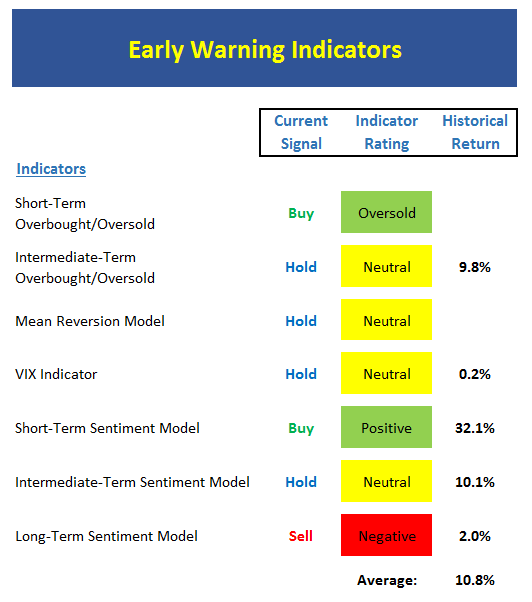

The State of the “Trade”

We also focus each week on the “early warning” board, which is designed to indicate when traders may start to “go the other way” — for a trade.

Executive Summary:

- From short-term perspective, the market is currently oversold

- The intermediate-term overbought condition has been worked off

- The Mean Reversion model continues to struggle to reach a reading high or low enough to trigger a signal.

- The short-term VIX signal (not shown) triggered a buy signal Friday and the intermediate-term signal remains on a buy, with a neutral reading currently

- Well lookie here – sentiment has gotten negative enough to trigger a buy signal from the short-term model. Note the historical return when the model is in this mode.

- The Intermediate-Term Sentiment model has also improved and is now neutral

- But longer-term, sentiment remains overly optimistic, which has historically kept returns restrained

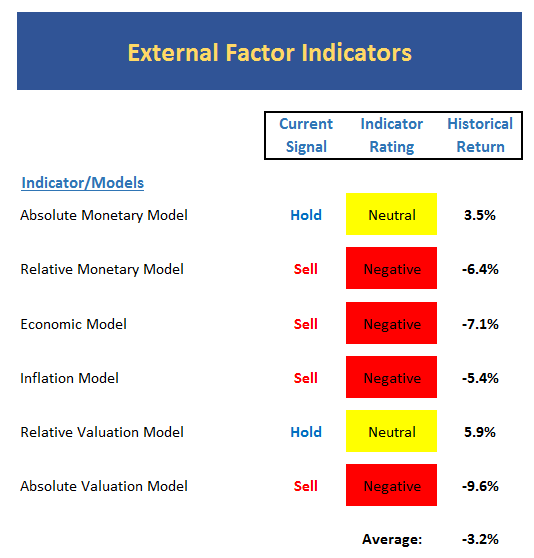

The State of the Macro Picture

Now let’s move on to the market’s “external factors” – the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

Executive Summary:

- The reading for the Absolute Monetary Model has leveled off at dead neutral

- With rates ticking a bit lower recently, the Relative Monetary model has improved a little – but the reading remains negative

- The Economic Model (the model using economic indicators to “call” the stock market) remains out of sync here

- The Inflation model hit the “high inflationary pressures” zone but is now starting to retreat and is very close to turning neutral. This tells us that runaway inflation is not a threat here

- Valuations continue to be an issue

The State of the Big-Picture Market Models

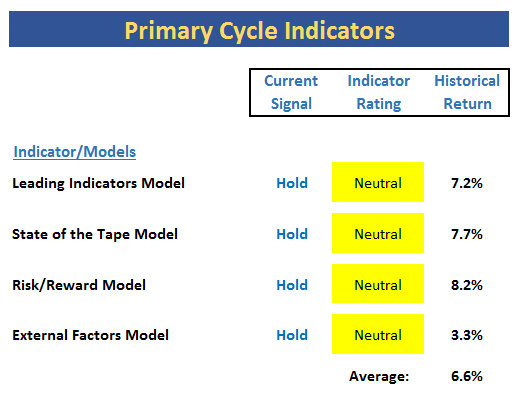

Finally, let’s review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

- The Leading Indicators Model, which is my favorite big picture model over the last 10 years is technically neutral but now at the lowest level seen since the mini bear 2015-16. The bottom line is if this model slips into the red, I will officially take a more cautious view. As such, I’ll be watching this indicator closely in the coming days.

- I remain concerned that the State of the Tape Model has not been able to move to an outright positive reading

- The Risk/Reward model continues to waffle back and forth between neutral and negative – this suggests some caution is warranted

- The song remains the same in the External Factors model as the current reading is too close to negative for my comfort

The Takeaway…

The overall message from this week’s review of the models/indicators is that things have weakened enough that the possibility of a meaningful pullback in the near-term is elevated. I remain concerned about all the yellow on the Primary Cycle board as these are my key big-picture models. As such, this is no time to be asleep at the wheel or to be overly aggressive. The bottom line is some caution is warranted in the short-term.

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any ...

more