Sector Strength - Monday, April 24

The US Dollar dropped right down to the 200-day. Where next? The decline off the late 2016 high is so choppy that it makes me think the next big move is higher, not lower. But other indicators point to a lower dollar.

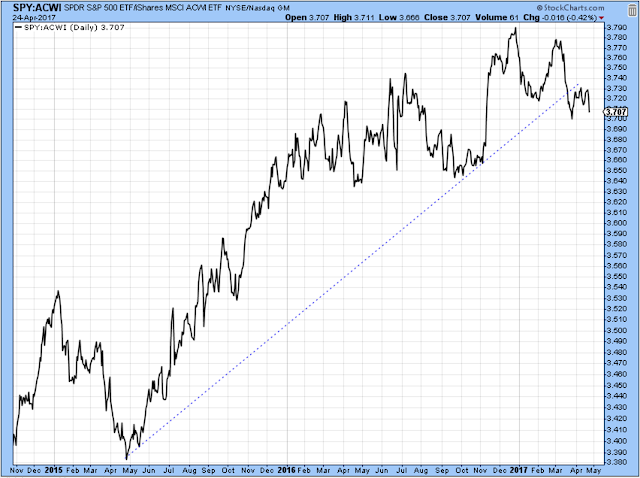

This chart favors a lower dollar with non-US large caps outperforming US large caps.

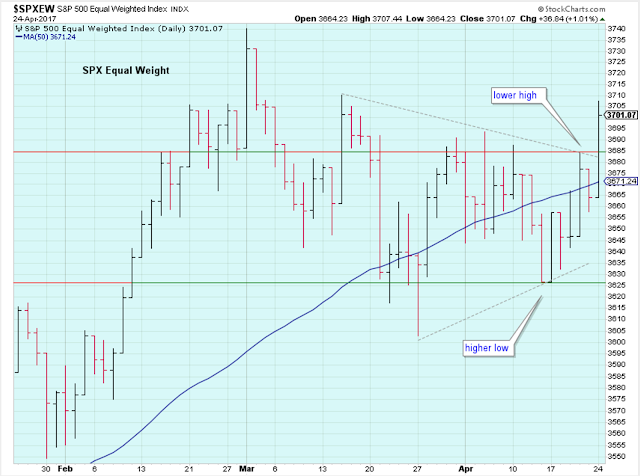

The coil broke to the upside despite the lower dollar.

The short-term up trend looks like it started last week. I missed it, but now that the PMO index is back I am feeling in sync with the trend again.

Just looking at the bottom panel of this chart, you wouldn't know that this was a gap up new high for the NDX. The top panel sure looks good though.

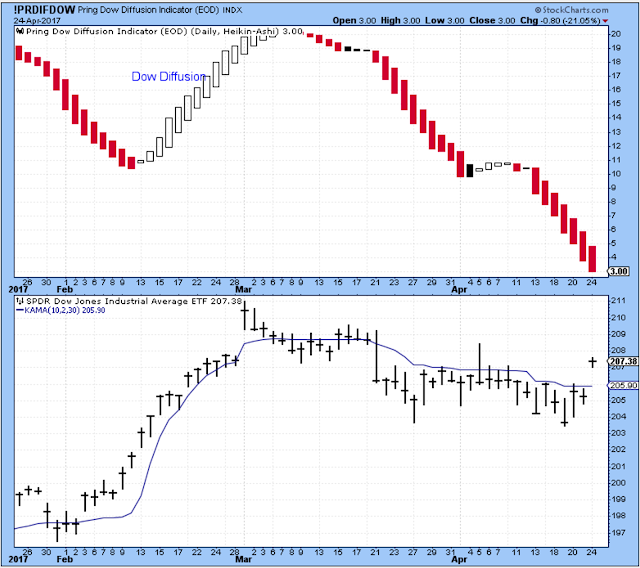

My favorite indicator was unimpressed by today's big move.

Outlook

The long-term outlook is positive.

The medium-term trend is down as of March 21

The short-term trend is up as of April-20

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, ...

more