Sector Strength - Monday, June 26

The oversold areas of the market bounced a bit today, such as retail and energy, while the leaders took a break.

I have my eyes glued to these Semiconductors because I think the market will likely follow this index either up or down.

It was a good day for Gold bears. This series of higher highs, higher lows, might be running out-of-steam?

Sector Strength

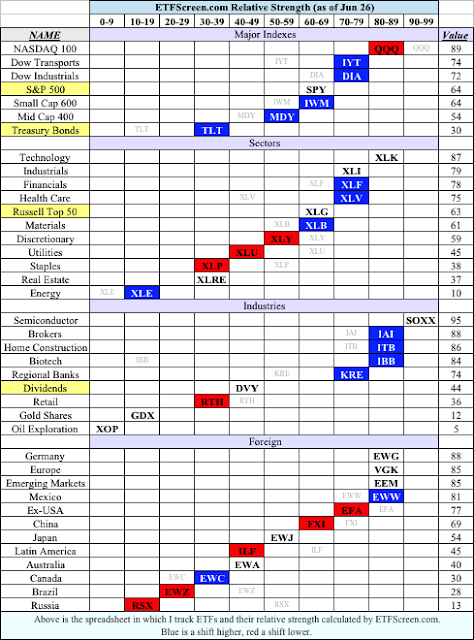

The major indexes are skewed to the right, indicating a bull market, although small and mid caps are weaker than large caps which is a sign of market weakness... or it often is. Also, bonds have been gathering strength which may be a warning for stocks.

The sectors show both strong and weak trends, although the defensive areas are showing relative weakness which is a good sign for the bulls. It may not be as simple as that.

It seems as though investors are looking for growth, and haven't yet flipped over to a strategy of looking for yield and safety. But I wonder if growth has been bid up to the point where it is making people nervous, and the defensive areas are too pricey as well?

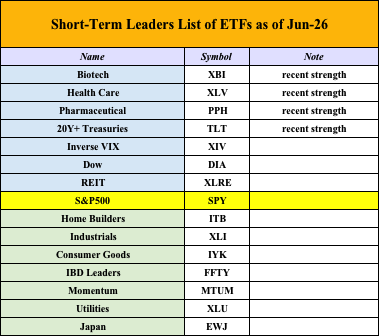

The Leader List

The spreadsheet below shows the current short-term market leaders primarily based on momentum and relative strength.

Mexico and most of the Emerging Market ETFs were strong today, along with Inverse-Volatility.

Technology was weak.

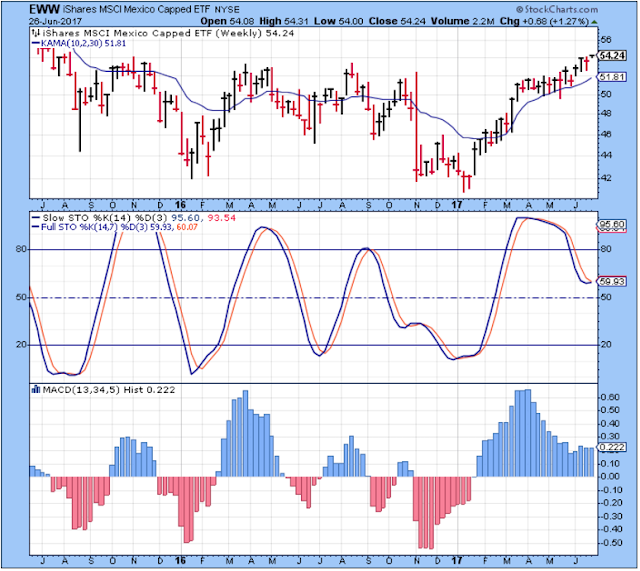

I bought this ETF after the election, but I sold it at the first sign of trouble which I think was late December. What a mistake to sell. But now, I am not a buyer because it seems extended even though this set up looks favorable.

Mexico is breaking out of a nice multi-year base. Mexico has a strong currency which is helping this ETF. I always think of Mexico as primarily an oil exporter, but maybe their economy is broadening out. I like this chart long-term.

Technology is finally looking like it will provide us with a buying opportunity in the weeks ahead.

Outlook

The long-term outlook is positive.

The medium-term trend is up. Overdue for a correction.

The short-term trend is ... not sure.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

Many thanks