Small Caps Outperform Large Caps

Small Caps Earnings Growth Falls But Financials Look Good

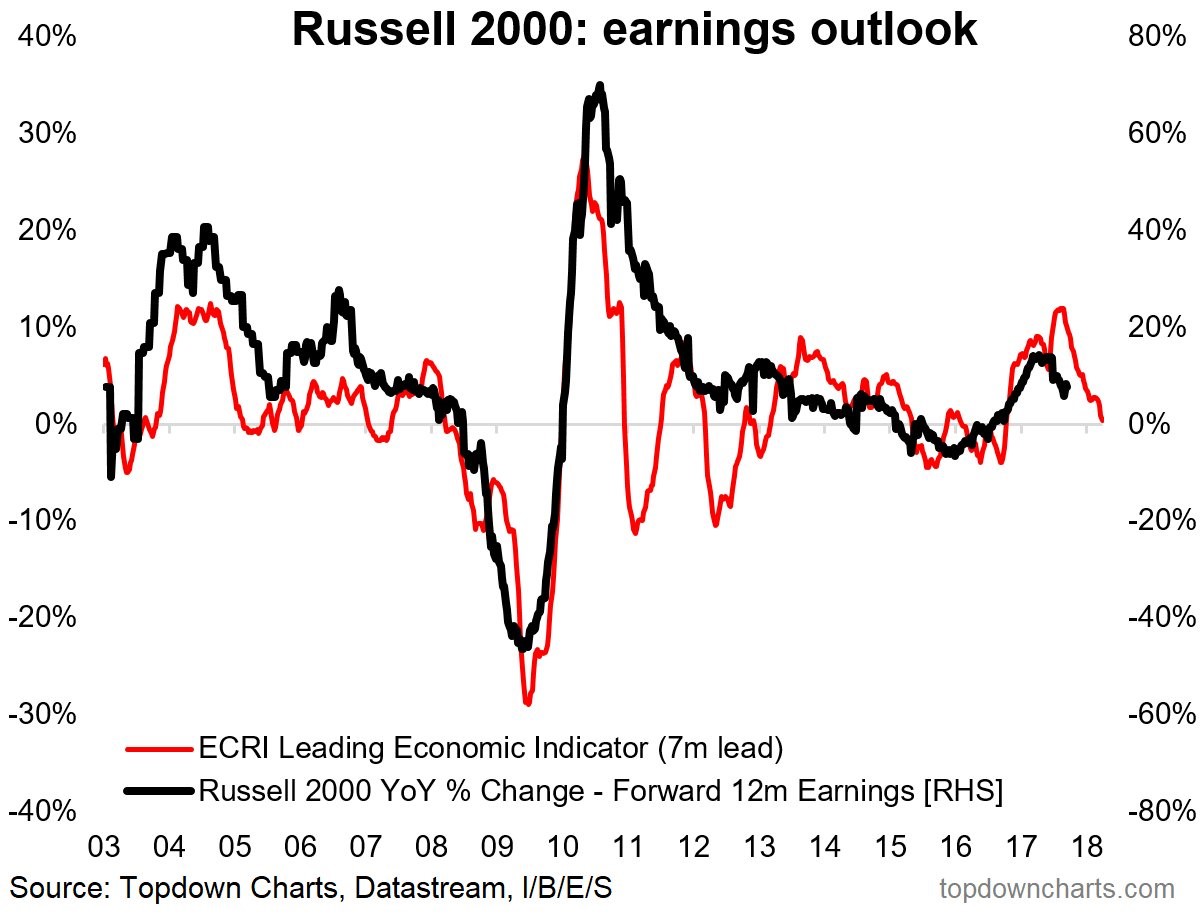

Even though the Russell 2000 was down slightly on Friday, the small caps are still in the best streak since the post-election run. The chart below shows the rally after the election was justified given the accelerated earnings growth after the earnings recession in 2015-2016. Unless the tax cut is passed, the Russell 2000 is going to continue its string of decelerating growth. That deceleration should continue in Q3 because small firms were the most affected by the hurricanes. Secondly, the ECRI leading indicator report is implying that growth will further decelerate. The ECRI has had a great track record of predicting Russell 2000 earnings growth implying that this rally has gotten out of hand.

