Sell These 2 Overvalued Stocks

With the market severely overvaluing these two stocks, they should be sold immediately so you don’t own them when they eventually fall. Find out the names of these two stocks and even how you can make some money if the prices do start to plunge.

All investing is arbitrage. The underlying belief of all (non-dividend) investments is that a stock’s future price will differ from its current price. This fact has given way too many models that attempt to find the correct, fair valuation of a stock so that mispricings in the market can be located.

One such model is Graham’s Number (GN). The creator of this number Benjamin Graham, was one of Warren Buffet’s early investing mentors. Like Buffett, Graham employed a simple approach to value investing, using GN to find stocks that are underpriced.

The GN calculation is so straightforward that you can perform it with only two variables and a coefficient: Earnings Per Share (EPS) and Book Value of Equity Per Share (BVPS)

GN = (22.5 * EPS * BVPS)^(1/2)

Here, EPS is that of the past twelve months, and BVPS stands for book value per share. Both metrics are easily looked up online. Thus, we can sift through lists of stocks, applying GN until we find clear mispricings – i.e., stocks trading at values significantly below their GNs.

Unfortunately, for most investors, the current market gives GNs much higher than true stock prices. The market is overpriced for the most part. However, options investors can easily take the short side when we find GNs that are much higher than the respective stock prices.

Today, we look at three stocks with GNs significantly lower or higher than the actual prices. Then, we look at some options strategies to invest in these mispricings. Let’s begin:

The Swatch Group AG (OTCMKTS: SWGAY)

The GN calculation for SWGAY is $15.34. The stock is trading at $13.59. This implies an upside of 13% in a market that is usually overvalued.

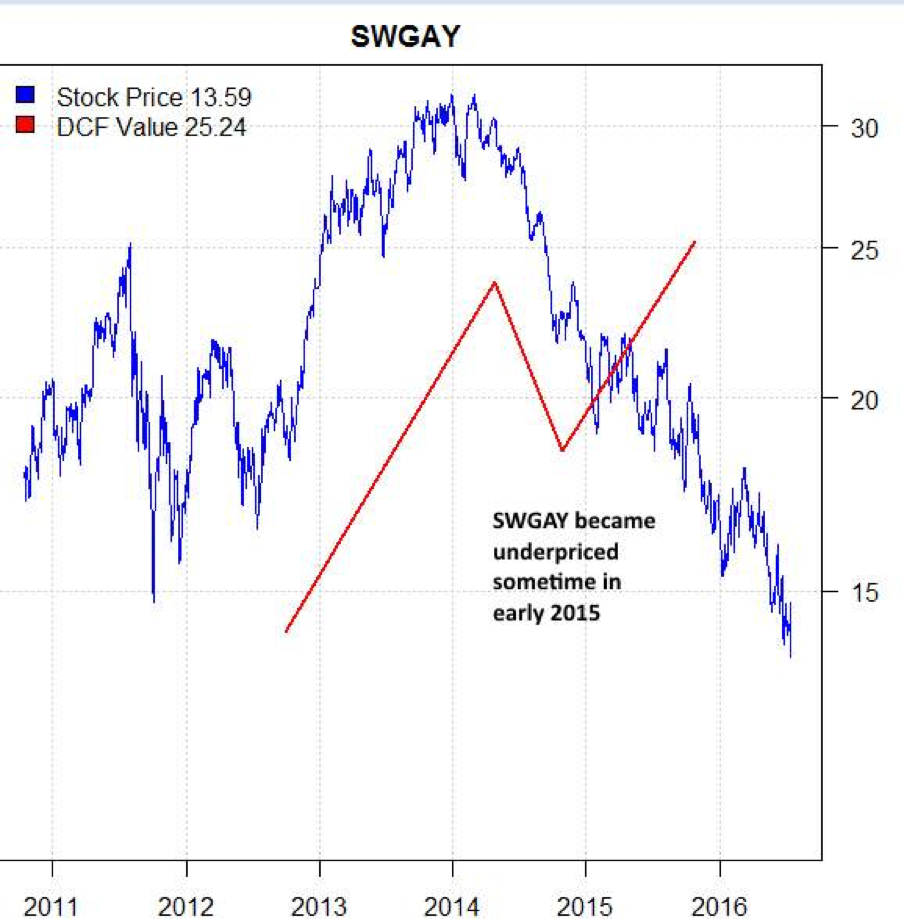

So, it seems we can still find strong, well-regarded companies that are underpriced. My discounted cash flow model also shows SWGAY as undervalued. My model runs on annual numbers, so the last calculation was actually from six months ago:

