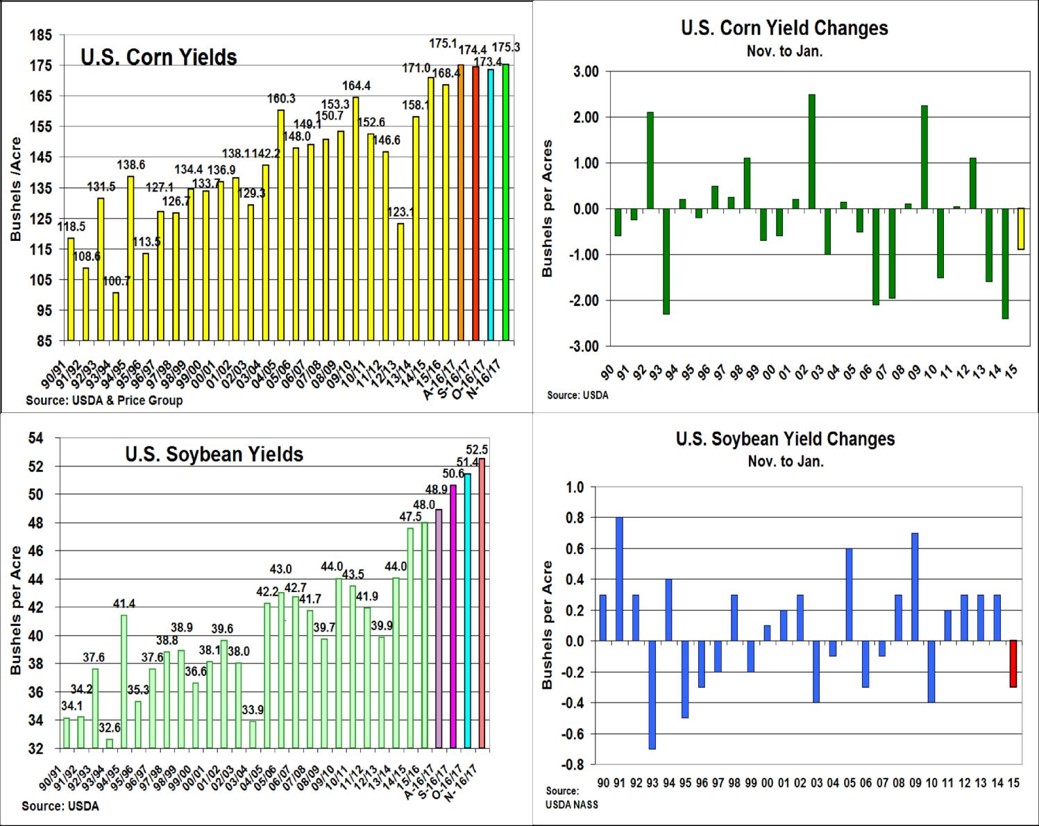

Slight US Crop Changes Expected With Corn Down & Soybeans Up

Market Analysis

As the commodity markets enter 2017, the focus will remain on South America’s weather prospects and growing season. However, the final row crop output levels for 2016/17 will also garner some interest when they are released on January 12. The changes aren’t likely to be monumental, but the direction and the size of these final adjustments could set some minor tones for the corn and soybean markets.

(Click on image to enlarge)

In corn, this year’s national yield estimate started at new record heights before slipping during the harvest months before rebounding back to the USDA’s initial record level on their November update. Many are anticipating that January’s corn yield and crop size will follow the adage that big crops will get bigger. Looking at the past 10 years, this hasn’t occurred with 6 of these years final yield dropping 0.8 to 2.3 of bushels from November to January. Interestingly, the only year in last ten, 2009/10, did January’s final yield rise over 2 bu. Given some less-than-impressive yields in the southern Midwest and SE being reported, 2016/17’s final yield could slip 1.4 bu. to 173.9 bu. or about 125 million bu. to 15.1 billion on the next USDA update. This will still leave this year’s crop 884 million larger than 2014/15’s previous record output.

In soybeans, 2016 had a different path with each yield update during the August to November monthly reports revealing a new record level of 48.9 in August to 52.5 bu. in November. With previous soybean crops also having slightly higher yields in 4 out 5 years and 6 out the last 10 years from November to January, the potential for a modest 0.3 bu. increase in 2016/17 bean yield seems logical given the extended frost-free fall season in the central US. This rise in the US yield to 52.8 bu could up the soybean crop to 4.383 billion bu.; This would a 22 million bu. rise if this year’s area doesn’t change, but this output would still be 884 million higher than the last 2 years.

What’s Ahead

If the USDA’s final crop sizes aren’t very far from current levels, corn and soybean demand changes might even reduce these two major crop’s US ending stocks when the USDA updates its balance sheets on January 12. With Argentina still trying to finish its plantings and Brazil’s first crops in the final stages of their growing seasons, the market’s focus will remain on S. American producing regions.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more