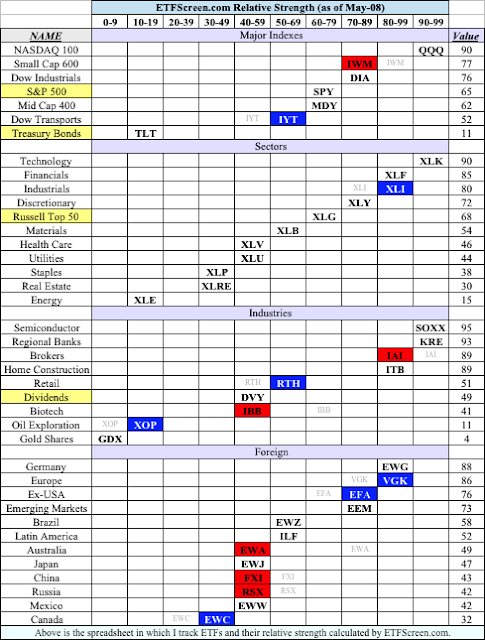

Sector Strength

I don't see much movement in this spreadsheet from last week. Mega-cap technology remains the leader, but small caps aren't too bad either. Financials, Industrials, Cyclicals are all leaders while bonds lag. That is generally the alignment of a healthy market.

The two big issues with the stock market at the moment are 1) valuations and 2) commodity prices.

I can't really comment on valuations except to say that the Value Line Survey consistently mentions its concern with valuation.

I do think that weak commodity prices is generally negative for the stock market, although, just like valuations, it is hard to say when weak commodity prices will start to impact stock prices.

(Click on image to enlarge)

The Leader List

South Korea re-joined the leader list. Oil Explorers were strong today. Health Care and Pharmaceuticals were weak. Biotech got hit very hard.

(Click on image to enlarge)

The South Korea chart looks very good, although extended short-term.

(Click on image to enlarge)

Biotech broke down short-term.

(Click on image to enlarge)

Outlook

The medium-term trend is struggling to head higher, but it also isn't showing a lot to indicate it is going lower. My medium-term indicators have turned upwards again, and I always do better when I just follow the indicators.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more