Slightly Lower US Corn & Soybean Crops Are Expected Next Month

Market Analysis

As the commodity markets end 2017, the main focus remains on South America’s weather and its impact on their growing season. However, the final row crop output levels for 2017/18 will also garner some interest when these numbers are released on January 12. The changes aren’t likely to be monumental, but the direction and the size of these final adjustments could help set tone for the corn and soybean markets.

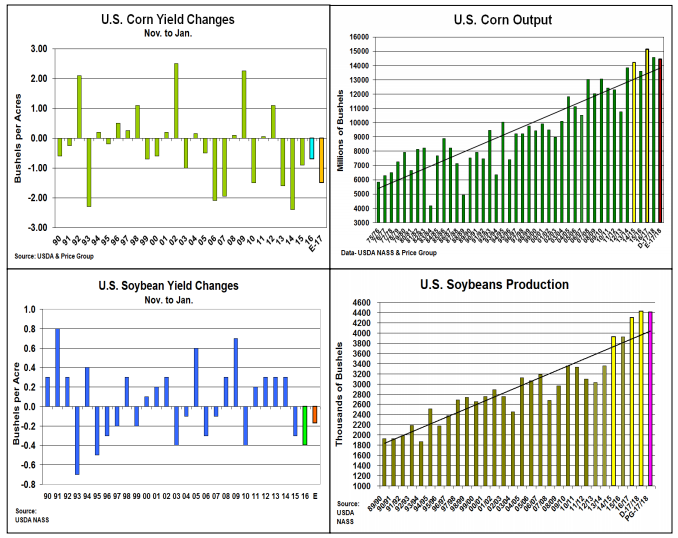

In corn, 2017’s US yield estimate started defensively because of the Midwest’s mid-summer dryness, but it grew during the fall on strong field reports. Hefty ear weights eventually prompted the USDA to project its US yield at a new record 175.4 bu on their November update. Many are anticipating that January’s corn yield and crop size will follow the adage that big crops will get bigger. Looking at the past 10 years, this hasn’t occurred with 6 of these years final yield dropping 0.7 to 2.3 of bu. from Nov to Jan. We expect a 1.5 bu. drop to 173.9 in the US yield given the past 4 years of large yield declines averaging 1.43 bu. on corn’s final yield. This is 125 million bu. decline to 14.45 billion on the next USDA update, but 2017’s crop is only 696 million bu. less than last year.

In soybeans, 2017’s growing season had a slightly different path with dryness continuing into September in the Eastern US prompting monthly yields to vacillate around 49.5 bu. each month. Despite 6 of the last 10 years final bean yields being slightly higher (0.2 –0.7 bu.), the last 2 years have experienced 0.3 and 0.4 bu. yield declines from November to January. With late season field yield reports not being numerous or exceptional, we are expecting a 0.17 bu. decline to 49.29 bu per acre for 2017’s US yield. This will result in just a 15 million bu. drop in the US total crop to 4.41 billion bu., 103 million bu..larger than 2016. This is still a new record crop despite 2.8 bu. lower US yield as harvested area grew by 7 million acres.

What’s Ahead

If the USDA’s final crop sizes aren’t very far from current levels, corn and soybean demand changes might even reduce these two major crop’s US ending stocks when the USDA updates its balance sheets on January 12. With the Pacific Ocean still in a La Nina phase, Argentina and Southern Brazil will likely have further dry periods keeping the market’s focus on this year’s S. American crop potential.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more