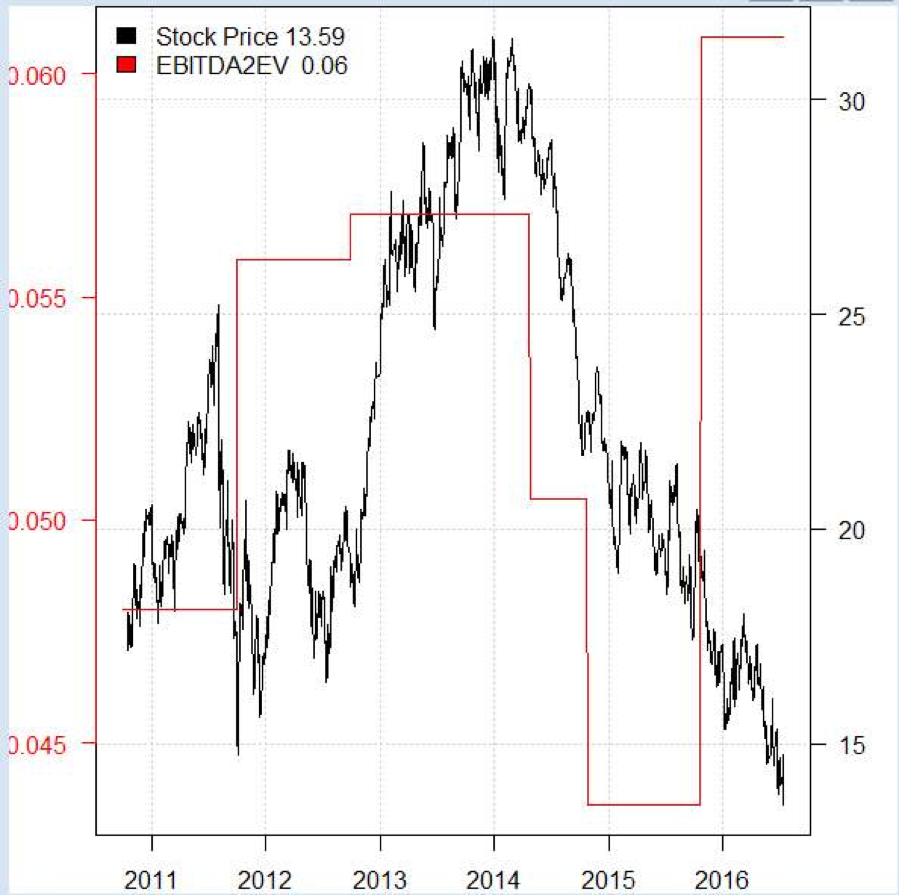

A third sign that SWGAY is undervalued lies in the EBITDA/EV ratio (Earnings Before Interest Taxes Depreciation Amortization/ Enterprise Value), which is one of the few metrics with statistical significance in predicting stock price movement. SWGAY’s EBITDA/EV ratio is on the rise, implying that the stock should follow. Note that it also correctly predicted that SWGAY would fall from 2014 to 2016 and rise from 2011 to 2014:

These three metrics all imply that SWGAY is underpriced and should rise to equal out this mispricing. However, fundamental news should be incorporated in your decision. After all, metrics only tell one side of the story; a stock that seems underpriced might actually be fairly priced when you take the industry’s environment into account.

One day ago, SWGAY released a preliminary report for its upcoming earnings report due on July 21. In this report, SWGAY pointed to falling sales numbers in Hong Kong, France, and Switzerland. In total, these sales have dropped the expected sales by 12%. In addition, SWGAY’s corporate philosophy of considering its employees as family and not mere cost factors has led to a drastically reduced operating profit (50% lower); most companies would be laying off employees under these circumstances.

That is, things do not look good for SWGAY in spite of the mispricing. In fact, GN, the discounted cash flow numbers, and EBITDA should all fall after the upcoming earnings report. Perhaps SWGAY is fairly priced after all.

Again, we see that the current market makes it difficult to find truly underpriced assets. In the current market, finding overpriced assets and safely taking a short position via options is actually the easier and more profitable choice. This is why options strategies are proving so useful in 2016.

So let’s take SWGAY off our watchlist and look for some overpriced assets that are receptive to bearish option strategies.

