Retail Reporting Season Begins With Monthly Retail Sales Ahead

“The retailers are reporting, the retailers are reporting”! Some of the biggest names in the retail sector have started releasing their latest quarterly results as we head into next week’s all-important monthly retail sales report. On November 10th, Macy’s (M) and Kohl’s (KSS ) both reported Q3 2016 results and with mixed results abound.

Kohl’s, while reducing its store count YOY, reported a bottom line beat while slightly missing on the top line by about $10mm. The company’s Q3 EPS of $.80 a share was ten cents better than analysts’ estimates. In addition to the strong bottom-line performance the company boosted its holiday period outlook and its share repurchase program by $2bn. As has been the case for several quarters, Kohl’s stores are exhibiting same-store-sales declines. In the latest reported quarter, the company saw same-store-sales fall 1.7% versus a gain of 1% in the same period a year ago. Gross margins were flat at 37.1%, which may be a short-lived result given the dramatic same-store and net sales declines. The results from Kohl’s over the last couple of years have been pretty apaltry, but the cash generation that has supported the company’s ability to repurchase shares has proven to provide a value to some investors.

Macy’s results were somewhat of a disaster as the company missed on both the top and bottom-line. Macy’s reported Q3 2016 EPS of $.17 a share that missed estimates by roughly $.24 a share. The company reported $5.6bn in revenue that also missed analysts’ estimates by $50mm and fell 4.6% YOY. I had offered investors a more expert point of view regarding company operations earlier in 2016 and especially with regards to the retailers store closings and restructuring efforts.

“Moreover, Macy's will be closing 40 stores and most within the 2016 fiscal year. That is what they have offered to date, but the reality is that even this number has the potential to change as results can quite easily worsen for the retailer. How many stores did J.C. Penney close since 2012 and upon its first store closure offering? How many stores did Best Buy and Target wind up closing post their initial store closing disclosures? The numbers almost always, always changes post the original planning. With Macy's operating roughly 900 stores and scheduling the closing of just 40 store units, it seems likely that when the company gets into the weeds with these store closures the numbers will change somewhat. With these store closures the company has offered the following.”

And the numbers did definitively change for Macy’s with the company slated to close upwards of 100 stores going forward. As Macy’s continues to downsize the company also continues to execute its real estate monetization plans. With today’s Quarterly release the company offered efforts with partner Brookfield Asset Management (BAM) on a "pre-development plan" for about 50 Macy's real estate assets, with an option for Macy's to identify and add properties into the partnership. This such partnership may be the outlying reason for the stock’s positive reaction to poor Q3 2016 metric performance.

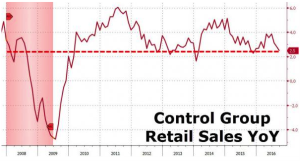

Without getting further into the weeds regarding individual retail quarterly results, investors are waiting to see the latest monthly retail sales, which are due out next Tuesday before the opening bell. Monthly retail sales have been downward sloping since 2011 and from 2015 to present that slope has exacerbated as displayed in the Retail Sales chart below.

Generally, charts exhibiting this sloping performance enter a period of contraction. September’s monthly retail sales surged, however. Sales at retail stores, online retailers and restaurants rose a seasonally adjusted 0.6% in September from the prior month, matching economists’ expectations for a rebound after sales fell 0.2% in August. As it pertains to total retail sales, the department store contribution to the data has been apaltry for some time now. The department store retailers have been showing YOY sales declines for the last 3 years. In the September retail sales data, department store retail sales fell by 6.4% and fell MoM by .7 percent. With regards to the poorly performing department store segment of the retail sales data, one can draw a direct correlation to the outperformance from Nonstore retail sales (otherwise understood to be e-commerce sales). In the September retail sales read, Nonstore retail sales grew 10.6% YOY, drawing more and more consumers and dollars away from traditional brick and mortar retailers.

When it comes to trading the retail landscape, back in July I had offered an opportunity in what I believed to be an overextended SPDR S&P Retail ETF (XRT). In the article titled “XRT Short Opportunity Patiently Awaits”, I suggested the following:

“In assigning these reasons for desiring to short the XRT, I also articulated the reasons for waiting to witness the ETF exhibit a $44 trading price. XRT managed to close higher last week and closed out the week with a whopping 2.6% rise on Friday.”

I shorted the XRT as high as $45 and since covered this for a rather nice profit below $43 a share and with the share price falling to the $41 range since July. With the XRT fighting its way back in the most recent market rally on the heels of the election cycle being completed, the next big indicator for the XRT will likely come from the next monthly retail sales report.

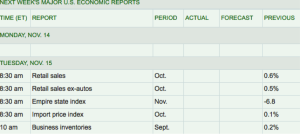

The table above outlines next week’s expectations for October retail sales. Given the subdued sales already being reported in previous periods and what may have been lesser consumer spending surrounding the election, the data will be interesting and of great consideration.