Rush For The Exits

The highways will be crowded this evening as the Thanksgiving rush will begin in earnest, but this morning investors are rushing for the exits with Technology and Retail leading the way lower. Apple (AAPL) is trading down close to 3%, Facebook (FB) is under $130, and Nvidia (NVDA) is down another 5%. While NVDA’s decline is bad enough by itself it follows two days of trading where the stock was down 18% and 12%, respectively. Since early October, the stock is now down over 50%!

In economic data, Housing Starts for October actually came in right inline or slightly ahead of forecasts, which is a bit of a surprise given the very weak homebuilder sentiment report on Monday.

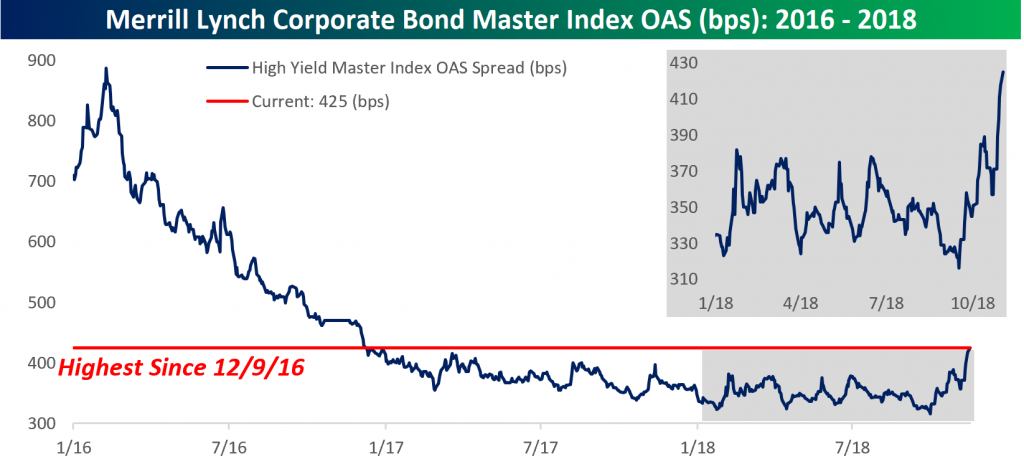

We often look to the high yield market for signs of confirmation of a move or divergences, and unfortunately for bulls, recent moves haven’t been positive. As shown in the chart below, after moving up and down within a range of 310 bps to 390 bps for much of the year, spreads have surged in the last several days to their current levels of 425 bps. That’s the highest level since December 2016,erasing nearly all of the narrowing that we saw in the thirteen months spanning the November 2016 election through early 2018. From the equity market’s perspective, this negative divergence suggests equity prices could be vulnerable to further weakness.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more