CBS Corp (NYSE: CBS)

A calculation of the GN for CBS gives a clear indication of the stock being overpriced. CBS’s GN is $29.17, but the stock is trading at $55.85 per share. This mispricing is to the degree of 100%!

The EBITDA/EV ratio of CBS has been falling since 2013, but the stock peaked a year later. This implies a lag on the stock with regard to the EBITDA/EV ratio. Indeed, the ratio and the stock price have moved in-line, after lagging the stock by one year:

After EBITDA/EV peaked, so did the stock. Both began to fall. Nevertheless, we now see this ratio implying that the stock is overpriced still. Both GN and this ratio point to CBS being a strong short opportunity.

Again, we should turn to the fundamentals before calling ourselves bearish. One day ago, UBS downgraded CBS to “sell.” Even the analysts, who are notoriously late to the party, are seeing CBS as overpriced.

Back when Americans had few choices of televised content, CBS held a good chunk of the monopoly on American eyeballs. But, in the on-demand viewing environment of today, companies such as Netflix (NASDAQ: NFLX) are outpacing the traditional market leaders in content. In the fall, an important season for television, CBS stands to make its relative lack of competitiveness more palpable to investors because of its lack of content and inability to maintain advertisers, who are the main revenue source for the company.

I agree with UBS: CBS investors should sell now – or at least before December when the results of the fall programming are clearer. But, a better idea is to short the stock via options. Here’s my recommended play:

Buy 1 Sept $60 call

Sell 1 Sept $57.50 call

Buy 2 Sept $47.50 put

GN gives us a price target of around $30, we stand to gain $3,500 with the above options strategy, a strategy that is opened at a net credit of $15. We get the net credit from the first two legs of the strategy, as they comprise a credit spread. The credit spread finances the bought puts, with about $15 left over to pocket.

The cool thing about this type of strategy is that we still profit if we are wrong. In fact, this strategy has so much to offer that it should be illegal. Other benefits of this strategy are:

- Capture maximum downside.

- Theta hedged (i.e., are not hurt by options time decay)

- Long vega (i.e., an increase in volatility will add to the profitability)

Cognizant Technology Solutions Corp (NASDAQ: CTSH)

Here, GN is $31.27. The stock, however, currently trades at $57.76. This gives a potential upside of 87% on a short position.

Again, we see the EBITDA/EV ratio agreeing with GN:

The stock has not yet fallen despite the ratio historically predicting stock price movement. This gives us a good entry point for a short position. But still, we might want to wait until the company releases its earnings report in early August (the company usually beats on earnings, though this might be changing soon).

Nevertheless, the importance of the short position should be placed on the long-term timeframe of the position. In the long run, prices are falling and will continue to fall in the IT consulting and outsourcing industry – CTSH’s industry. Competition has become fierce here and is pricing out CTSH.

CTSH is a market leader but still affected by the recent developments in the industry. The company has justifiably been downgraded by many analysts and earnings estimates have dropped. We are likely looking at a turning point for the company, and a long-term short position could pay off to the tune of 100% ROI.

But option traders strive to avoid the unlimited risk inherent in shorting stock. I suggest the following short strategy for CTSH via options:

Sell 2 Oct $55 put

Buy 3 Oct $52.50 put

This is called a ratio spread. We open the position at a net credit of roughly $20. The sold puts finance the bought puts with some money left over for us to pocket.

Because we are holding more long puts than short puts, we not only gain 100% upside for when CTSH falls but we are also long vega, meaning that volatility increases make this strategy more profitable. We are also theta hedged here, so we don’t need to worry about time decay. In the end, this is a strategy that pays off handsomely if CTSH is corrected by the market and exposes us to no risk if CTSH continues upward despite the mispricing.

I hope that the above strategies have taught you a bit about the versatility of options. Try looking for mispriced equities using GN yourself, and you just might be surprised at the amount of mispricing in the market. The above options strategies can be applied to virtually any stock, so long as the stock has liquid options.

Using options to short overvalued stocks has made me a bunch of money, but if that isn’t a strategy that you are comfortable with, check out what my colleague Tim Plaehn is doing with dividend stocks.

He makes it a habit of only hunting down and recommending stable companies that regularly increase their dividends, and this is the strategy that he uses most often to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given him the most consistent gains out of any strategy that ha has tried over his decades-long investing career.

And, there are currently over twenty of these stocks to choose from in his Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

Disclosure: