Selling Pressure In U.S. Bonds Came From Europe

- Is there a generation gap among financial professionals?

- Has the financial services industry gone off-mission?

Numbers:

(Click on image to enlarge)

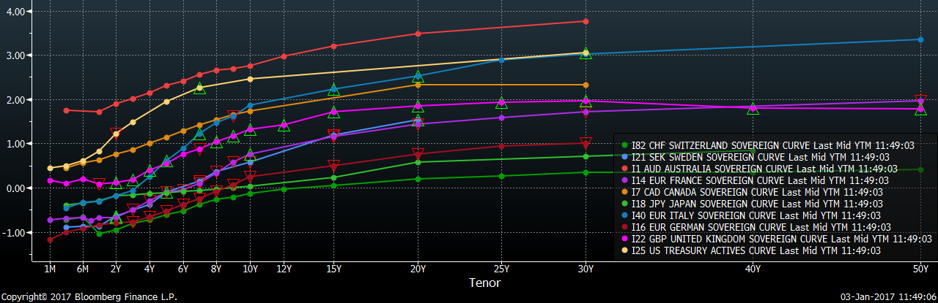

Yield Curves:

(Click on image to enlarge)

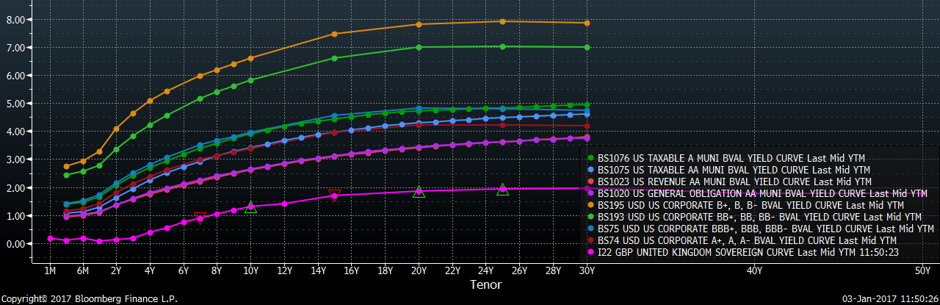

Credit Curves:

(Click on image to enlarge)

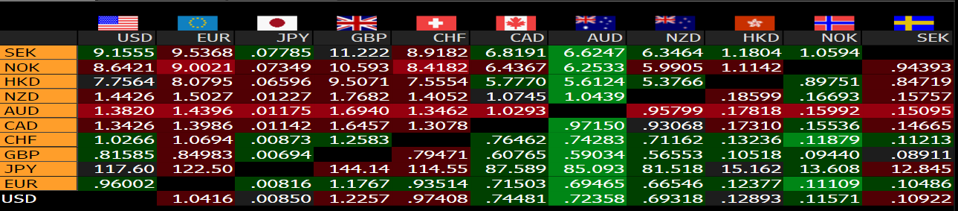

Major Currency Exchange Rates:

(Click on image to enlarge)

Since the financial crisis, the number of experienced capital markets professionals available to financial advisors has declined, significantly. This is bemoaned by experienced financial advisors but has gone unnoticed by less experienced advisors. After all, you can’t miss what you never had. For the past several years, I have battled against strategy commentary which called for rising short-term rates and booming economic growth (most of which was based on cherry-picked correlations designed to help gather assets) when the economic data and construct of the U.S. and other large economies did not augur for such outlooks. Although my loyal readers understood and appreciated my opinions, my commentary largely fell on deaf ears, in spite of my significant media coverage. Over the past several years, I have felt like the proverbial voice crying in the wilderness.

Since Election Day, investment strategists and investors have exhibited optimism not seen in nearly a decade. They are cheering monetary policy renormalization and rising long-term rates because these are occurring for the “right reasons.” Right reasons or not, monetary policy renormalization and rising long-term rates do impact consumer spending and corporate profits. At present, it appears that markets are pricing in only the positive aspects of fiscal policy reform and are cheering the possibility of monetary policy renormalization. However, markets participants are ignoring the potential negative impacts on U.S. multinationals (stronger U.S. dollar), retailers (border-adjusted taxes) and domestic producers (higher wage requirements from fiscal policies). There seems to be little concern in the wealth management industry.

As I have stated in the past (many times); as a young trader I was taught to watch retail investor capital flows. If retail was going in one direction, the pros were supposed to go in the opposite direction. We are seeing that in the municipal bond market. Following the election of Donald Trump to the presidency, retail investors have pulled money out of municipal bonds quite aggressively. The impetus for this exodus is the potential for lower income tax rates. However, tax-free municipal bond yields climbed and credit spreads widened to the point that tax-free municipal bonds became attractive for investors in lower tax brackets or even for investors which cannot take advantage of the tax-free status of municipal bonds. This has led to non-traditional investors stepping into municipal bonds as retail investors step out. As Barron’s Amey Stone reported last week, retail investors continued to pull money out of municipal bonds, even as municipal bond prices rebounded. One has to wonder who (if anyone) is advising these investors.

More than ever, Wall Street has been gripped by group-think, at least in my opinion. Many equity strategists have been scratching their heads over the trend for retail investors to pull money from equities, during the past several years. The common opinion among equity strategists is that investors are frightened of equities, since 2008. I believe there is some truth to this, but demographics is playing a large part, as well.

As investors age, they can less tolerate equity market volatility. They also tend to value reliable investment income more highly. Thus, it is probably a combination of the memory of what a market downturn can do to portfolio values and the need for investment income which has resulted in many individual investors carrying lower equity weightings than in the past. Demographics is seemingly being ignored by equity market strategists, many of whom continued to wait for investor euphoria to return to the equity market, thereby signaling a cyclical peak. When one considers demographics, with most of the investible wealth concentrated among Boomers (who value income more than in the past) and less investible capital among Millennials (who are at the age which typically augurs for growth strategies) and it appears far from certain that euphoria will materialize during the current market/economic cycle. However, few in the equity markets or in wealth management appear ready to consider this possibility.

Problems exist in high yield, as well. I attended a luncheon, last December, in which a discussion erupted over corporate defaults weighing down returns of high-income bond portfolios. What puzzled me was how few attendees made the connection between high income and high yield (junk bonds). With rare exceptions, high income involves either high yield credits, long-duration bonds or a combination of the two. There are few free lunches in fixed income. Yet it seems that is what has been marketed to both advisors and investors.

What all of this might mean for the future of Bond Squad is unclear. Just as technology, demographics and changing priorities may not bode well for suburban housing developments, automobile ownership and traditional media, the days for services, such as those provided by Bond Squad, may be numbered. Of course, unknown-unknowns could crop up, in the future. Hopefully, someone will be around to interpret and explain what is happening. However, financial industry demographics appear to be pointing to a “blind leading the blind” scenario.

That is something to worry about for the more distant future. In 2017, Bond Squad and other financial professionals who have lapped the Sun for decades remain at their posts, ready to share their knowledge and experience. Let’s take it one year at a time.

Over There

It looks like much of the early selling pressure in U.S. bonds came from Europe, where higher-than-expected inflation pressures sent European sovereign yields higher and may have attracted some fixed income capital from U.S. Treasuries. However, following the closing of European markets, long-dated U.S. Treasuries have recouped most of their losses, in spite of strong U.S. economic data. I remain of the opinion that long-term UST yields may have risen too far, too fast.

Disclaimer: The Bond Squad has over two decades of experience uncovering relative values in the fixed income markets. Let us work for you. more