As we’ve discussed, Russell 2000 earnings growth relies on the financials much more than the S&P 500 and relies on technology much less. The chart below shows the return on assets of the S&P 500 financials to give you an idea of where the sector is headed and for the small caps as well. As you can see, there has been a rebound in the past 18 months. The net interest margins of the banks improved substantially with the two rate hikes this year. The chart shows the relationship between the 10/2 yield curve and the financials ROA, but there’s no reason why this divergence can’t continue. We’re still some ways away from another recession. Once the yield curve starts to fall flat, the Fed will stop raising rates and the banks will start to lose profit growth again. The 9 basis point increase in financial services return on assets is mostly caused by trading related profit growth. This is on 1% year over year growth in assets. This all implies momentum for Russell 2000 earnings.

We’ve discussed how the companies with the highest tax rates haven’t been doing well despite the possibility of tax cuts. The chart below shows the breakdown among low taxed and high taxed companies. Another point worth mentioning is domestically focused small caps would possibly benefit more than large caps from tax cuts. Since small caps have done better than large caps in the past few weeks, that trend differs from the tax rate breakdown. The reason why I say there’s a possible benefit for small caps over large caps is because there’s three dynamics at play. The small caps benefit more from the lowered corporate tax rate. The internationally focused large caps benefit from the repatriation tax holiday. The third aspect is that the U.S. economy will outperform after tax cuts are passed. That makes it so that small caps do better than large caps.

GDP Growth Improves

The GDP Now forecast fell back down to earth in its latest update on Friday. As you can see from the chart below, the GDP growth forecast fell from 2.8% to 2.5%. This decline was caused by the weakness in the employment report. It caused the forecast for real private fixed investment growth to fall from 1.8% to 0.9% and the forecast for real consumer spending growth to fall from 2.55% to 2.2%. This quarter includes the back to school shopping season which is the second biggest shopping period of the year. The NY Fed’s guess at GDP growth for Q3 increased from 1.46% to 1.53% because of the ISM reports. It was negatively affected by the payrolls report and the imports for goods and services report. The estimate for Q4 had a large jump as it increased from 1.95% to 2.45%. The St. Louis Fed remains the highest of the bunch, expecting 2.97% growth.

Oil Prices Crash Below $50

Just after energy stocks had a good few weeks, oil has started crashing once again. My expectation for oil to fall below $50 proved to be correct as now is a seasonable weak season. The price fell 2.95% on Friday to $49.29. It was down 4.5% this week which makes it the worst week since March 10th. The price had rallied on Thursday because the market thought Russia would lead OPEC cuts. However, on Friday Putin said he never offered to extend cuts only recognizing it as a possibility. This shows that if Russia doesn’t lead the cuts, oil can spend much of 2018 in the $40s. The Saudi Arabian energy minister said the country is “flexible” on the decision whether to continue the production cuts into 2018. He’s going to look at the supply dynamics, the price, and what other nations have in mind. There has recently been a record in U.S. exports, the largest Libyan oilfield was reopened, the dollar has improved, and there was recently a new year high in U.S. production. These are all factors which have sent oil lower this week.

Besides the OPEC production cuts, the other factor which will affect oil prices is hurricane Nate. The storm will make landfall as a category 1 hurricane in either Louisiana or Mississippi. While the storm won’t have catastrophic damage like hurricane Harvey, there will be an impact on gasoline prices because refineries will be shut down. BP and Chevron have shut production at all platforms. Royal Dutch and Anadarko stopped some activity. Exxon and Statoil have brought in some workers from the refineries. This is a fast moving storm, so it will have effects for less than a day. Obviously, it will take longer than that to repair the damage it causes.

Conclusion

Oil prices declining into the $40s make Q4 energy earnings look weak. This quarter’s coming reports will be the last of the easy comparisons for the sector. Speaking of disappointing earnings, the small caps look to be in trouble as the leading indicators signal weakness is ahead. The small caps were also the most affected by the hurricanes. On the bright side, the Fed futures have been showing the market is expecting more rate hikes in 2018 and that the December rate hike is a lock. This is great for the net interest margins of all the banks especially the small cap ones which have been rising quickly in the past 4 weeks.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more