Short End Of The Curve Could Cause An Inversion

Inflation Breakdown

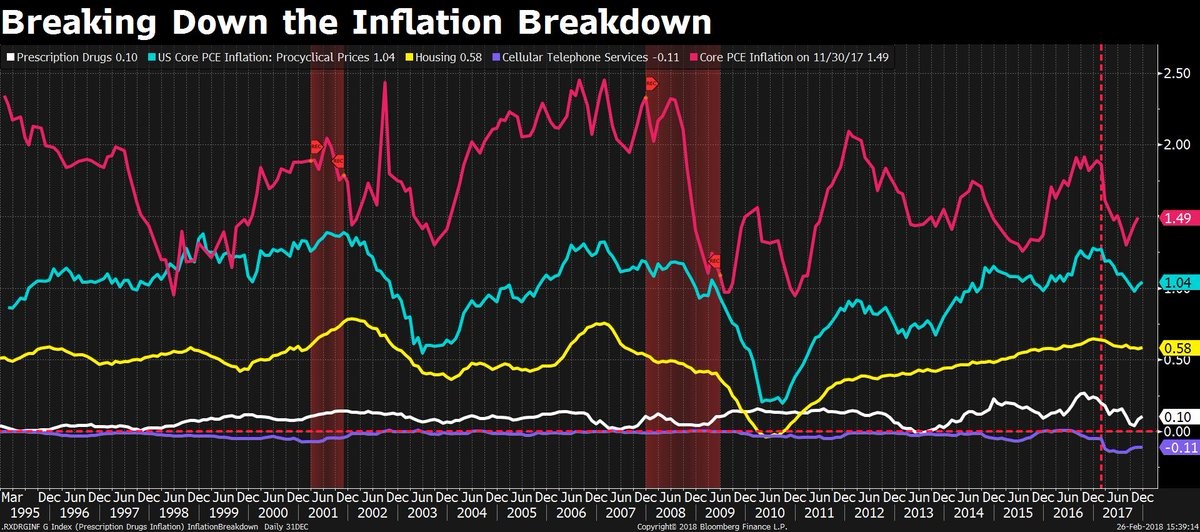

Since inflation was mentioned numerous times during Powell’s testimony and then in the interview with former Fed chairs Ben Bernanke and Janet Yellen, let’s look at a breakdown of the metric. As you can see from the chart below, the purple line shows the cellular data series Yellen referred to often last year. Yellen blamed this measurement for the decline in inflation. It doesn’t appear to be increasing since then even though overall inflation is picking up. Cellular prices weren’t the only cause of the decline. As you can see, housing, prescription drugs, and other pro-cyclical prices decelerated last year. The pro-cyclical and prescription drug inflation accelerated at the end of the year. The definition of pro-cyclical is something which acts in tune with the economy or magnifies its effects. It’s the opposite of counter-cyclical.

The pro-cyclical basket includes housing, recreation services, food services and accommodations, non-profit expenditures, and what the BEA defines as other non-durable goods. The chart makes it look like the market is overreacting to the slight increase in prices. The metrics in this chart will go up along with the Fed prices index this year, but they’re starting from a low level so the economy is far from overheating.

(Click on image to enlarge)

Focus On The Short End

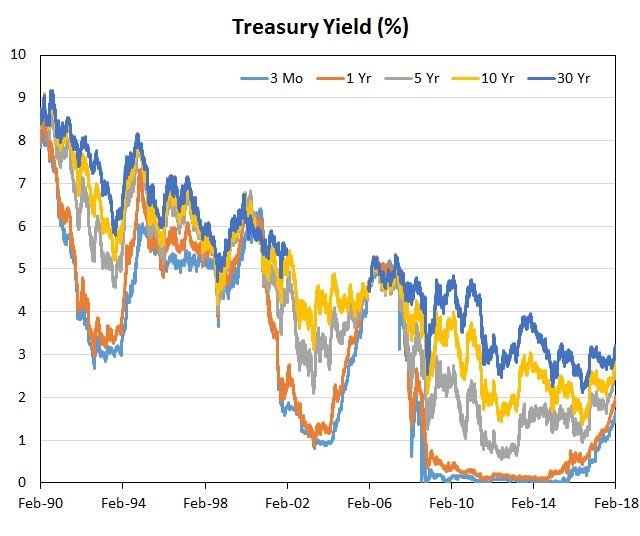

I have been focusing greatly on the long end of the treasury yield curve. However, if you look at the chart below, it appears the real action is on the short end. As you can see, the long end has been relatively stable. As you get closer, the curve is more volatile. The rising rates on the short end are mostly responsible for the flattening of the curve. Therefore, regardless of how the balance sheet unwind affects the long end of the curve, the focus should be on how the Fed funds rate hikes push up the short end. If the Fed raises rates 4 times this year, I expect it will probably invert the curve. It all depends on how much economic growth pushes up the 10 year and 30 year yield. It also obviously matters how many times the Fed raises rates. I’m still expecting 3 for the year.

