Sector Snapshot: Defensive Sectors Take The Lead

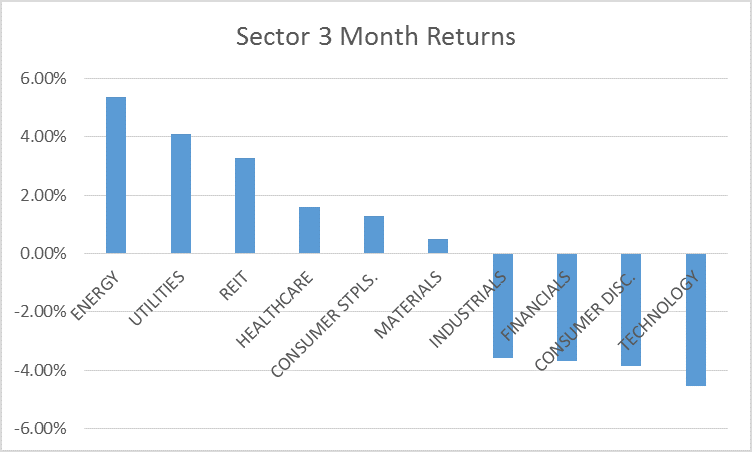

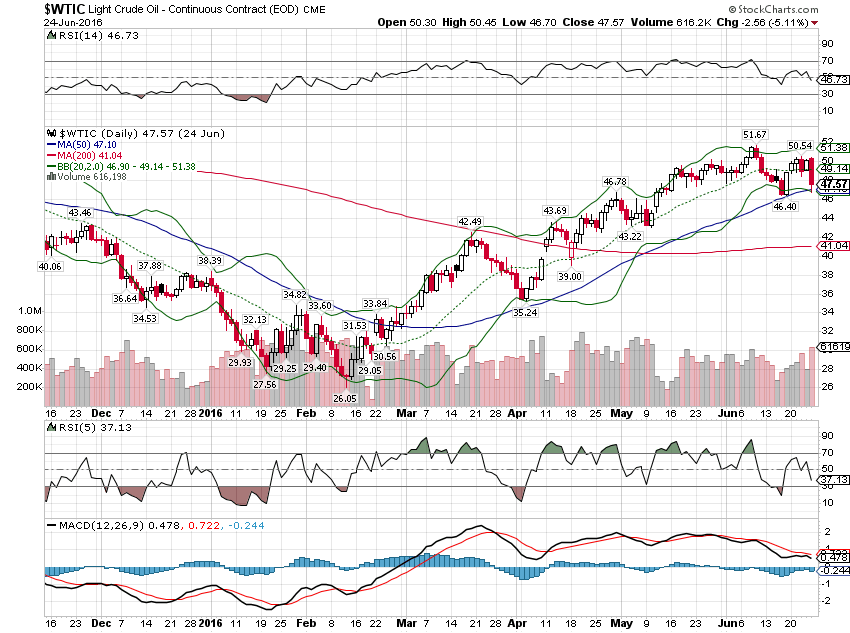

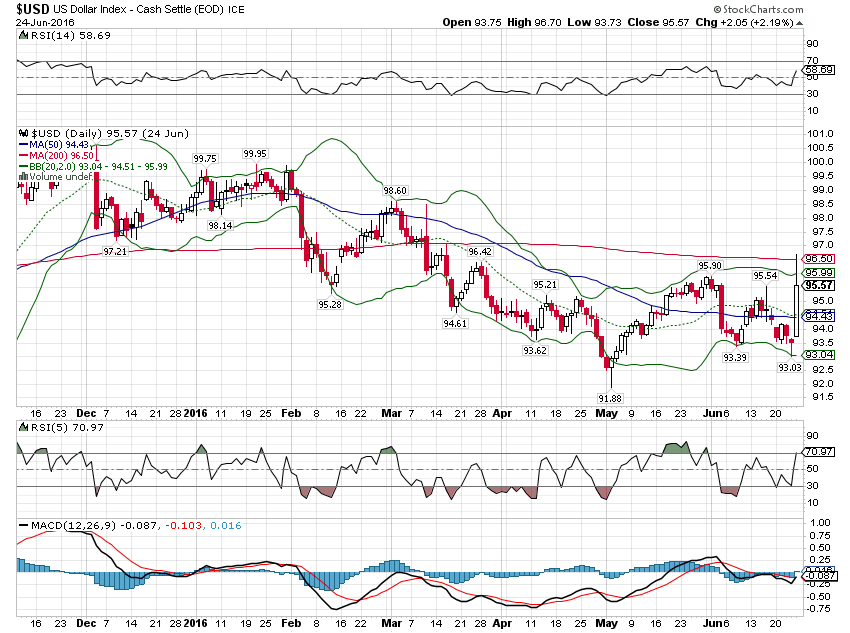

Even before the Brexit vote, momentum was shifting to defensive sectors. The rally in weak dollar sectors – other than the gold/silver mining industry – was looking very overbought and tired anyway, so Brexit was a good excuse to take some profits. Whether the dollar can retain the strength it has gained on this historic vote is the big question. For now, I don’t think we have sufficient evidence in either direction. Negative real rates in the US would point to continued weakness but this is a relative game. If foreign economies are even worse and have even more negative real rates, then the dollar could stay well bid.

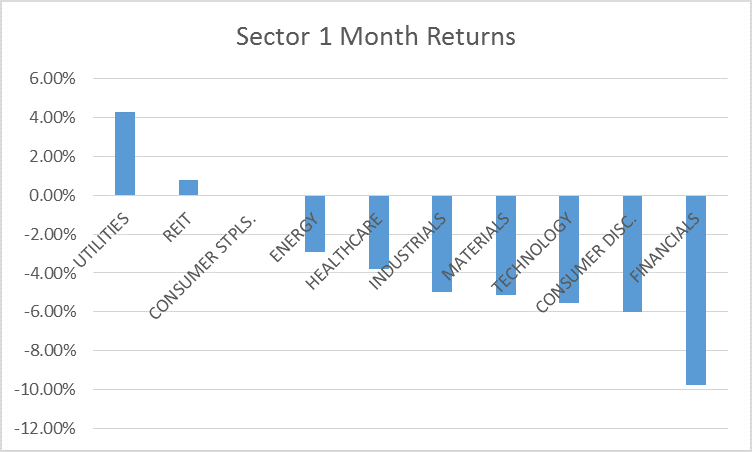

For the very short term, the one month returns show only two sectors with positive returns, utilities and REITs. Consumer staples are only slightly negative at -0.02%. Worst performing are financials, much of that loss coming just last Friday as Brexit was figured to be very negative for the banks. But again, financials were already starting to fall before Brexit based on the still flattening yield curve. Brexit just accelerated a trend that was already in place.

Defensive sectors are not particularly cheap but they do have momentum. More cyclical sectors are having a hard time and one can’t help but wonder if that isn’t the canary in the coal mine. Is the US headed for recession? Or is the rest of the world just continuing to get worse with some part of the blowback from that being felt in the US? I don’t know but with US growth already below trend it wouldn’t take much of a shock to start a contraction phase. With the 10 year Treasury trading at a sub-1.5% yield, the market seems to be voting for recession.

So, where from here? I’d be wary of the energy sector and concentrate more on the defensive sectors. Crude has stopped its rebound and if the dollar continues to rally it will trade lower.

Disclosure: This material has been distributed for ...

more