Semi Equipment Still Robust, Book-To-Bill Trend Intact And Thoughts On The Market

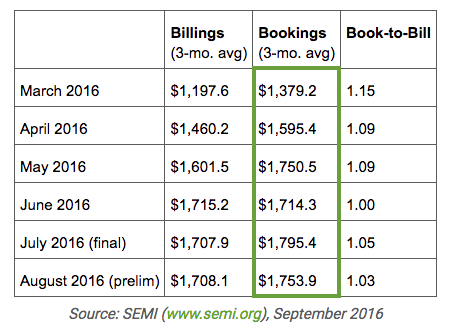

SEMI snuck its August Equipment book-to-bill report by me, releasing it earlier than usual on the 15th. No matter, we got bullish months ago (despite some expert bearish views I was notified about at the time) and while stock prices have ramped up significantly (as the herd caught on), the sector remains strong, business-wise. The green box represents a trend and if the data were put into chart form it would be a bullish uptrend that has been in place since we began tracking it early this year.

Here is what the SEMI mouthpiece had to say…

“The book-to-bill ratio has been at or above parity since December of last year with current monthly bookings and billings levels at $1.7 billion,” said Denny McGuirk, president and CEO of SEMI. “Given the current data trends, North American equipment suppliers are clearly benefiting from strong investments by device manufacturers in the second half of the year.”

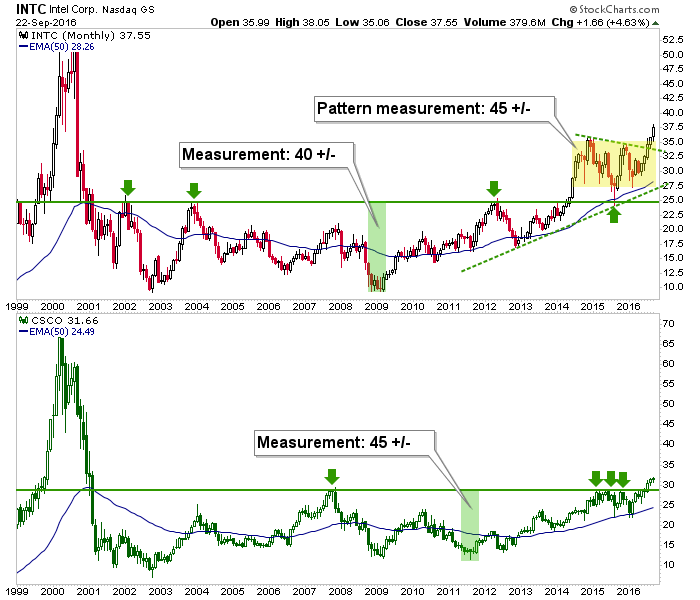

While I took profits on related stocks like AMAT, LRCX and CCMP, I’ve held and increased INTC, which is in very long-term breakout territory. It’s not because Intel is a large cap and a highly visible chip making dinosaur (it’s first entry into the mobile space has landed with a thud, and the cancellation of its Broxton and SoFIA processors; although they may not be done in the mobile space). It’s because the chart told us 40+’ over 2 years ago and because Intel has had positive news on other fronts over the last month or so (increased demand for boring old PC processors, which appears to be an inventory build cycle and nothing to get overly excited about).

Here’s the most recent chart of Intel (along with fellow dino, CSCO); a monthly, showing the targets.

I think the easy money has been made in the stock market on this post-Brexit sentiment surge and reset (which came along with the Breadth Thrust) and have raised cash levels to ‘intolerant’ in order to preserve the majority of gains. The Semi Equipment sector is notoriously cyclical along with being an early indicator on economic bounces/fades. It is thus far intact, but how much is now priced in by momentum chasers?

In the stock market they pay you to look ahead, not herd and chase. So my Semi exposure – while I might trade in and out a bit – is pretty much a thing of the past, save for the likes of the dinosaur with the still good looking chart.

Disclosure: Subscribe to more