Richmond Fed Manufacturing Survey Unchanged In August 2017

Of the three regional Federal Reserve surveys released to date, all are in expansion.

Analyst Opinion of Richmond Manufacturing

The Richmond Fed subcategories were positive, The data seems similar to last month.

Market expectations from Bloomberg/Econoday was 9 to 12 (consensus 11). The actual survey value was 14 [note that values above zero represent expansion].

Reports on Fifth District manufacturing activity were largely unchanged in August, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index remained at 14 in August, with an increase in the employment index offsetting a decrease in the shipments index and a very slight decline in the new orders metric. Although the employment index rose from 10 to 17 in August, other measures of labor market activity — wages and average workweek — were largely unchanged.

Expectations around manufacturing activity six months ahead were somewhat tempered from July, but manufacturers remained optimistic. Every index for expected activity was well into positive territory, although almost all of the indexes declined from July to August. The one exception was the measure for expected lead time, which rose from 7 in July to 10 in August.

Survey responses show that growth in both prices paid and prices received moderated in August. Meanwhile, reports on inventory levels were little changed, with the index for finished goods inventories down from 17 to 15 and the index for raw materials inventories rising from 17 to 19.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

z richmond_man.PNG

Kansas Fed (hyperlink to reports):

z kansas_man.PNG

Dallas Fed (hyperlink to reports):

z dallas_man.PNG

Philly Fed (hyperlink to reports):

z philly fed1.PNG

New York Fed (hyperlink to reports):

z empire1.PNG

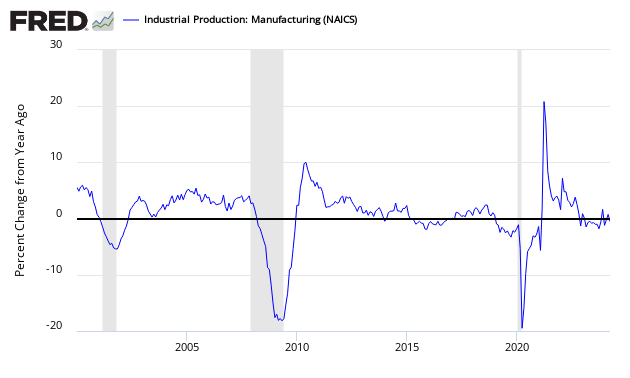

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Richmond Fed survey (darkest bar).

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Disclosure: None.