Singularity Of The Dollar

by Reverse Engineer, Doomstead Diner

On Wednesday, March 18, 2015 at precisely 4:04 PM ET in the FOREX trading Markets, there was a Flash Crash of the Dollar. Just prior to that though, the Almighty Dollar was subjected to an event known in Mathematics and Physics as a“Singularity”

Discuss this article at the Economics Table inside the Diner

Mathematical Physics

Singularity: A point at which a function takes an infinite value, especially in space-time when matter is infinitely dense, as at the center of a black hole.

You see clear evidence of The Singularity in the compression of values that occurred directly before just about every FOREX trading pair went berzerk, and the Dollar value relative to all of them Flash Crashed.

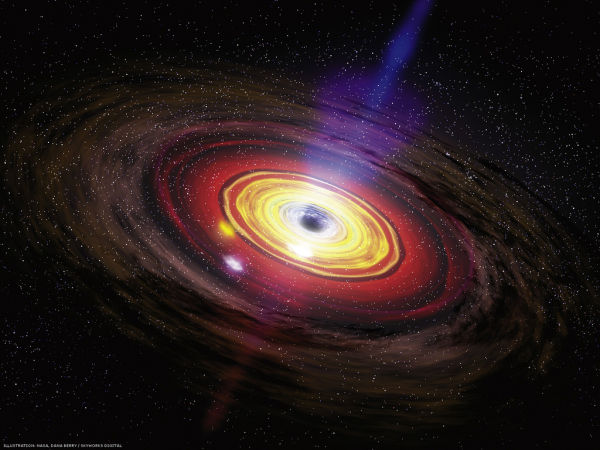

You see a similar effect in a Black Hole, when matter is compressed to infinite density and infinitessimal space, collapsing on itself from too much Gravity pulling it inward and lack of Energy pushing it outward.

The formation of Black Hole comes at was is known as an “Event Horizon”. That is the point in Space-Time at which the equation “flips over” and irreversible collapse occurs, leading to the Singularity. In the diagram at left, you see that everything is drawn inwards to create the singularity, but it doesn’t show what comes out the“Other Side” of said Singularity.

You see that better in the photo above, which has Radiation streaming outward from the Center of the Black Hole.

The graph at the top of the page shows the very same features, the Event Horizon was crossed at approximately 13:53 ET based on the X-Axis, and then the Flash Crash occurred about 10 minutes later at 14:04 ET. Why did this occur?

Well, as just about everyone knows by now, most trading is no longer done by Humans, it is done by Computers which follow certain Algorithms, known as High Frequency Trading algorithms, or HFT for short. By no small coincidence, the folks who program up these algorithms do not usually come from Economics, they are recruited from Ph.D. Theoretical Physicists graduating from schools like MIT, Columbia, Oxford, etc. Economics tends to be pretty “soft” on the quantitative end, whereas Physics is more rigorous in this regard, basically Physics people are better at Math than Economics people.

They are known as “quants” because they do quantitative finance. Seduced by a vision of mathematical elegance underlying some of the messiest of human activities, they apply skills they once hoped to use to untangle string theory or the nervous system to making money.

This flood seems to be continuing, unabated by the ongoing economic collapse in this country and abroad. Last fall students filled a giant classroom at M.I.T. to overflowing for an evening workshop called “So You Want to Be a Quant.” Some quants analyze the stock market. Others churn out the computer models that analyze otherwise unmeasurable risks and profits of arcane deals, or run their own hedge funds and sift through vast universes of data for the slight disparities that can give them an edge.

Still others have opened an academic front, using complexity theory or artificial intelligence to better understand the behavior of humans in markets. In December the physics Web site arXiv.org, where physicists post their papers, added a section for papers on finance. Submissions on subjects like “the superstatistics of labor productivity” and “stochastic volatility models” have been streaming in.

Quants occupy a revealing niche in modern capitalism. They make a lot of money but not as much as the traders who tease them and treat them like geeks. Until recently they rarely made partner at places like Goldman Sachs (GS). In some quarters they get blamed for the current breakdown — “All I can say is, beware of geeks bearing formulas,”Warren Buffett said on “The Charlie Rose Show” last fall. Even the quants tend to agree that what they do is not quite science.

[Note: I don’t think these grads are “seduced by a vision of mathematical elegance” as much as they are seduced by pulling home a big paycheck, but that is another question for another day. LOL.]

So, with the advent of computers, Physics grads have been recruited to design up the HFT trading programs, which tend to reflect the kinds of equations that they learned in physics, so if you get a similar “Event Horizon” on the mathematical level with all the variables that are being computed, you’ll get a similar type of rendering on a graph, which is of course what you got with the graph up top here.

So, your next question is just what was it that occurred at 13:53 that pushed the algos over the edge of the Event Horizon? Some parameter must have had a significant change, but we don’t know what that change was, although to be sure somebody does. What are some likely possibilities?

1-One of the Algos “misfired” with a glitch, which sent all the rest of them over the edge also. That’s a plausible Random Explanation.

However, with so much ongoing here in the world of Global Finance Manipulation, it seems more likely to me that somebody who can push very big money around did a significant dump of Dollars, against the current general trend of the market to run toward the dollar right now, since it’s still the best looking Dog**** in the Pound. Who could possibly make such a large Dump of Dollars? Only two reasonable possibilities there.

- Da Fed: Da Fed can buy or sell as many Dollars as it wants to, doing Currency Swaps at will. Perhaps TPTB in charge there wanted to stop or at least slow down the appreciating value of the dollar relative to other currencies or raise the price of Oil by devaluing the dollar.