10 Year Short Position Rescinds

I have been harping on the large short position in the 10 year bond. It’s one of the reasons I expect the 10 year yield to decrease in the next month. As you can see from the chart below, the CFTC net short position reversed its recent trend as of February 20th. It’s also worth noting that the 10 year yield peaked on February 21st, so it’s probable that the short position will further decline in the next update of this report. This makes me less bullish on the 10 year bond, but usually we see trends over correct, so there is room for it to fall further. As I mentioned in a previous post, the 10 year yield spiked after Powell spoke. It peaked at 2.92% before declining back to 2.89%. Half the increase vanished.

(Click on image to enlarge)

Stocks Accelerate Their Decline In The Afternoon

To further my point that stocks and bond yields aren’t always inversely correlated, the 10 year bond yield declined in the afternoon which is when most of the stock market decline occurred. The S&P 500 declined 1.27% on Tuesday. This means it’s very likely February is a down month, ending the record long streak of positive months. I think this a normal decline after stocks have rallied so much in the past two weeks. It feels abnormal because February has seen more action than all of 2017, but it’s just regular action. I expected 2018 to be more volatile than 2017 mainly because 2017 was a year which happens a couple times in a century.

As usual, the dollar index increased when stocks fell. The DXY was up 0.56%. This type of relationship with stocks is why I have been saying a strong dollar would be worse for stocks than a 10 year bond yield of 3%. In keeping with its extremely high correlation with the stock market, oil was down 1.4% to $63.01.

The reason why I downplay the importance of Powell’s testimony on Tuesday is because if the market was actually scared of a hawkish Fed, it would decline more than 1.27%. Stocks will probably ‘forget’ about this in a few days. I won’t be concerned about a hawkish Fed until next year when the Fed funds rate goes above the CPI.

Weak Durable Goods Orders

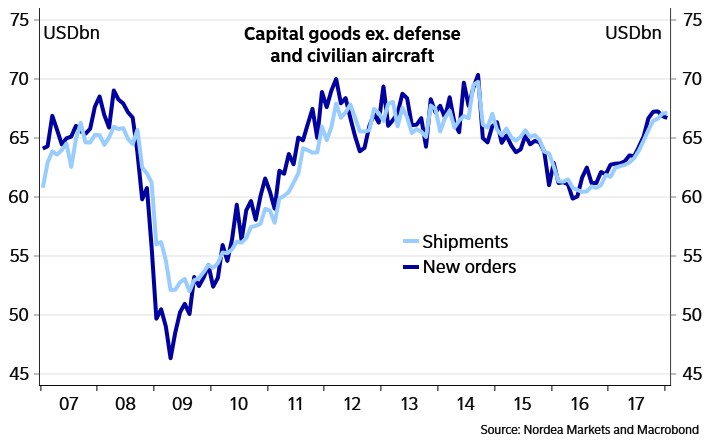

While I think Powell’s statement wasn’t a legitimate reason for stocks to decline, I think the durable goods orders report was a reason for bearishness. The month over month change in new orders was -3.7%. That was below the consensus for -2.0%. The year over year change was up 6.8%. Excluding transportation, the month over month change was -0.3% which was below the estimate for 0.3%. It was even below the lowest estimate in the range which was 0%. Year over year, ex-transportation was up 6.9%. As you can see from the chart below, core capital goods orders were -0.2% month over month. That was below the 0.5% consensus and the lowest estimate in the range which was 0.1%. Year over year it was up 6.3% which is down from the prior revised figure which was 8.0% growth.

Conclusion

I’m not willing to claim the weak durable goods report is enough to signal economic weakness like the ECRI forecast projects, but I think it’s a far more reasonable basis to sell stocks on than the Powell statement. The Fed can easily decide to not raise rates 4 times if the inflation data weakens slightly. The decision probably won’t be made in the next 6 months, so it’s premature to base your intermediate term trades on this. 4 rate hikes would probably invert the curve. Even the curve inversion probably won’t be a sell signal. There are still a bunch of thresholds that need to be passed before I’m bearish on stocks because of monetary policy. I’m probably going to lean bearish in 2019, but it’s too early to tell.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more