- The Chinese: The Chinese have a vast hoard of Dollars, and their own currency of the Renminby has a “soft peg” to the dollar, so as the dollar has been increasing in value relative to other currencies, so has Renminby. The problem with that of course is that it hurts the Chinese Export market and their “competitiveness” as everyone rushes to “Beggar Thy Neighbor” by devaluation, attempting to be able to undersell competitors in this manner.

Such devaluation comes at a Price though, because it makes any you import relatively more expensive, most notably here Energy Imports which none of the mercantilist economies can do without if they want to keep producing and exporting industrially manufactured goods, and which is necessary for producing Food in Industrial Quantities to support their large populations.

There are some other possible candidates, the Ruskies for instance are in a pitched battle with the Western Illuminati Banking system that uses the Dollar as World Reserve Currency, but it doesn’t seem likely that with all the sanctions currently in place they would have sufficient leverage in Dollars to pull a stunt like this. Nor does it seem likely the Japanese would do it either, except perhaps as a proxy for Da Fed.

The next important question is what are the consequences of this? In the aftermath the following day, the Dollar “rebalanced” and climbed right back up to where it was before, and BAU resumed.

So, if there was intention to permanently crash the system, it obviously failed. If the purpose was to get a few FOREX traders to stain their underwear, it was wildly successful.

The purpose may have simply been to demonstrate how unstable the House of Cards is and to make everyone more skittish than they already are. If you were able to Front Run this you might have been able to make a lot of money, but besides the folks who set it off, it would have been impossible to front run. I’m not sure even the folks who set it off could front run it, because they don’t have access to all the other algos which are trading, so they wouldn’t know what the behavior of all the currency pairs would be. Probably though it could reasonably be assumed the dollar would plummet in value relative to everything else.

Moving into the future, it reminds us first that all the markets are thoroughly manipulated and being run by a very few very big players, mainly the Central Banks and TBTF Investment Banks. There are some large Hedge Funds running HFT that possibly could set off another Singularity event as well, and it doesn’t have to be just in the FOREX market, although that is where the biggest and quickest potential damage is possible. In the worst case scenario, there is a rapid and massive shift of all currencies which actually holds, like the recent rebalancing of the Swissie against the Euro. This has a cascading effect on the balance sheet of banks with large number of loans denominated in Swissies which can quickly render them insolvent, as was the case with the Austrian Regional Bank Hypo Alpe Adria & Heta Asset Resolution AG and the province of Carinthia; From Zero Hedge:

A Black Swan Lands In Southern Austria: The Ripple Effects Of “Mini-Greece Going Off In The Heartland Of Europe”

By far the most notable news of the past week, which has still gone largely unnoticed by the greater investing community whose focus instead was on whether algos would ramp the Nasdaq to 5000, and keep the S&P above 2100, even before Mario Draghi finally began buying bonds that nobody wants to sell, was the “Spectacular Development” In Austria, whereby the “bad bank” of failed Hypo Alpe Adria – the Heta Asset Resolution AG – itself went from good to bad, with its creditors forced into an involuntary “bail-in” following the “discovery” of a $8.5 billion capital hole in its balance sheet primarily related to ongoing deterioration in central and eastern European economies.

This shocking announcement promptly sent the price of Heta bonds crashing as creditors, no longer enjoying the explicit guarantee of the state, scrambled to get out of “northern Europe’s” first Lehman moment.

But while the acute pain came and went for Heta bondholders who have seen a nearly 50% loss in just a few short months, the bigger and far more diffuse pain is only just starting, or as Bloomberg put it,

“Austria’s decision to wind down Heta Asset Resolution AG sent ripples through the financial system, causing credit rating downgrades in Austria and bank losses in Germany.”

The first casualty: the beautifully picturesque southern Austrian province of Carinthia.

This by itself is bad enough, with cross contagion effects already being felt by other banks in Germany. However, imagine if numerous currency pairs rapidly changed in valuation, then you have similar problems going on everywhere in many countries, and many simultaneous bank failures as a result. If the system has this much trouble handling the failure of one small Austrian Bank, imagine what happens if it is many of them, plus a few large systemic banks like Deutchbank too! In this case the whole Jenga Tower comes down, and quite rapidly also.

This by itself is bad enough, with cross contagion effects already being felt by other banks in Germany. However, imagine if numerous currency pairs rapidly changed in valuation, then you have similar problems going on everywhere in many countries, and many simultaneous bank failures as a result. If the system has this much trouble handling the failure of one small Austrian Bank, imagine what happens if it is many of them, plus a few large systemic banks like Deutchbank too! In this case the whole Jenga Tower comes down, and quite rapidly also.

To date, all the failures have been contained through a variety of accounting frauds and the endless expansion of CB balance sheets with gobs of Irredeemable Debt now on their books. Each of those is an increasingly malformed block being placed ever higher on the Jenga Tower. It is Magical Thinking to believe that this tower will not eventually collapse under its own weight and increasing instability, demonstrated by the nearly daily “Flash Crashes” in markets all over the Globe, all linked together at the speed of light by the telecommunications network and run not by human hands, but by HFT algorithms, which while they may be designed by Geniuses, are still subject to the laws of mathematics and physics.

The main law involved here is one everyone is familiar with, which is:

What Goes UP, must come DOWN

When this Tower does collapse, it will come down a whole lot faster than it went up. That day approaches ever closer now, and it would be a good time to get started running in the other direction away from it, as fast as you can. Run Away, Run Away FAST, Run Away NOW TM.

No content is to be construed as investment advise and all content is provided for informational purposes only. The reader is solely responsible for determining whether any investment, security ...

more